Zaggle Prepaid Ocean Services plans strategic acquisitions after raising ₹595 crore via QIP

Zaggle Prepaid Ocean Services, a listed B2B SaaS fintech, is eyeing strategic acquisitions after raising ₹595 crore through Qualified Institutional Placement.

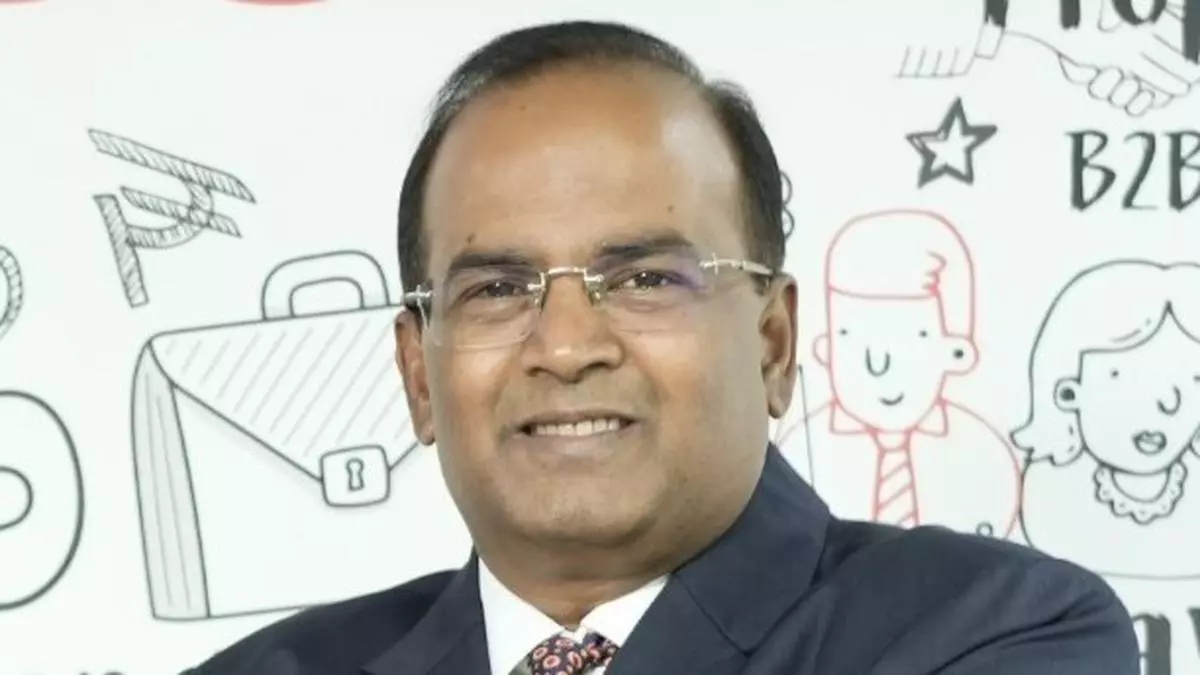

“We plan to acquire at least two companies in the upcoming financial year,” said Dr Raj Narayanam, Founder and Executive Chairman, Zaggle.

The company is evaluating 5 to 6 potential targets in the SaaS FinTech space, including in areas such as merchant card software, accounts receivables and FASTag solutions, said Narayanam.

He believes that the proposed acquisitions will fuel Zaggle’s growth rate by 70 to 75 per cent. Zaggle aims to achieve billion-dollar revenue in 5 to 6 years and the strategic acquisitions will drive the company towards an accelerated growth trajectory.

Zaggle recently acquired 98 per cent controlling stake in Span Across IT Solutions (TaxSpanner) through an investment of ₹32 crore and also picked up a 26 per cent stake in Mobileware Technologies for ₹16 crore.

Zaggle reported consolidated net profit of ₹20 crore against ₹8 crore in the year-ago period. The revenue from operations also increased by 64 per cent to Rs 302 crore against ₹184 crore in the year-ago period.

To fuel growth, the Special Purpose Committee of the board of directors approved the allotment of 1.13 crore of equity shares at ₹523 per share to eligible qualified institutional buyers.

Major financial institutions including Bank of India ELSS tax saver secured 16.8 per cent stake, Societe Generale – ODI secured 9.2 per cent while both ICICI Prudential Technology Fund and Nuvama Enhanced Dynamic Growth Equity (Edge) Fund picked-up 6.7 per cent stake in the QIP.