How Should You Invest $50,000 In Real Estate Right Now?

FAQ on BiggerPockets Forums It goes something like, “I have $50,000 and I’m looking to invest in real estate. How do I get started?”

In normal times, nine times out of 10 would be my advice hack homes For the first time investor, especially given the significantly better rates and terms homeowners can get compared to investors. However, in the past year, that delta in terms of the loan terms has shrunk significantly, and so while home hacking is still an option, it’s not head and shoulders above everything else that it used to be. Although house hacking has certainly held up better than many other strategies.

In fact, if there ever was a challenging real estate market—especially for new investors or those with $50,000 or so burning a hole in their pockets—this would be the market. This 2022 meme spells out that challenge as succinctly as any article (updated for 2023 audiences) can:

But sitting on the sidelines also has its costs. Susan Woolley bloomberg sums up The dilemma facing investors from all walks of life, most notably real estate investors in this current market,

In the short term, focusing on capital preservation may make more sense than focusing on growth. But in the long run, inflation eats away at liquidity and reduces the purchasing power of savers.”

So, given this predicament, what are the best options to proceed?

BRRRR Strategy: Mostly not

Don’t get me wrong, if you find a great deal that you can buy for 75% of its market value and is cash flowing at current rates, go for it. Unfortunately, the BRRRR strategy is dead (or hibernating, to be exact). This is hard for me to say BRRRR strategySpecifically, in our case, buying on a private loan, rehabbing, leasing and then refinancing with a bank was our favorite strategy of all.

The main problem is that almost every lender expects a property to have a debt service coverage ratio (DSCR) of 1.2 or better. Namely, net operating income (total income minus expenses) should be 1.2 times the mortgage payments. Even in high cash flow markets it is very difficult to get a 75% loan with interest rates in 6 and 7 and rates where they are.

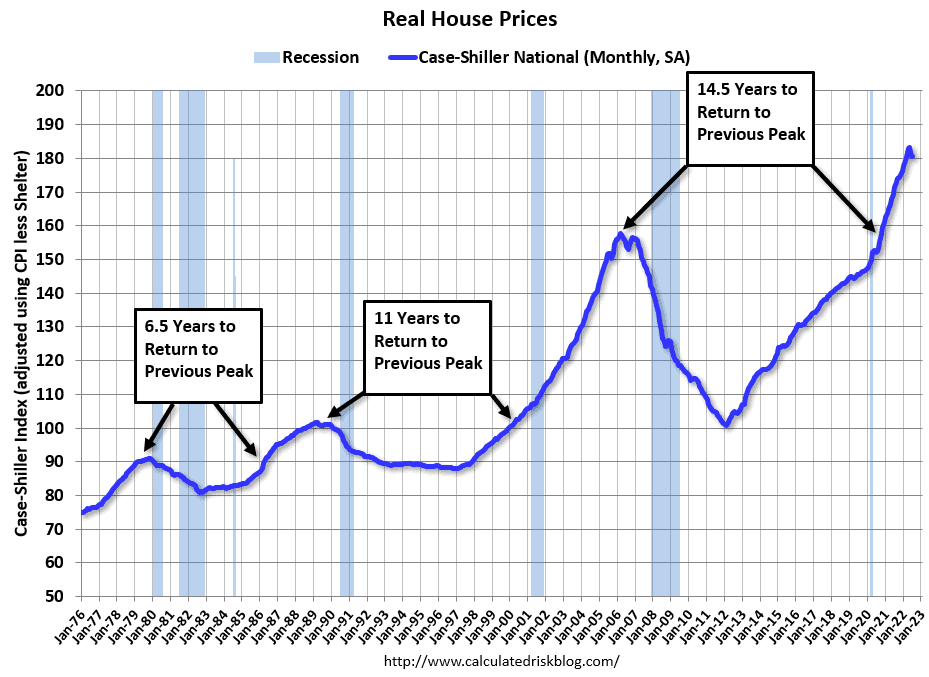

In addition to, Real estate prices began to fall. Sure, they didn’t fall much (see the meme above), but after skyrocketing, they started to cool off. A breakdown is unlikely, but there is a high estimate for it in the near future. Like Bill McBride show upwas the time between a single peak for CPI-adjusted property prices to equal again the same price after falling between 6.5 and 15 years in the past three cycles.

