Gland Pharma Stock Analysis: Q4FY23 Results and Intense Competition Impact Investors

Gland Pharma stock fell 20 percent on May 19, after the results shocked investors. With issues ranging from one-time to structural, it reported an overall failure in the fourth quarter of fiscal ’23, missing revenue and EPS estimates by 21 percent and 70 percent, respectively. The company’s revenue decreased by 28 per cent in the quarter from Rs.1,103 crore in Q4FY22 to Rs.785 crore in the quarter. The lower revenue base affected EBITDA margins, which fell from 32 percent in Q4 FY22 to 21 percent in Q4 FY23. In commenting to the publication results, among a host of issues , Only a few of them can be called a “one-time” or short-term effect. Other issues may range from medium term to structural impact.

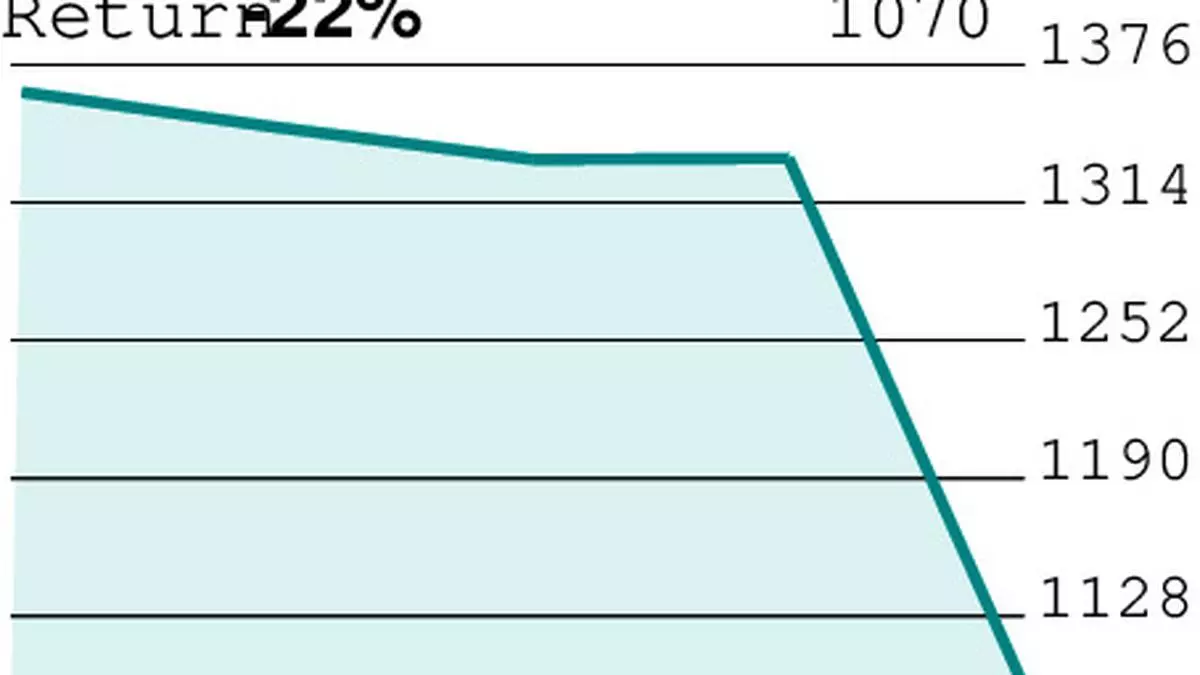

Amidst this uncertainty, Friday’s stock correction does not mean a buying opportunity despite valuation at 14 times EV/EBITDA compared to an average of 22 times last year. Also prior to this result, the company’s performance in 9 months of fiscal ’23 (revenue decline of 14 percent) had not been encouraging. The stock is now down 68 percent from April 2022.

Complex portfolio competition

Gland has developed a range of complex sterile products for the US market. Competition and severe price erosion, even in this segment, continue to take their toll on the company. In the fourth quarter of fiscal ’23, the contribution of new launches of 3 percent was insufficient to offset the 23 percent annual decline in US markets (revenue contribution of 70 percent).

Heparin and Enoxaparin, which contributed around Rs 1,200 crore in FY22, have fallen to Rs 980 crore this year as competition from Chinese players in the two products intensifies. There was a loss of exclusivity of antifungal Micafungin to the tune of ₹375 crore in FY23 for Gland which, along with high competition in core products, may affect FY24 performance as well.

The company has been seeing significant stock divestitures in US channels affecting sales recovery, which has not yet normalized. The company cited a higher cost of interest as the reason for reducing the sales channel for product inventory, but the increase in regular sales has yet to be seen. Gland’s high stock of finished products in anticipation of sales resuming has also been returned to the same.

One customer converted 14-15 Gland products in the quarter. A new client has been allocated and is expected to help recover in Q1 FY24. Apart from this, one client with annual exposure of Rs 200 crore has filed for bankruptcy in the US. Actions and sale of assets will validate this revenue stream stream, which the company is confident to recover. In the current quarter, one production line was also shut down to add an additional line which affected sales by Rs 40 crore – but is now operational.

The company cited bid delays for the decline in RoW markets (down 10 percent year-over-year and 22 percent in revenue). Reducing heparin sales by a smaller margin impacted RoW and in Indian markets was included in Price Control (NLEM). The Indian market, which accounted for 18 percent in Q4FY22, was down 68% in Q4FY23 and now contributes 8% to revenue. Last year’s Covid sales appeared to have contributed more to last year than peers (2-11 percent for other drug companies), which affected domestic performance.

From the current situation, Gland has gradually normalized the impact of the loss of exclusivity of Micafungin, recovery of the loss of sales to customers, tenders in RoW and even inventory rationalization in the medium term. But the effect of higher competition in the sterilization sector in the United States is not yet known.

Amidst a wave of negative impacts, the quarter also recorded some positive developments for the company. The company acquired Europe-based Cenexi (€184m revenue in FY21). This provides an opportunity to expand contract developments into Europe, along with additional technologies (ophthalmic, pre-packaged, oncology). The company has invested more than ₹ 300 crore in its biosimilars contract development arm, which has signed its first contract. Within three years, the streams can add additional value to existing operations. However, for now, the negatives outweigh the positives.