SEBI on expense ratios: Four ways investors are being short-changed by mutual funds

By now, mutual fund investors need to be aware of the market regulator SEBI, in an advisory paper Released on May 18, Suggested Reset expense ratios.

This step aims to achieve transparency and reduce the investment cost. The costs of operating and managing a mutual fund scheme are collectively referred to as TER or total expense ratio and are expressed as a percentage of the fund’s daily net assets.

The daily net asset value (NAV) of the mutual fund is disclosed net of expenses. Lower TER can lead to higher returns.

The SEBI proposal is open for comments until June 1 and may or may not be implemented in the manner stated in the paper. However, this 40-page page contains important findings for investors about the ways in which fund houses are performing in terms of charging expense ratios.

Finding #1: Equity and hybrid funds fare worse

The data as of March 31, 2023 shows that 60.06 percent of total assets under management (AUM) are held by retail investors. Individuals invested more than 57.18 percent of their investment in equity schemes and 17.49 percent in hybrid schemes.

On the other hand, companies hold the majority of their investments, i.e. 51.75 percent, in debt schemes and 28.94 percent in ETFs. However, although many finance houses have large AUMs (assets under management) in equity and hybrid schemes, the conditional repayment rate is often close to currently established regulatory limits.

In the case of debt schemes, although the investors are mostly corporate/institutional investors with bargaining power, the rate of exposure to value (TER) is well below the stipulated limit.

Therefore, the benefit of economies of scale (AUMs of the industry grew six-fold from ₹6-lakh crores on 31st March 2012, to ₹39-lakh crores on 31st March 2023) accumulated in debt schemes seems to be passed on to the investors but not so in Stock and hybrid charts.

Finding #2: Regular plans bear the brunt of extra overhead

On top of the specified TER rate (called base TER), MFIs are allowed to charge four additional expenses: brokerage and transaction costs, expenses for new investments from B-30 cities, for schemes that have an exit burden (when redeemed within specified timelines) and for a tax liability Goods and services on investment and advisory fees (investment and advisory fees are part of operating / management costs).

However, because there is no cap on additional expenses, SEBI has found that the investor’s actual expenses are significantly higher than the base TER limits set for the regular plan. In contrast, the investment cost (including all incremental expenses) of the direct plan is well below regulatory limits (see table).

Finding #2a: Brokerage and transaction costs are more than the maximum brokerage exposure

Brokerage and transaction costs are part of the recurring expenses that can be charged to the system. The overhead limit is set at 0.12 percent of the trade value in the case of money market transactions and 0.05 percent of the trade value in the case of derivative transactions. However, any payments in excess of the above limits are allowed to be charged to the schemes within the maximum Temporary Payment Rate (TER) as stipulated.

Doing excercise, The brokerage and transaction costs charged to investors are based on the actual number and value of transactions undertaken by a scheme with no cap applied on the total outlay towards such costs. As a result, there is no accountability for total expenditure under this heading for any scheme. From the data shared by AMCs, it has been observed that the spending of some schemes on brokerage and transaction cost is more than the maximum stipulated TER limits. This has resulted in investors paying more than double the scheme’s set exposure limit for expenses, the report notes.

Outcome #2b: Higher expenditure savings for B30 abuse

MFIs are allowed to charge expenses not exceeding 0.30 percent of daily net assets, if new inflows from individual retail investors outside the top 30 (B-30 city) meet certain criteria. This additional expense is charged to unitholders for the regular plans of the scheme, which AMCs then use to pay the distribution commission to bring in the inflows.

SEBI noted the following in this regard: One, B30 is not charged to all schemes uniformly. B30 fees are often not included in the charts as AMCs intend to maintain a low expense ratio. Thus, this incentive is often used as a mechanism to promote one scheme over another by showing lower expenditures. two, Applications with an investment amount above ₹2 lakh (threshold for classification as a retail investment) are often divided to make each application for investment less than ₹2 lakh, so that B-30 expenses can be charged. three, Investments of B30 investors are often triggered by withdrawal and reinvestment after a year (one year is the minimum holding period requirement), incurring additional expenses on the same investment schemes. four , The methodology for calculating incremental expenses for flows from B-30 cities is not standardized across funds. five, The expenses charged are usually based on forecasts of weekly or fortnightly flows and not on actual values, which may differ from projections.

