Semiconductor giant Nvidia is facing unexpected new U.S. export controls on its H20 chips.

In a filing Tuesday, Nvidia said it was informed by the U.S. government that it will need a license to export its H20 AI chips to China. This license will be required indefinitely, according to the filing — the U.S. government cited “risk that the [H20] may be used in […] a supercomputer in China.”

Nvidia anticipates $5.5 billion in related charges in its Q1 2026 fiscal year, which ends April 27. The company’s stock was down around 6% in extended trading.

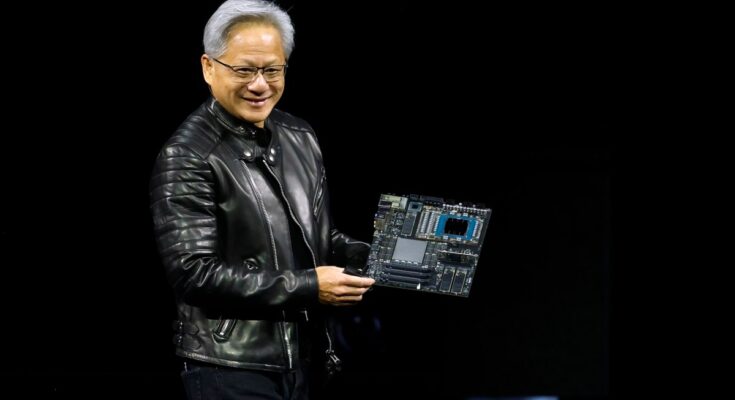

The H20 is the most advanced AI chip Nvidia can export to China under the U.S.’ current and previous export rules. Last week, NPR reported that CEO Jensen Huang might have talked his way out of new H20 restrictions during a dinner at President Donald Trump’s Mar-a-Lago resort, in part by committing that Nvidia would invest in AI data centers in the U.S.

Perhaps not-so-coincidentally, Nvidia announced on Monday that it would spend hundreds of millions of dollars over the next four years manufacturing some AI chips in the U.S. Pundits were quick to point out that the company’s commitment was light on the details.

Multiple government officials had been calling for stronger export controls on the H20 because the chip was allegedly used to train models from China-based AI startup DeepSeek, including the R1 “reasoning” model that threw the U.S. AI market for a loop in January.

Nvidia declined to comment.