Last mile banking gets big push as number of bank mitras reach 8.50 lakh

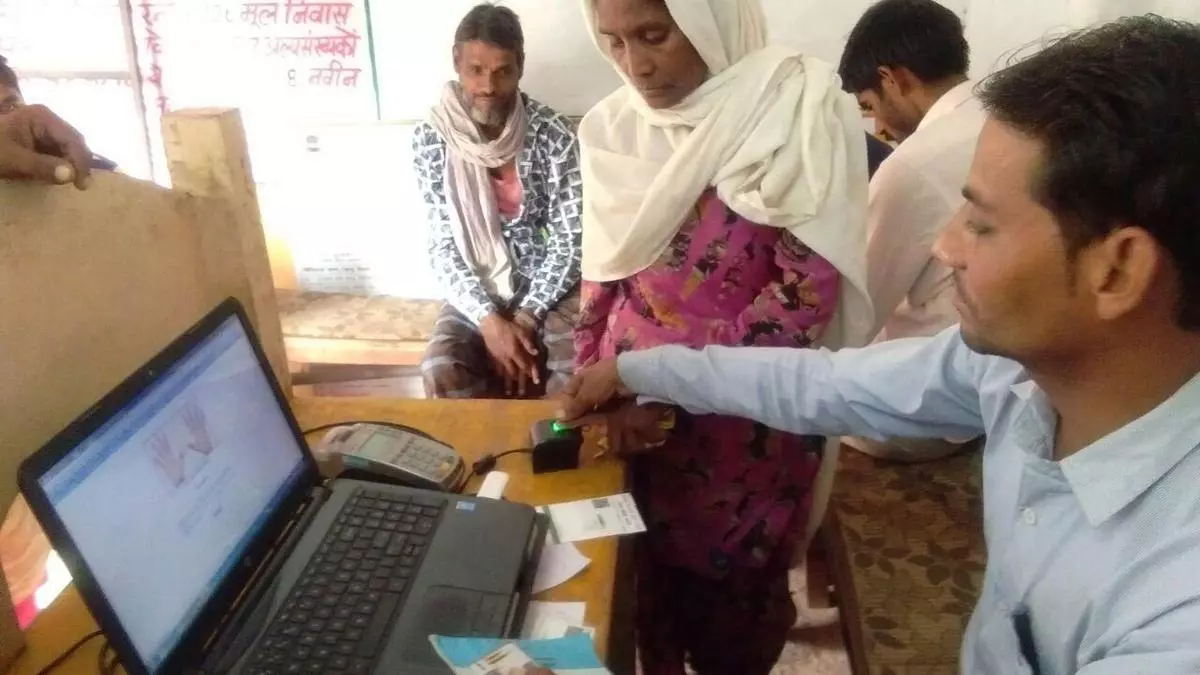

The number of Met Banks, the field force to ensure financial connectivity in the last mile, has now reached 8.50 lakh, which has a huge positive impact on financial inclusion.

The last financial year saw the addition of nearly one lakh Mitras Bank, employed as field agents by Business Correspondents (BCs) to provide last-mile financial services, taking the total number to 8.50 lakh, according to Ministry of Finance data.

“These are like the silent army providing branchless banking services across the country. The Covid-19 pandemic has proven the effectiveness of Bank Mitra’s model, and they have provided a remarkable service,” said a senior official of the Indian Banks Association (IBA). business line.

increased penetration

The increased penetration is due to a variety of factors. According to Bibikananda Panda, Chief Economist, State Bank of India, due to the penetration of digital banking services in the country, banks are strategically deploying more banking transactions to provide superior customer service at a lower cost.

“For public sector banks, it serves the dual objective of reducing footfall in rural and semi-urban branches (RUSU) while at the same time providing high-quality service to all customers,” Panda said.

Also read: TCS Tax: Credit card holders may have to file a declaration with banks

There has been an increase in service offerings from Mitras Bank in recent years. “For a geographical area as vast as ours, this is the best way to connect everyone to the formal financial network. Meter banks provide almost all services, from cash deposits and withdrawals to sourcing loan offers and selling other value-added services such as mutual funds and insurance, among others. other things.

It is a win-win situation because banks are able to serve the last mile at a lower cost. To improve the system, banks have board-approved SOPs for Mitras Bank appendages, and applicants go through a rigorous due diligence process to ensure that the security of the system is not compromised.

The success of the Pradhan Mantri Jan Dhan Yojana (PMJDY) scheme, which now covers more than 49 crores beneficiaries, is also a financial contribution of the banks, bankers say.

challenge

Despite their contribution, small banks face many challenges. “Since a long time, we have been asking for an increase in the fixed payment component as well as commission on transactions,” said M Raju, Mitra Bank in Bhopalapatnam village in Karimnagar district in Telangana.

“We get only 1,250 euros as fixed wages and around 80-100 euros for every 1 lakh transaction,” he added.