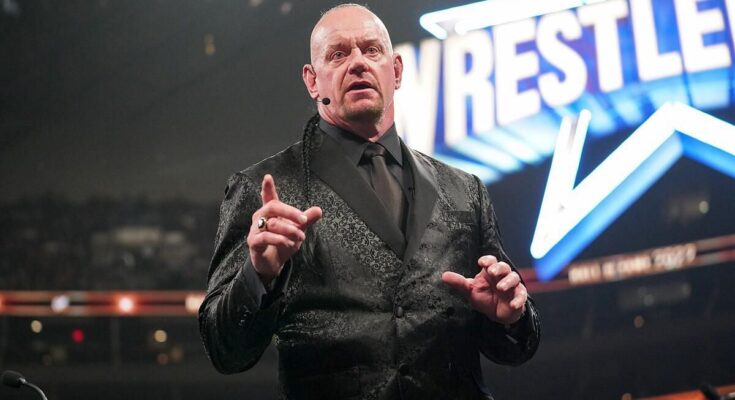

If rumors are to be believed, The Undertaker might be joining the WWE creative team in the near future. While it poses its problems, former NWA Champion EC3 thinks it can still be a good step.

While the Undertaker has more than enough experience to take on the new role, Vince Russo believes that he may unintentionally be biased due to his history of working in the company and its large roster. However, EC3 believes the pros outweigh the cons, and the Undertaker could be put in a niche WWE creative role.

Speaking on the latest episode of The Wrestling Outlaws, EC3 stated:

“It’s a catch-22. So, if the biggest issue is he is gonna have some favorites and he has history with the people, I would wash that right away with what he can actually bring to making a coherent and context written product. So, I would kind of keep him in a role, maybe that’s not, like you are talking about cliffhangers and writing a show. He is not gonna be sitting there typing it up and formatting it. But I would put him in some position that’s like, ‘make-it-make-sense’ guy.” [6:05 onwards]

Vince Russo thinks the Undertaker may not be fully qualified for a WWE creative role

According to Vince Russo, being in the creative department is more than simply generating new ideas.

Speaking on the same episode of The Wrestling Outlaws, the former WWE Head Writer stated:

“It’s the nature of the beast. I love Taker. He is the nicest guy in the world. But he has got history, you know, with a lot of these people. He has been around a lot of these people a long time. And again, there is more to creative than just throwing out ideas. There is knowing how to write a show. There is knowing how to format a show. There’s knowing how to write dialogue. There is knowing how to do cliffhangers.” [2:17 onwards]

As of now, it remains to be seen what is next for The Undertaker.

If you use any quotes from this article, please credit Sportskeeda and embed the exclusive YouTube video.

Edited by Angana Roy