Finding No. 2c: Carrying the burden out of credit was charged

The rules state that the exit burden imposed on investors exiting the scheme must be returned to the scheme. The intent is that early redemptions by investors from the system have an effect on non-exit investors, and therefore should be compensated by adding the burden of exit to the system. For this purpose, AMCs are allowed to charge an additional 5 basis points (base points) for schemes where SIDs (Scheme Information Documentation) have an exit overburden requirement.

Indirectly, this means that AMCs can force an additional 5 bps on the system even if there is no return/load exit claw added to the system, provided the SIDs have the ruling. The available data for overhead charged to the schemes and actual exit loads recovered from the investors was analyzed and it is noted that in the 2021-22 financial year, while the total amount of overhead charged to the schemes was Rs. 735 crore, the exit burden was recovered from the exiting investors and credited to the schemes. About Rs. 611 crores.

Outcome #3: Distributors may switch your schemes to get more commissions

The data, compiled by SEBI on NPOs from April 1, 2021, to September 30, 2022, reveals two things: one, switch transactions on regular plans accounted for 93 percent of all switch transactions; Two, the amount earned by new active schemes was Rs.82,733 crore, of which Rs.22,437 crore, i.e. 27.12 per cent, was through switching transactions from regular plans to other schemes of the same AMC. In one scheme, up to 55 percent of the funds obtained in the NFO were by diverting transactions from the other schemes of the fund house.

Under the current rules, a new scheme with a small base AUM can charge a higher TER compared to the current scheme with a higher AUM. Thus, AMCs can be incentivized to award high distribution commission to non-financial organizations as they can charge high TER and pay switch transactions from existing schemes with large AUM size to new schemes with smaller AUM size.

Secondly, SEBI says that although prepayment of commissions is prohibited, tracking commissions paid by AMCs are often higher in the initial/early year(s) of inflows/investments and decrease in subsequent years, somewhat in advance of payment. This practice also encourages manipulation and/or mis-selling of products by distributors after the first year of investment. The fact that in fiscal year 2021-2022, about 71 percent of total microfinance units were recovered within two years of investment, and in 2022-2023 again, 73 percent of units were recovered within two years puts this result into perspective.

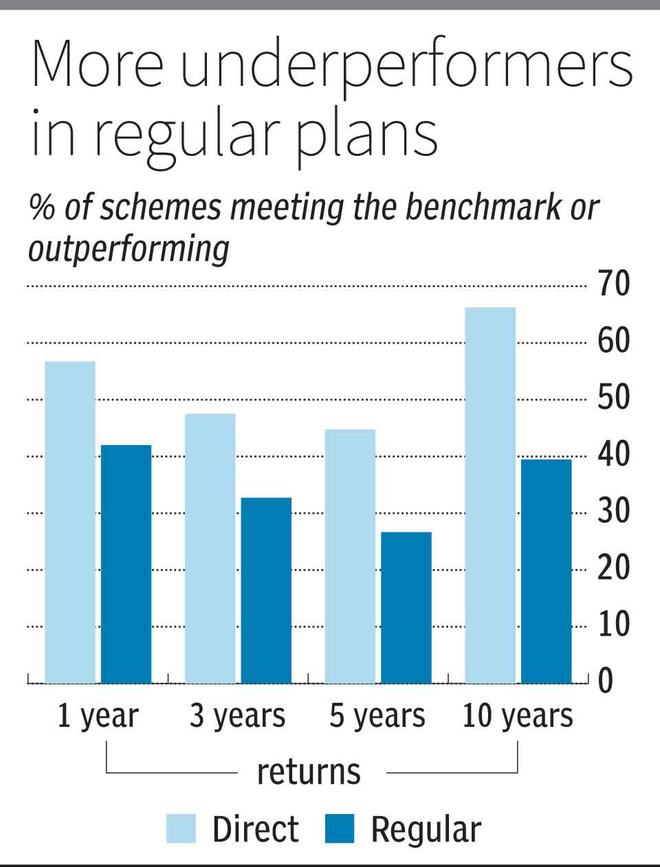

Finding #4: More regular plans fall short of performance standards

Analysis of performance data for active schemes over one year, three years, five years and 10 years as of February 2023 shows that regular plans are twice as high compared to direct plans over all time periods. Furthermore, more than 22 percent of the plans’ regular plans underperformed by more than 1.25 percent (equivalent to the maximum tracking spread allowed for ETFs/index funds) versus the benchmark for all of the periods listed above.