The San Diego Padres suffered a setback against the Baltimore Orioles on Monday after All-Star pitcher Jason Adam sustained a leg injury. Adam was charged off the field after pitching 0.2 innings.

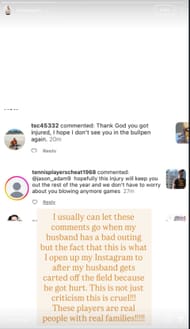

Following Adam’s injury on Monday, his wife, Kelsey, shared the hate the pircher’s family received on social media. In an Instagram story, Kelsey, shared a snapshot of the comments, writing:

“I usually can let these comments go when my husband has a bad outing but the fact that this is what I open up my Instagram to after my husband gets carried off the field because he got hurt. This is not just criticism, this is cruel!!! These players are real people with real families!!!”

•

![]()

Kelsey’s message caught the attention of fellow Padres pitcher Adrian Morejon’s wife Melany. She shared Kelsey’s story on Instagram, captioning it:

“Some of you need to realize that those players on your TVs are HUMANS!! Jason and his family are some of the kindest, most amazing people we have ever played with. This is just cruel and disgusting, especially coming from ‘fans.’ Stop feeling so comfortable behind a stupid screen and think before you leave these type of comments!!!”

Jason Adam went down in pain, holding his leg, after throwing his 26th pitch on Monday. His cleats seemingly got stuck on the mound and he slipped, injuring his left leg.

While fans on social media were brash with their comments, the crowd at Petco Park gave Adam a standing ovation as he was being charged off the field.

Adrian Morejon’s wife, Melany, enjoys time away in the woods.

Adrian Morejon earned his first All-Star selection this year and is gearing up for his team’s strong push for a postseason spot in an intense battle for the NL West title.

While Morejon is doing his stuff from the mound, his wife, Melany is cooling off away from the action. She shared pictures of her time in the woods, relaxing on a tree near a stream in one of the pictures.

“Fairy whispers and secret streams,” Melany captioned her Instagram post.

Edited by Chaitanya Prakash