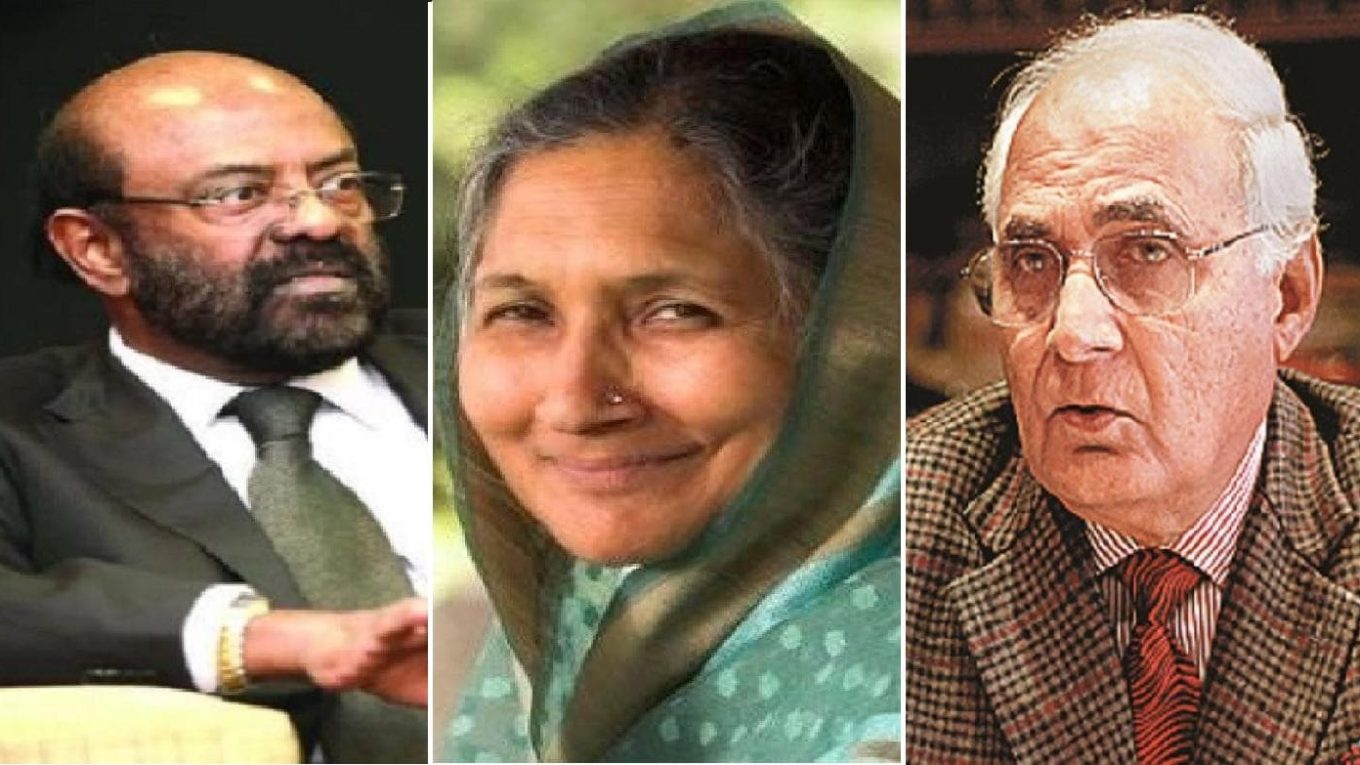

Year Ender 2023: Shiv Nadar, Savitri Jindal make the biggest leap in wealth

The Indian economy grew at a decent pace, the fastest among emerging markets, in 2023. Sensex moved past the 72,000 mark, and shares of major businesses rallied along with the wealth of many Indian businesspeople. The torchbearers among them were Shiv Nadar and Savitri Jindal. Here is the list of those ten people whose wealth escalated the most.

Total Net Worth – $33.8B

Surge: +$9.29B

Shiv Nadar is the founder and majority shareholder of HCL Technologies, an Indian multinational information technology consulting company headquartered in Noida. He also has a majority stake in publicly traded HCL Infosystems.

A strategic partnership with Verizon Business, valued at $2.1 billion, positioned HCLTech as a key collaborator in global managed network services. The company collaborated with Amazon Web Services (AWS) to drive the adoption of generative Artificial Intelligence (GenAI).

HCLTech entered India’s top-10 most valuable companies following a 4% stock rise in September. And in December, it joined an elite group of companies with a market-cap of Rs 4 trillion.

