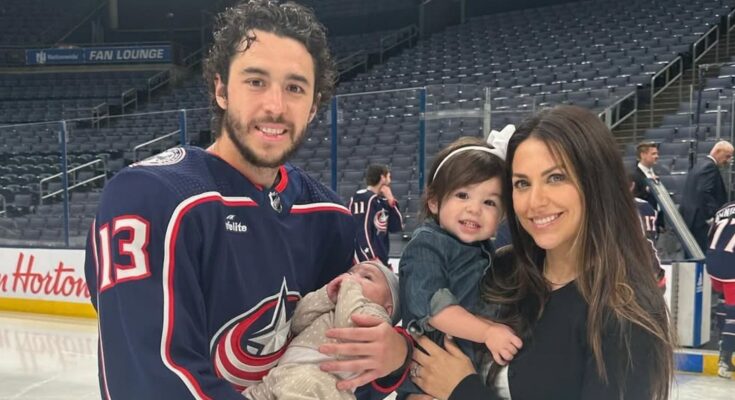

Late NHLer Johnny Gaudreau and his brother Matthew were killed last year in August in a tragic road accident. Since then, the hockey community has come together to pay special tributes to the memory of the beloved stars from time to time.

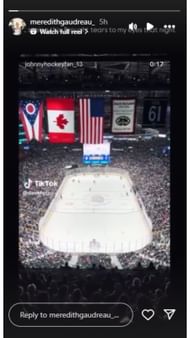

On April 17, the Columbus Blue Jackets played their final game of the season at Nationwide Arena. During the game, the crowd broke out into loud ‘Johnny Hockey’ chants in honor of the former Blue Jackets’ memory.

This Thursday, Johnny Gaudreau’s wife Meredith noticed a clip of the emotional moment posted by a fan account on Instagram. She reposted the clip on her own stories and wrote:

“Just seeing this. Brought tears to my eyes that night.”

The Blue Jackets have been paying special tributes to Johnny Gaudreau’s legacy throughout the 2024-25 NHL season. The team wore helmet stickers featuring his names and numbers, and Johnny’s jersey number 13 was added as a patch on all player uniforms.

At the home opener, a memorial display was set up and a tribute video was played, while a special banner with his number was raised on the rafters. During the Stadium Series game in March 2025, the Blue Jackets and Red Wings paid further tribute with special Gaudreau outfits and a video honoring the brothers.

Johnny Gaudreau’s mother thanks USHL and Commissioner Glenn Hefferan

Earlier this year, the USHL created the Gaudreau Award to honor the legacy of late hockey brothers Johnny and Matthew Gaudreau. On April 12, Ethan Wyttenbach of the Sioux Falls Stampede was named the first recipient of the award.

The same week, the award was officially presented to him in Sioux Falls. Johnny Gaudreau’s parents Guy and Jane Gaudreau surprised Wyttenbach alongside USHL Commissioner Glenn Hefferan in Sioux Falls.

Jane later thanked the USHL and Hefferan on X, and shared several pictures from their trip. She wrote:

“A special thank you to Glenn Hefferan and the @USHL for establishing the award to honor John & Matty Gaudreau. Guy and I were incredibly honored to be invited to Sioux Falls to surprise Ethan Wyttenbach and let him know he was the winner of the Gaudreau Award.”

Earlier in the month, the Omaha Lancers also honored the Gaudreau brothers. On April 5, before a game against the Dubuque Fighting Saints, the Lancers held a special tribute ceremony. The Gaudreau family was invited to join a ceremonial puck drop and fans observed 11 seconds of silence for Matthew, who wore jersey No. 11 while playing for the team.

Edited by Anjum Rajonno