Why does the rise of Nvidia and AI remind people of the dot-com boom?

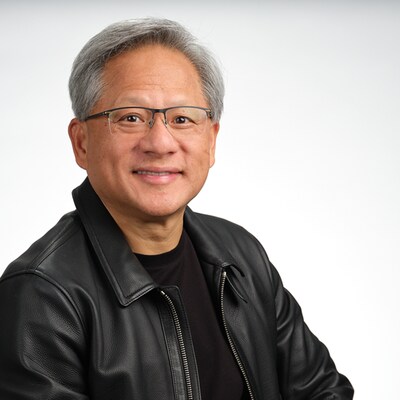

Jensen Huang, Founder, President and CEO, NVIDIA | Image: NVIDIA

Nvidia: Background on tech company

Nvidia Corporation is an American semiconductor company based in Santa Clara, California. Founded in 1993, it has solidified its position as a dominant player in the semiconductor industry, commanding nearly 80 per cent of the global market share in graphics processing unit (GPU) semiconductor chips as of 2023.

Nvidia’s GPUs have been pivotal in advancing AI and machine learning. Unlike general-purpose central processing units (CPUs), GPUs are optimised to accelerate graphics-intensive applications such as video games, editing, and 3D rendering, as well as AI and machine learning (ML) workloads.

The company’s products have become essential tools in the development of sophisticated AI systems.

Who is the founder of Nvidia?

Jen-Hsun ‘Jensen’ Huang, co-founder, president, and CEO of Nvidia, has been instrumental in the company’s rise to prominence. Born in Tainan, Taiwan, on February 17, 1963, Huang moved to Thailand at a young age before relocating to the United States. He completed his undergraduate degree in electrical engineering at Oregon State University in 1984 and earned a master’s degree in electrical engineering from Stanford University in 1992.

In 1993, at the age of 30, Huang co-founded Nvidia. Under his leadership, the company has not only pioneered GPU technology but also expanded into AI and other high-tech areas.

As of June 2024, Forbes estimated Huang’s net worth at $118 billion, making him the 11th richest person in the world.

Nvidia’s role in the AI revolution

Nvidia’s AI chips have become a pivotal tool in developing advanced AI systems. These systems are capable of generating coherent text, images, and audio with minimal input, driving investor confidence.

The last time a major computing infrastructure provider held the top spot was in March 2000, when Cisco was the most valuable US company during the dot-com boom.

Nvidia market valuation and investor excitement

Nvidia’s stock closed at $135.58 on Tuesday on Nasdaq (one of three US stock market indices), pushing its market valuation to $3.335 trillion, just surpassing Microsoft’s $3.317 trillion. This marks a significant milestone as Nvidia has leapfrogged from being the fifth largest by market valuation a year ago and tenth two years ago.

Its rapid ascent to the top highlights investors’ excitement about AI’s potential to revolutionise productivity and the global economy.

Reasons behind Nvidia’s rise

The scramble among tech giants like Microsoft, Meta, and Amazon to lead in AI development has led to a surge in demand for Nvidia’s chips, propelling the company’s revenue to unprecedented levels.

In its latest quarter, Nvidia reported $26 billion in revenue, more than triple the same period a year ago. The company’s stock has more than tripled in value over the past year, and its market value hit $3 trillion just months after reaching the $2 trillion mark.

AI vs dot-com boom

The enthusiasm around AI today mirrors the late 1990s and early 2000s internet boom. According to a report by the Wall Street Journal, John Chambers, former CEO of Cisco, noted that while there are similarities, the dynamics of the AI revolution are distinct. The market opportunity for AI is seen as combining the scale of the internet and cloud computing, with a faster pace of change and a different stage of value creation.

What was the dot-com boom?

The dot-com boom was ignited by the 1993 release of Mosaic, one of the first widely used web browsers. This, along with subsequent web browsers, made the World Wide Web accessible to the general public, significantly boosting internet usage. The reduction of the digital divide, advancements in connectivity, and increased computer education all contributed to the growing number of internet users.

Between 1995 and its peak in early 2000, investments in the Nasdaq composite stock market index soared by 800 per cent. This period was marked by exuberant investment in tech companies, particularly those with “.com” in their names, reflecting a widespread belief in the transformative power of the Internet. However, this speculative bubble was unsustainable.

How did the dot-com bubble burst?

In 2000, the bubble burst. By October 2002, the Nasdaq had plummeted by 78 per cent from its peak, erasing all the gains made during the boom. The crash resulted in the failure and closure of many online shopping and communication companies that had thrived on speculative investments without achieving profitability.

Larger, more established companies like Amazon and Cisco Systems also suffered significant losses, with Cisco losing 80 per cent of its stock value.

Despite these setbacks, some companies managed to survive and even thrive in the aftermath. Online retailers such as eBay and Amazon eventually became highly profitable, demonstrating the long-term potential of the Internet economy despite the short-term turmoil.

Future prospects of Nvidia AI technology

CEO Jensen Huang has positioned the company as a key player in what he calls the new industrial revolution powered by AI. Nvidia’s innovative “AI factories” are designed to process data and produce intelligence, underpinning the future of AI-driven technologies. Despite concerns about potential market bubbles and competitive pressures, Huang remains confident, recently announcing new AI chip developments set for 2026.

Market dynamics and investor caution

Significant investments in AI chips contrast sharply with the relatively modest sales figures for generative AI startups, suggesting potential market imbalances. Experts warn that the current enthusiasm bears the hallmarks of a bubble, which could lead to significant market corrections in the future, one report by Business Insider noted.

Lessons and risks

While Nvidia’s rise has been meteoric, investors should remain cautious about the sustainability of the AI boom.

The dot-com era serves as a reminder that while technological revolutions bring transformative change, not all companies driving these changes will succeed.

Many internet companies from the dot-com boom went bankrupt, and a similar fate could befall some AI companies.

Recent examples like Byju’s in the edtech industry and FTX in the cryptocurrency market are examples of the volatility and risks associated with high valuations based on emerging technologies.