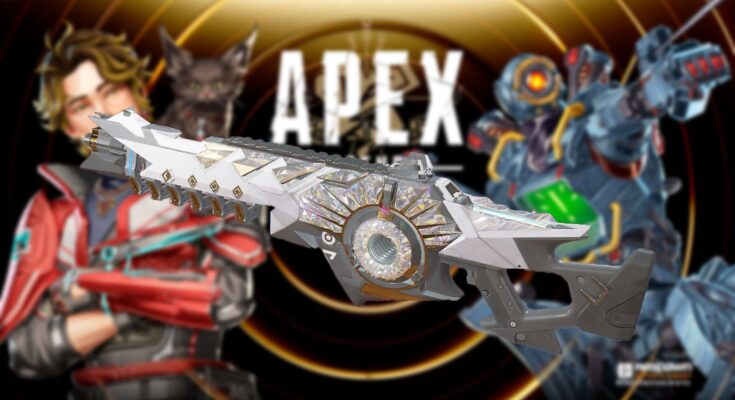

The Radiance Burst Reactive Nemesis skin in Apex Legends Season 25 can be obtained from the Split 1 Battle Pass. It is one of the most eye-catching items on the current battle pass and is available as the reward on the final level. Although you can keep on gaining more XP points to increase your level, the item drops stop at level 60.

The Radiance Burst skin for Nemesis is notable for its reactive nature. The weapon’s cosmetic is capable of evolving to a different look in the match if you can secure kills and knockdowns. This can act as a great incentive for players to rush into battles and adopt aggressive strategies to bring the reactive skin to life.

This article will highlight unlocking the Radiance Burst Reactive Nemesis skin in Apex Legends Season 25.

Note: Parts of this article are subjective and reflect the author’s opinion.

How can you unlock Radiance Burst Reactive Nemesis skin in Apex Legends

As mentioned above, the Radiance Burst Reactive Nemesis skin can only be unlocked by progressing through the battle pass. This means that once the Split 1 Battle Pass for Season 25 ends, you will not be able to obtain it or purchase it from the in-game store.

Also read: Apex Legends fans call out for better Nintendo Switch 2 support

Unlocking the skin is straightforward; you need to complete Daily and Weekly Challenges that appear on the Challenges tab to gain Battle Pass Stars. There are different tasks that you can do, and every challenge provides you with a different number of stars. You can earn a maximum of 10 stars from the lengthy or more difficult challenges. However, the game provides you with the option to complete some of the challenges in Non-Battle Royale mode (in different game modes that appear in the playlist).

You can also gather XP and secure stars by simply playing the game as well. However, the progression may be slower than completing specific challenges. Once your account starts gathering stars, the battle pass will start progressing automatically and unlock various rewards.

Read more: Apex Legends EAC update deals a massive blow to cheaters

It is important to note that the Radiance Burst Reactive Nemesis skin is present starting from the Premium track and is not a free item. This battle pass variant costs a total of 950 Apex Coins and will give you back slightly more AC than you spent, helping you buy the next split battle pass without needing to spend anything extra.

Investing in one seasonal battle pass can almost guarantee that you can recycle the currency to purchase the next pass as well. This makes it easier for players to redeem the rewards of the Premium Battle Pass without purchasing it repeatedly.

Be sure to follow Sportskeeda for more updates, guides, and news.

Are you stuck on today’s Wordle? Our Wordle Solver will help you find the answer.

Edited by Krishanu Ranjan Sarma