McBride expects prices to fall in total by 10% nominally and 25% in real terms (adjusted for inflation) from their peak in mid-2022. Opinions on this, of course, vary widely. but general consensus is that real estate prices will most likely fall, and are unlikely to rise more than a marginal amount, and even if they do rise, they will almost certainly follow inflation.

For his part, McBride believes property prices will be “in purgatory” for seven years. I tend to agree.

Therefore, you will likely need to leave a lot of money in a property and are unlikely to see much appreciation in the next few years. If you have a decent amount of capital or partners with cash willing to go with you, that’s one thing. And yes, if you find a great deal, pull the trigger.

But for the most part, BRRRR’s strategy is not perfect in the current market.

sponsored

Home hacking: maybe

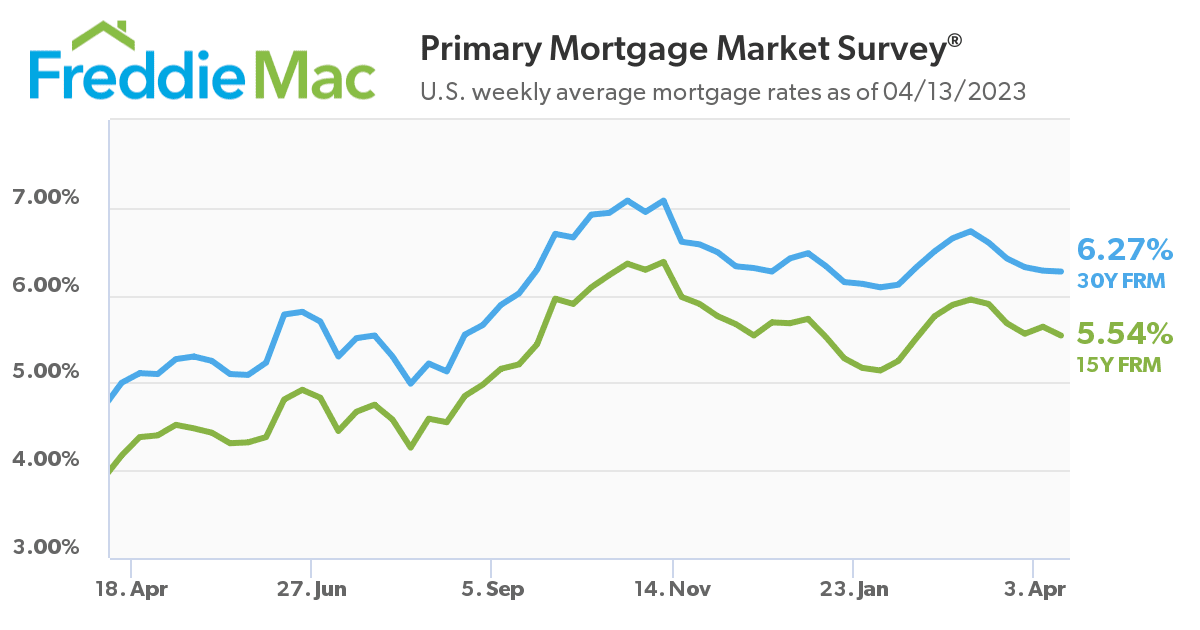

I purchased my personal residence mid 2021 and took out a 30 year fixed rate 3% mortgage. I have heard of many people who have taken out second mortgages. (I think Mark Zuckerberg set the record in this regard With a mortgage rate of 1.05%). Unfortunately, these rates are a thing of the past.

Today, mortgage rates are in the mid 6s. Although that’s better than the low 70s they were in during the start of the year. At least we can all be thankful for the little mercy.

While rates are higher than normal, it is still a good idea to get your foot in the door of real estate investing. and with FHA loansYou can do this with just a 3.5% cut, which would cover $50,000 in almost any market. What’s more, you can buy up to four floors with an FHA loan, live in one unit and rent out the other three, get a place to live and become an investor at the same time.

Many banks will even offer conventional financing of up to 95% of the purchase price for homeowners.

However, for the first time in my investing career, I cannot unequivocally endorse home hacks for new investors or those looking to put down $50,000 or so. But it’s still definitely an option to consider.

Before moving on, I should point this out Inflation cooled, so there is reason to believe that interest rates will fall later this year or early next year. So while I’m usually a big fan of fixed rate mortgages, now might be a good time to consider adjustable rate mortgages. (Although you should test your financial ability in case prices go up, you can never know such things.)

