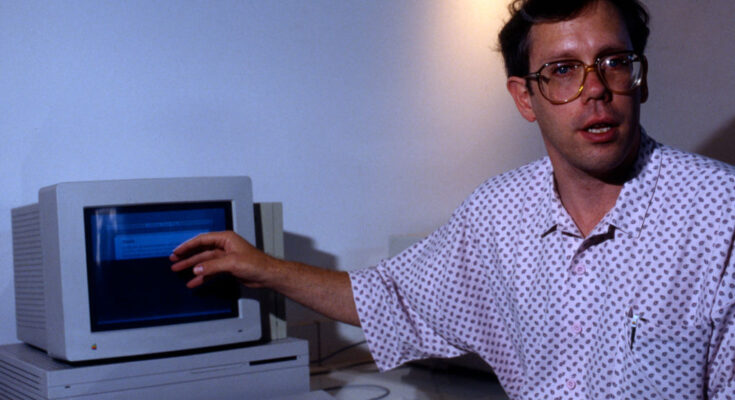

Bill Atkinson, an engineer who played a key role in the development of the Macintosh and other landmark Apple products, has died of pancreatic cancer.

After Atkinson’s family announced his passing on Facebook, Wired’s Steven Levy provided an overview of Atkinson’s many accomplishments as Apple employee number 51 . In addition to the Macintosh, the Apple projects he either created or contributed to include the Lisa computer, QuickDraw, the Magic Slate (a precursor of the iPad), and HyperCard (a precursor to the World Wide Web).

Atkinson, who was 74, eventually became passionate about nature photography and, when he was diagnosed with cancer last year, wrote on Facebook that he had “already led an amazing and wonderful life.”

In a post on X, Apple CEO Tim Cook described Atkinson as “a true visionary whose creativity, heart, and groundbreaking work on the Mac will forever inspire us.” And Daring Fireball’s John Gruber wrote that “with no hyperbole,” Atkinson “may well have been the best computer programmer who ever lived.”