Govt rakes in the moolah from handsome dividend by public sector banks

The government will collect the money as it will receive a combined dividend out of profit of ₹ 13,804 crore public sector banks (PSBs). This is about 58 per cent higher than the ₹8,718 crore paid out in the previous financial year.

The impressive dividend announcement by state-owned banks comes against the backdrop of healthy profitability and comfortable capital position.

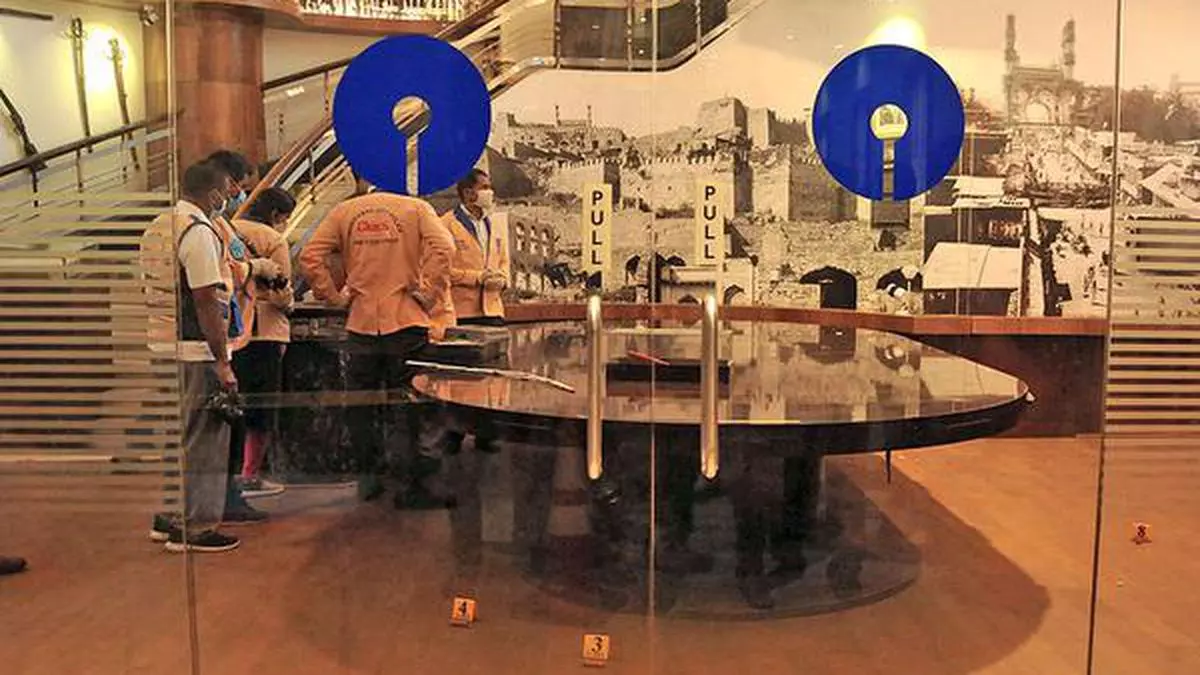

Of the 12 PSBs, three reported earnings in excess of triple digits in percentage terms for the fiscal year ending March 31, 2023 – State Bank of India (SBI) declared the highest dividend of 1130 percent (on a share of shares of par value 1 ruble), followed by Bank of Baroda (275 per cent equity share of FV ₹ 2), W Canara Bank (120 per cent equity stake worth FV ₹ 10).

Dividend income for fiscal year ’23 will form a portion of the government’s non-tax revenue for the current year.

SBI, which reported an all-time high standalone net profit of Rs 50,232 crore in FY23, will hand over a dividend check of around Rs 5,740 crore to the government. This is about 42 percent of the total profits that the government will accrue from PSBs. The country’s largest bank declared a dividend of 710 per cent in FY22, with the government’s share of the profit amounting to Rs 3,607 crore.

Six PSB offices declared dividends ranging from 4.8 percent to 86 percent. but, Central Bank of Indiawhich was taken out of the Immediate Corrective Action Framework (PCAF) by RBI in September 2022, Indian Overseas BankAnd Yoko Bank (Both banks were exited from PCAF in September 2021), and they have not declared a dividend.

positive vision

Karthik Srinivasan, Senior Vice President, Financial Sector Ratings, ICRA said: “The fact that banks are making more money and their capital position is also much better than it was two or three years ago, to that extent they are also able to announce higher earnings. The outlook for the current year is also good net net, it should be a fairly strong year in terms of the banks’ financial performance.”

Emkay Global Financial Services said in a report that most of its covered banks posted a good earnings outperformance in the fourth quarter, mainly driven by continued strong credit growth, healthy margins, increased write-offs (for PSBs) and lower loans. Loss savings, as asset quality continues to improve.

Also read: RBI will pay Rs. 87,416 crore as dividends for FY23 position

And PSBs posted its best quarter in history, with net profit growing 98% year-over-year / 19% quarter-over-quarter.

For fiscal ’24, in our view, credit growth/grossing margins will moderate, as will operating profit provision growth. However, treasury gains for PSB and continued lower loan loss provisions for most banks should sustain net profit growth,” Emkay analysts said.