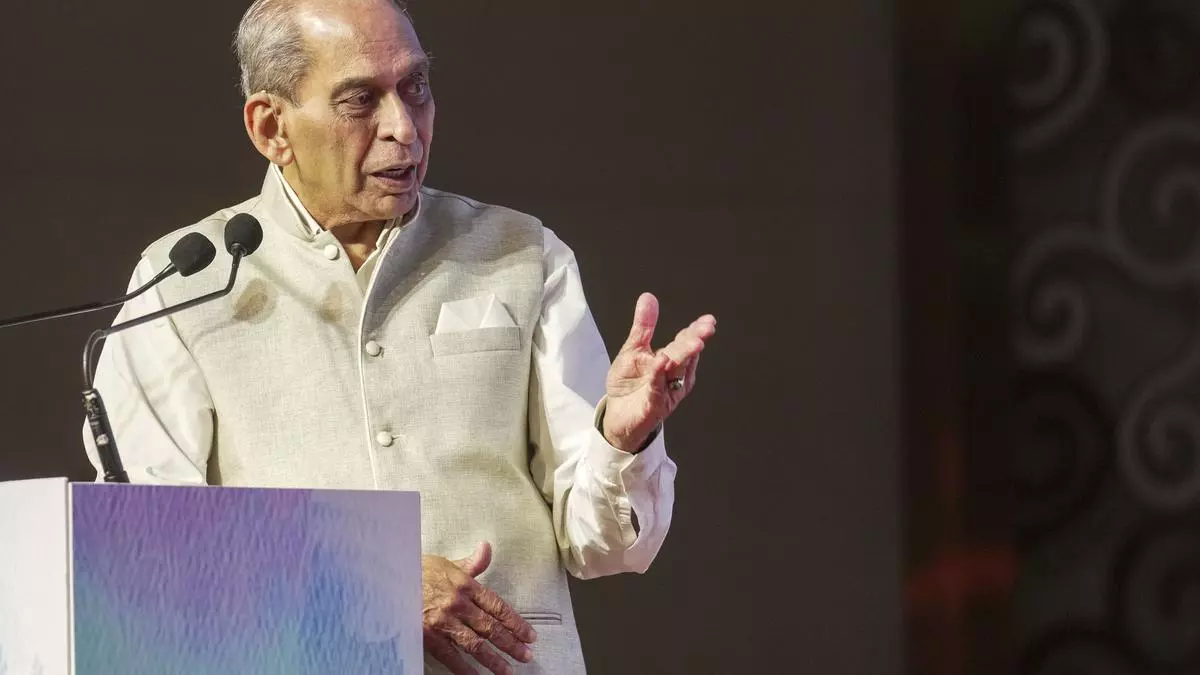

Banking will be all digital in 10 years: N Vaghul

Updated – April 28, 2023 at 09:02 PM.

How do you see the future of the banking sector?

You cannot combine the present with the future, which will be very different from today. The speed at which things are transforming, and banking in 10 years, will all be digital. Everything will be fintech oriented. Loans will be granted online. One of the reasons I didn’t continue with the Piramal board, even though it could have lasted another year, was that I didn’t understand the language. My language has become irrelevant. People speak a new language, new terms. In the same way people of this generation in the next decade will be treated very differently. We are not behind in technology. In those days we would travel abroad and look at ATMs. Today, that is not the case. We lead in the space with the latest technology.

Do you use UPI, Digital Banking?

Naturally. I use it in everything I do. Because ICICI Bank is the one I use. I use i-Mobile, I make all payments through that. When my granddaughter came over from the US, she was amazed at how easy it was to make payments. And there was a huge difference.

There is a mention about the need for privatization in your book, and the government is in the process of privatizing IDBI Bank. Are the right steps being taken?

ICICI Bank, HDFC Bank and Axis Bank are the largest private sector banks. The characteristics of these banks are that they are publicly owned and managed in a more professional manner. Management roles are not hereditary, but by choice. These are the characteristics that I think we should pass on. We really should divide this space into three — one that’s state-owned. The other is publicly owned, like HDFC Bank, and the third is private, development is by succession, which is quite normal there. I want more people in the middle space. finally [in privatisation], you are looking for a viewer. For this you have to first strengthen the bank by having a proper board of directors and by a proper CEO to give credibility in the market. Once you make the market credible, you don’t need to sell the bank to anyone. They will attract money.

You also talk about creating a fund to inject capital into banks…

All this has become obsolete. Today, what is really happening is that if you have a good and skilled management team, it is easy to collect money from the public. We don’t need financing or anything. After all, ICICI Bank and HDFC Bank collect money from the public. Today, capital adequacy is 18-19 percent, and 99 percent of it is not contributed by anyone. It all aroused from the public. This is the only way we can contribute to trade; We are sure of a good money and sound board. This is the way to protect the interests of shareholders. This is how the country should go.

Will state-owned banks be challenged to adopt the technology?

Today, they don’t make a difference. We used to play a game when we were younger – how do you draw a line, how do you make it smaller? You can do this by drawing a larger drawing. The state banking sector is getting smaller.

Corporate Governance Standards have increased in Company India. Do you create a positive hypothesis for them to enter the banking field?

Corporations will not dominate banks. It will be the professionals who will dominate the sector. For diverse public ownership, what the public wants first is professional boards and a selection process rather than succession. This matters a lot of difference. So here’s the way forward for the next 10 years.