Total Net Worth – $24.5B

Surge: +$8.79B

Apart from being the fourth richest Indian, Savitri Jindal is also the richest woman in India. She took over Jindal Group in 2005 when her husband, the founder of Jindal Group, died in a helicopter crash.

Her income surged despite Jindal Steel & Power having reported a 67.91 per cent year-on-year (YoY) drop in consolidated net profit to Rs 518.67 crore in Q3FY23 on higher input cost and lower steel prices.

Mukesh Ambani

Total Net Worth – $95.9B

Surge: +$8.75B

Several reasons are connected to the surge in Mukesh Ambani’s wealth.

Reliance Jio is still topping the industry with the most significant gain in subscriber base, as it added 3.4 million mobile users respectively in September. It is also leading in the 5G race after a year of the launch of 5G networks in India.

As Jio Financial Services demerged from Reliance Industries, it reported a two-fold jump in its profits for the Q2 of FY24. Reliance Industries recorded 27.4 per cent increase in its consolidated net profit for the September quarter.

In November, Reliance Industries opened a 750,000 sq feet retail shopping destination for luxury brands. Reliance has recently announced that it will start working with IIT-B to launch a ‘Bharat GPT’ programme along with an operating system for televisions.

)

Total Net Worth – $15.8B

Surge: +$7.55B

Kushal Pal Singh is the wealthiest real estate developer in India. He along with his family controls about three-fourth stakes of the Delhi Land & Finance (DLF).

In March, DLF shared that they sold 1,137 luxury apartments in Gurugram worth over Rs 8,000 crore in just three days.

In March, DLF’s rental arm, DCCDL, reported that its net profit increased 43 per cent to Rs 1,429 crore in FY23 due to an increase in demand for office and retail properties. DLF’s own net profit for Q2 of FY24 stood at Rs 622.78 crore, with an increase of 31 per cent. Shares of DLF hit a multi-year high of Rs 500.90, rising 2 per cent on the BSE in Tuesday’s intra-day trade. The stock of the real estate developer claimed the Rs 500 mark for the first time since September 2008.

Total Net Worth – $35.1B

Surge: +$7.30B

Shapoor Mistry’s income is derived from his stakes in Tata Sons, which is the parent company of the Tata Group. Shapoor Mistry and family have 18.4 per cent of Tata Sons after his father, Pallonji Mistry, passed away in June 2022, and younger brother, Cyrus Mistry, died in a car accident two months later.

Bloomberg Billionaire Index has added the stakes previously held by Cyrus’s family with Shapoor Mistry because succession arrangements were unclear following Cyrus’s sudden death.

)

Total Net Worth – $17.7B

Surge: +$6.29B

Kumar Birla is the chairman of Aditya Birla Group, the company that controls India’s biggest cement maker, Grasim Industries and is in the League of Fortune 500. The group also engages in supermarkets and life insurance operations along with holdings of Hindalco Industries, an aluminium company.

In Q2FY24, Grasim Industries reported a net profit of Rs 1,164 crore, a rise of 15.3 per cent. It is also eyeing launching its paint business under the brand name Birla Opus in the fourth quarter of FY24.

Other sources of Birla’s income were enough to bear the loss-making telecom firm VI, which reported a 15.2 per cent higher consolidated net loss of Rs 8,746 crore in the second quarter of FY24.

Total Net Worth – $14.3B

Surge: +$5.89B

The Indian Billionaire is the chairman of RJ Corp, which is focused on F&B sectors. Under this, he manages Varun Beverages, the second-largest bottling partner for PepsiCo’s soft drink brands outside the US. He also controls Devyani International, which is India’s largest franchisee of Yum!, American multinational fast food corporation.

According to Forbes, his wealth jumped as Varun Beverages recently announced that it would acquire South Africa’s BevCo for $ 158 million. It has been the best performer over the past year in the fast-moving consumer goods (FMCG) space, delivering a return of 60 per cent to its shareholders.

Total Net Worth – $17.5B

Surge: +$3.30B

Cyrus Poonawalla is the chairman and managing director of the Cyrus Poonawalla Group, which includes Serum Institute of India, the world’s biggest vaccine manufacturer. The company made the Indian vaccine against Covid-19, known as Covishield.

He also owns Poonawalla Fincorp, a non-banking finance company controlled by Adar Poonawalla, his son. The surge in his income can be attributed to the remarkable performance of Poonawalla Fincorp. The financial report for the September quarter revealed a substantial 77% year-on-year jump in net income, reaching Rs 230 crore. This surge was fueled by exceptional loan sales and a notable enhancement in asset quality.

First Published: Dec 28 2023 | 7:49 PM IST