Creative Finance: Yes

In this regard, I am mostly talking about subject to deals. With such deals, the property is purchased “subject to” the existing mortgage. So, the deed is transferred to you, but the seller remains on the mortgage.

There is a huge opportunity here in this market because most homeowners have great loans, however the market has slowed down, so it is difficult and can take longer to sell (although prices have only come down a bit because so few people have the motivation to sell). And as put in previous article“The advantages for the buyer, in this case, are clear. If you can ‘afford’ a 2.85% loan on a property, how important is the purchase price?”

There are some drawbacks to submission. For example, the bank has the right to call the loan accrued, although it rarely does such a thing. The other thing is that the buyer cannot borrow any of the money for the rehab. And if there is a large discrepancy between sale and loan prices, there is no way to bridge that gap without taking out a second mortgage.

But for an investor with about $50,000 to spend, that will more often than not fill the gap.

It should also be noted that seller financing is another option for buyers to consider in this market. It presents similar challenges and opportunities, except for the obvious fact that almost no homeowner will ever loan you at 3% interest to buy their home from.

Unions: Mostly not

Real estate unions It usually takes place on larger deals where the principal party finds, negotiates and arranges a deal and brings in investors to cover the down payment and repairs. Typically, equity retains about 15-35% of the capital, and passive investors get the rest.

Over the past few years, syndicated loan investors have made huge losses as real estate prices skyrocketed. But now, yields are lower because interest rates are higher, and rates haven’t (at least not yet) come down much to quell that lower cash flow. And as mentioned above, there is no reason to believe that real estate prices will rise much, if at all, in the near future. It will almost certainly not keep up with inflation. So, most of the advantages offered by syndicated mortgages are no longer there, especially for passive investors.

Of course, as with BRRRR, there are still good deals. And if the market gets more chaotic, there could be more eager sellers, and therefore more opportunities for really good deals, which will be worth it regardless of the interest rate or potential rally. But this has not yet been achieved.

Private lending: maybe

Private lenders often lend at 8-12% interest. Hard money lenders (usually companies set up to lend private money to fins) rate 12-15% by three to five points.

$50,000 isn’t generally enough to lend someone to buy a house to turn over or keep, but if you’ve got close to $100,000 or more, chances are it should.

Indeed, with interest rates in the mid-60s, a 10% private loan doesn’t look as bad to an investor as it did a year ago. If this type of return meets your goals, private lending is something to consider.

Sidelines: Maybe

Another first thing for me to even consider is possibly recommending to those with $50,000 who want to get started in real estate to instead sit on the sidelines for the time being. Time in the market beats market timing – or at least it usually is.

This market is one of the few times that I would say that it’s not a bad thing to sit on the sidelines for a while. For our part, we’re focused on completing our rehab, increasing our occupancy, improving our systems. We are not looking to buy a lot this year. Although, in part, that’s because we had a great year in 2022 and we’re playing a little bit of catch-up.

As of this writing, The one-month US Treasury yield is 4%., and six months provide a return of 5%. This was that last year. So, sitting on the sidelines isn’t the actual equivalent of stuffing money under your mattress like it was not so long ago.

While these returns are still below inflation and somewhat paltry compared to what real estate investors tend to make, they are much better than buying a modest bargain with a high interest rate loan in a volatile and likely to decline market.

Ultimately, my recommendation is not to sit on the sidelines. But I’m going to be much more comfortable holding on to a really good deal and waiting a lot longer than I would have been last year and more comfortable than, say, five years ago.

In this economy, especially, you don’t want to force anything.

Conclusion

This is the most confusing and challenging real estate market I have ever seen. I certainly do not envy someone who is looking to get started now. It is important to approach the market with caution and not try to force a trade. There will be time for that, and the economy will, sooner or later, become more beneficial to real estate investors.

Even still, there are opportunities in real estate available to someone with $50,000 or so, even in this market. You just need to be more careful and be more patient.

Innovative financing techniques to do more deals, more often

Does your lack of liquidity prevent you from achieving your real estate dreams? No matter how much money you have in your checking account, there is always real estate you can’t afford. Don’t let the contents of your wallet determine your future! This book offers many strategies for leveraging other people’s money to achieve amazing returns on your initial investment.

Note by BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.