Equity market sizzles as FPI inflow in June hits 10-month high

As monsoon clouds gather pace, the bearish dark cloud cover in the Indian stock market has been decisively lifted with benchmark indices climbing to fresh highs for a third day.

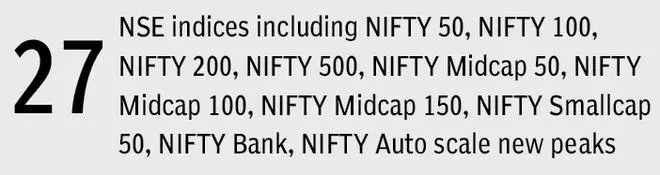

On Friday, the Sensex rose another 803.14 points, or 1.26 percent, to close at a new high of 64,718.56. The broad-based Nifty Index rose 216.90 points, or 1.14 percent, and witnessed the best closing at 19,189 points.

- editorial. Retail investors should remain cautious

Powerful FPI streaming

This comes on the back of renewed investment by FPIs which took the total inflow to more than $10 billion in FY24. In June, FDI inflow into equity market was Rs.47,148 crore, the highest level since August 2022.

Amol Athowali, Technical Analyst, Kotak Securities Ltd, said, “There is a clear picture showing that India has shown strong resilience across all growth parameters and is poised to do well going forward. With most global economies, including China, experiencing declining growth, it has emerged India as a green shot in a bleak scenario and then investors bring back their strong faith in local equities.”

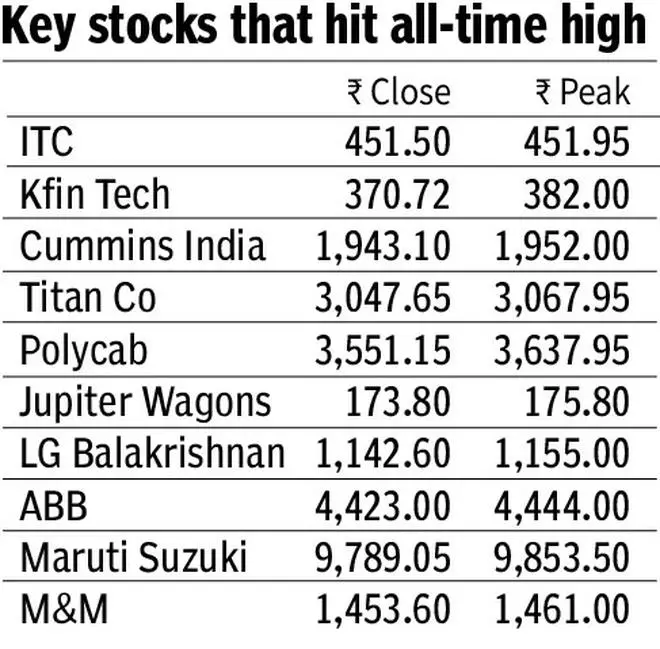

All of the sectoral indices closed in the green except for Nifty Metal which closed largely unchanged. Nifty IT (+2.5%), Nifty Auto (+2.1%) and Nifty PSU Bank (+2.1%) were notable gainers. Among Sensex shares, M&M was the best performer, gaining 4.1 percent. Infosys shares jumped 3.2 percent, while Indus End rose 3 percent. Sun Pharma gained 2.8 percent, TCS 2.6 percent, Maruti 2.5 percent and L&T 2.2 percent.

universal signals

Developments in the US also added to the bullish sentiment. US stocks closed positively on Thursday after strong economic data reinforced expectations that the Federal Reserve will raise interest rates further to tame inflation. The final revision of US first-quarter GDP showed the economy growing at an annual pace of 2 percent in the first three months of the year, much higher than the 1.3 percent rate previously reported, said Mitul Shah, head of research at Reliance Securities. .

-

is reading: Today’s elegant prediction – June 30, 2023: Be careful. We have a decisive resistance ahead

“With the positive surprises aiding the recovery in the global market and the advance of the southwest monsoon, the local market has managed to march to new heights with renewed vigor. Vinod Nair, Head of Research at Geojit Financial Services said, “Global investor sentiment has been boosted by the positive review in Q1 GDP, lower jobless claims and positive US Fed stress test result”.

Looking ahead, the markets are likely to maintain the momentum as positive monthly auto sales figures will take center stage on Monday. The near-term uptrend for Nifty remains intact and one might expect Nifty to reach 19,500 levels in the next week. “The immediate support is at 19,050 levels,” said Nagaraj Shetty, Technical Research Analyst, HDFC Securities.