Will Investors With High Credit Scores Pay More Now? What The New Mortgage Rules Actually Mean

There has been a lot of concern in the real estate investing community recently about the newly enacted Federal Housing Finance Agency Act for Fannie Mae and Freddie Mac loans in relation to mortgage fees.

The gist of the complaint is that homebuyers with good credit will now have to subsidize those with bad credit. Technically, this is true. However, the way it is framed is completely misleading. The general argument goes something like this: Those with a 620 FICO score will receive a 1.75% discount, and those with a 740 FICO score will pay 1%.

Or another example would be this One particularly famous tweet:

?

Homebuyers with credit scores of 680 or higher will pay $40 per month more on a $400,000 home loan.

Buyers with down payments of 15% to 20% will receive the largest fees.

Buyers with riskier credit ratings and lower down payments will get lower rates and fees. pic.twitter.com/yVEp3btNJg

– WallStreetSilv (@WallStreetSilv) April 19, 2023

While what is being said is technically correct, it sounds a lot worse than it is.

First of all, this would Only affects Fannie Mae and Freddie Mac loans. This accounts for most loans to homeowners but won’t affect the FHA, FHA or nonconforming loans that many investors get.

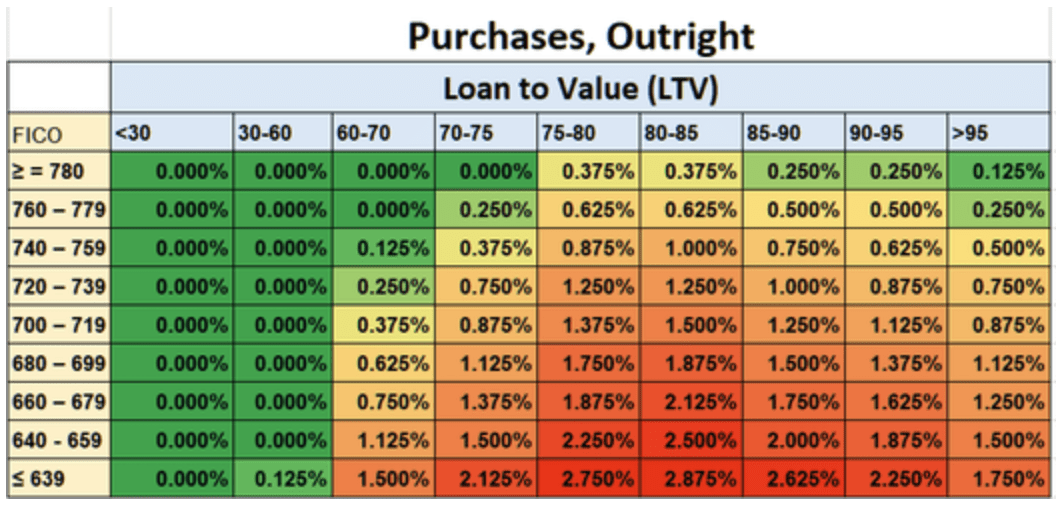

The fees discussed here are called Loan level price adjustment Or the LLPA, which mostly takes into account the borrower’s FICO score and the mortgage’s LTV. To a lesser extent, it also takes into account whether or not the property is occupied, whether it is a condominium or single-family residence, whether it is a second or first mortgage, and if there is any cash withdrawal for a refinance.

The LLPA fee is then effectively added to the mortgage. So, for example, if the mortgage is $100,000 and has a 1% LLPA, the LLPA would be $1,000. This can be paid as a fee but more often than not it is absorbed by the lender in exchange for a higher interest rate on the loan.

This added cost on the mortgage is to cover Fannie Mae and Freddie Mac from the additional risk of lending to riskier borrowers.

Riskier borrowers still pay more

The mistake many make here is that the percentages given are changes, not totals. Well, not quite that. The said 1% fee is the amount someone with a 740 FICO score would pay if they took out an 80-85% long term loan. The “discount” of 1.75% is not the fee someone with a 620 FICO score would pay, but instead the reduction in those fees from before. And in this case, it is for someone who is taking out a long-term loan of 95% or more.

