WWE is one of the largest entertainment companies in the world, and Drake is one of the biggest celebrities going today. The two brands coming together was bound to happen as it appears Drake is now a wrestling fan. The five-time Grammy Award winner just went viral for interacting with a few top superstars, including a certain current champion that really caused a stir among fans.

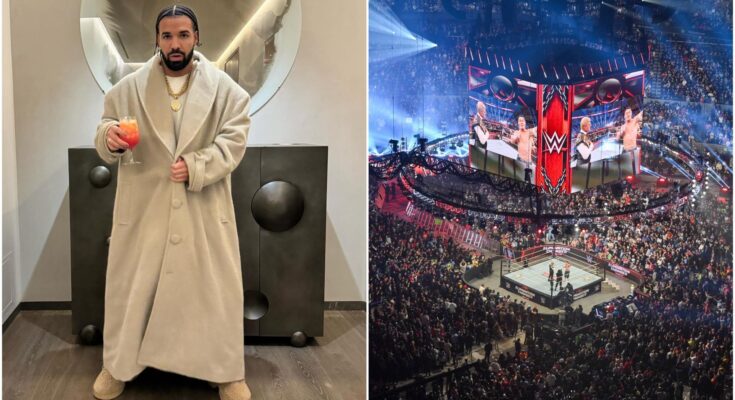

Champagne Papi caused a stir at Elimination Chamber on Saturday. The 38-year-old entertainer did not make an official appearance at the PLE, but he was in attendance at Rogers Centre in his hometown of Toronto and was seen backstage as well as ringside. Drake indicated on social media that he is sold on being a World Wrestling Entertainment fan, and he thanked fellow rapper Lil Yachty for turning him onto it.

Drake went viral within the WWE Universe today for an interesting follow he made on Instagram. The former Degrassi actor, with more than 143 million followers, is following less than 4,000 others, but one of those is now Liv Morgan. However, the current Women’s Tag Team Champion is not the only wrestler he followed.

After following Morgan, Drake then gave an Instagram follow to several others from the industry. Billboard’s Artist of the Decade is now following Logan Paul, Nikkita Lyons, Pat McAfee, Ronda Rousey, The Rock, and Rhea Ripley.

Drake and The Rock meet at WWE Elimination Chamber

Drake visited WWE Elimination Chamber on Saturday after the biggest wrestling company in the world visited his hometown of Toronto. The platinum-selling artist was seen backstage at Rogers Centre hanging out with The Rock and others, as seen below.

Drake’s trip to Elimination Chamber has drawn several instances of mainstream media attention for World Wrestling Entertainment. ET, Hot97, HNHH, VIBE, The Source, Vice, MTV, and many others have covered his presence at the PLE, and all follow-up coverage.

Edited by Jacob Terrell