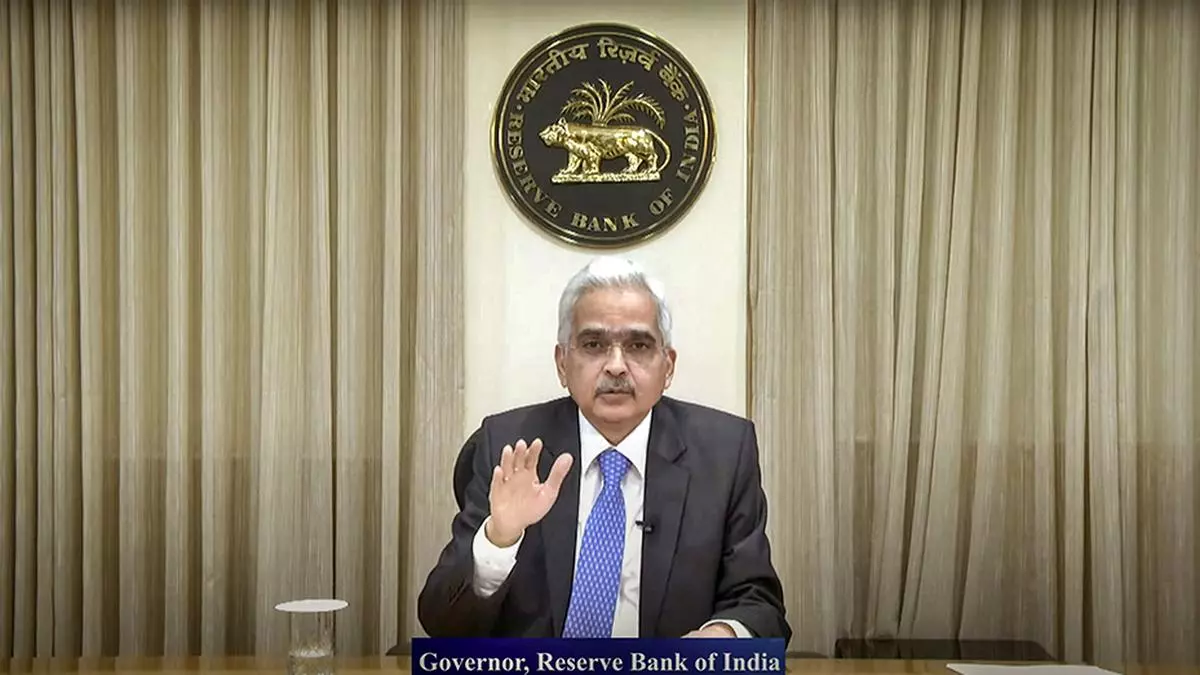

Cumulative impact of monetary policy actions still unfolding, needs to be monitored closely: RBI Governor in MPC Meeting

All six members of the MPC were on the same page about the need to assess the cumulative impact of monetary policy tightening to date, thus voting unanimously for a temporary moratorium at their last meeting, even as they left the door open for higher rates in the future.

The policy repo rate was left unchanged at 6.50 percent at the last meeting of the Monetary Policy Committee held between April 3rd and April 6th.

Of the six members, only Jayanth R Varma, professor at the Indian Institute of Management, Ahmedabad, expressed reservations about the decision “The focus remains on drawing down accommodation to ensure that inflation is gradually in line with target, while supporting growth,” according to MPC meeting minutes.

RBI Governor Shaktikanta Das emphasized that the cumulative impact of our monetary policy actions over the past year is still unfolding and needs to be watched closely.

on inflation

He noted that the inflation rate is expected to decline in the period 2023-24, but inflation towards the target is likely to be slow and long-term. Expected inflation in Q4: 2023-24 at 5.2 percent will still be well above target.

“Therefore, at this juncture, we must persevere in our focus on bringing about lasting moderation in inflation while at the same time giving ourselves some time to observe the impact of our past actions.

Therefore, I think we are making a tactical stop at this MPC meeting. Accordingly, I vote for a pause in price action and to remain focused on pulling the residence… This is a tactical pause, not a pivot or change in policy direction,” said Das.

Michael Batra, Deputy Governor, said it was prudent to anticipate future shocks to the inflation path while assessing the cumulative tightening of monetary policy to date.

The balance of risk has shifted slightly towards inflation since the February meeting, Varma said, but the current best estimate is that 315 basis points of effective tightening of the overnight rate (from the reverse repo rate of 3.35 per cent to the repo rate of 6.50 per cent) is sufficient. to control inflation.

Therefore, he voted to keep the interest rate unchanged at this meeting.

Varma said, ‘I can’t put my name in a situation that I don’t even understand. At the same time, it is clear that the war against inflation has not yet been won, and it would be too early to declare the end of this tightening cycle.

Increased vigilance is needed in the face of the new risks that I highlighted earlier in my statement. For these reasons, I refrain from opposing this part of the resolution and confine myself to expressing reservations about it.