Before this rule was passed, the LLPA fee for someone with a 620 FICO score getting a 95% loan rate was 3.5%. Now it is 1.75% (1.75% reduction). Here is a chart from Daily mortgage news Show the effects this rule changes might have on loans to borrowers depending on the LTV and FICO score.

These are the actual prices people will pay.

like Daily mortgage news sums up,

“As you can clearly see now, if you score a 640, you will pay much more than if you have a 740. Using an 80% loan-to-value ratio as an example, your LLPA at a 640 is 2.25% versus 0.875% for a score of 740. That’s a difference of 1.375%. , or just over $4,000 on a $300,000 mortgage. That’s about half of the previous difference, and that’s definitely a big change.”

In fact, this rule change was made on January 1, 2023, and is only now in effect. here is advertising From the Federal Housing Finance Agency, here it is Complete matrix of loan level rate adjustment From Fannie Mae herself.

However, the long and short story of it is that those with low credit will pay more than those with high credit. The real estate world has not been completely turned upside down.

Is it still subsidized for those with low credit?

At the beginning of this article, I said that this new rule still includes those with good credit subsidizing those with bad luck. Given that those with good credit still pay less, how is that?

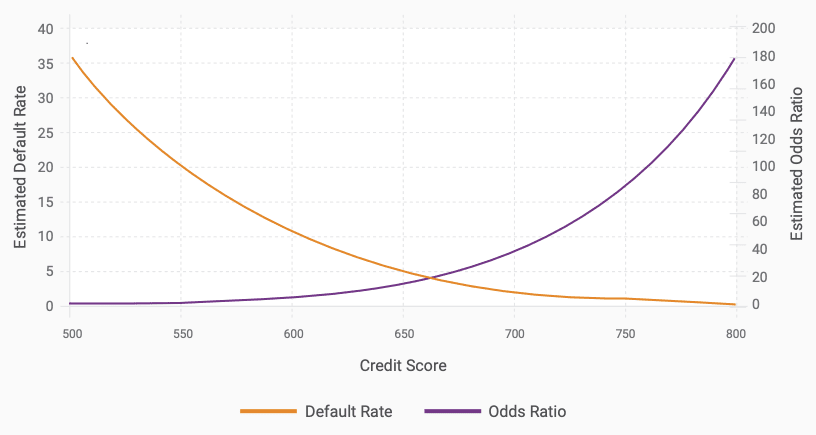

The reason is that those with low credit scores are more likely to default than those with good credit. And the difference is probably greater than most people realise.

For example, FICO white paper Their model concluded that “at a score of 800, we would expect approximately 180 borrowers to repay their loans on time for every borrower who defaults. This compares very favorably with consumers with a score of 600, where 1 in 11 borrowers are expected to have problems in repayment.”

In general, this was the relationship they found between FICO scores and mortgage default rates as follows:

another sheet It found that between 2000 and 2002, those with a FICO score of 750 or greater had only a 1% probability of default, while those with a score of 600-649 had a default rate of 15.8%, and those below For 500 they have a whopping 41% rate. Similar results were found at Another study by the SEC of mortgages obtained between 1997 and 2009.

The overall result should come as no surprise, although the size of the discrepancy could be quite large (has the 2008 financial crisis made a little more sense now?).

The LLPA aims to cover some of these additional risks. But from just looking at the graph above, it appears that even the old LLPAs were a bit generous (especially given the average loss a bank incurs on a mortgage that is foreclosed on). is something like 40%). Lowering the LLPA for risk borrowers will likely push up costs for Fannie and Freddie even more. As basic economics indicates, this loss must be compensated for by rate increases across the board, including on borrowers with higher credit ratings.

Thus, this rule is likely to mean that borrowers with a high credit rating will subsidize those with low ratings.

But no, the angry clickbait headlines are wrong. Borrowers with low credit ratings will not pay less than borrowers with a high credit rating. And it’s important to be specific about exactly what’s going on.

Find a lender in minutes

Many do not sit. Quickly find a lender that specializes in investor-friendly loans that suit you and your investment strategy.

Note by BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.