What Should You Do With the Amara Raja Energy & Mobility Stock Now?

When we last wrote on Amara Raja in early June 2023, the company was still Amara Raja Batteries, and we recommended a ‘buy’ on the stock due to its very reasonable valuation of 15 times its trailing 12-month earnings as well as plans to remain relevant in the era of electric vehicles (EV).

Fast forward to September 2024, shareholders are sitting on big gains of about 142 per cent from our recommendation. The name change to Amara Raja Energy & Mobility seems to have brought its share of luck too, with the stock up by around 138 per cent since the rechristening in end-September 2023. A re-rating to recognize the efforts in the EV battery space as well as the sharp rise in price has pushed up the valuation to about 29 times its trailing earnings now. However, the stock is still at a discount to peer Exide Industries, which trades at over 35 times.

Fundamentally, prospects look steady its traditional lead-acid battery business. On the OEM business front, while sales of passenger vehicles have crossed the peak and is into a cyclical downturn, two-wheelers sales saw a late pick-up post Covid, and hence, is still going strong. Usually, battery makers derive a good proportion of sales and see better margins in the replacement market, which keeps them going when new vehicle sales slow down and Amara Raja will continue to be a beneficiary of this trend. While it holds promise, the new energy business continues to be in its infancy – still in the process of setting up its facilities/infrastructure, technology tie-ups as well as signing up customers. It requires heavy investments and needs a close watch as to how things shape up. The business contributes only about 4 per cent to total revenues currently.

Long-term investors can continue to hold the stock, while fresh exposures need not be considered at this juncture due to the run-up as well as higher valuations now.

Stable footing

Amara Raja earns two-thirds of its revenues from automotive batteries (lead acid) and in that, predominantly from four-wheelers and the replacement markets. After two years of double-digit growth each in FY22 and FY23, new car sales volume growth came down to 8.4 per cent in FY24 and has further weakened to 1. 8 per cent in the first four months of this fiscal. While the company supplies to almost all leading players such as Maruti Suzuki, Hyundai, Honda, Mahindra & Mahindra and Tata Motors, robust new car sales post Covid imply that the battery replacement demand for these vehicles would hold the fort in the near to medium term, as the cyclical downturn in new vehicle sales plays out. The company has a 35 per cent market share in the four-wheeler aftermarket.

Besides, two other factors can also cushion the downturn in new car sales to an extent. One, volume growth in new bike sales continues to be in the high teens into FY25. The company has a 25 per cent market share in supplies to OEMs. Two, Amara Raja also derives a little less than a third of its revenues from supply of industrial batteries (telecom, home inverter, UPS, railways, etc.) where the cycles and prospects vary from the automotive segment.

Nascent segment

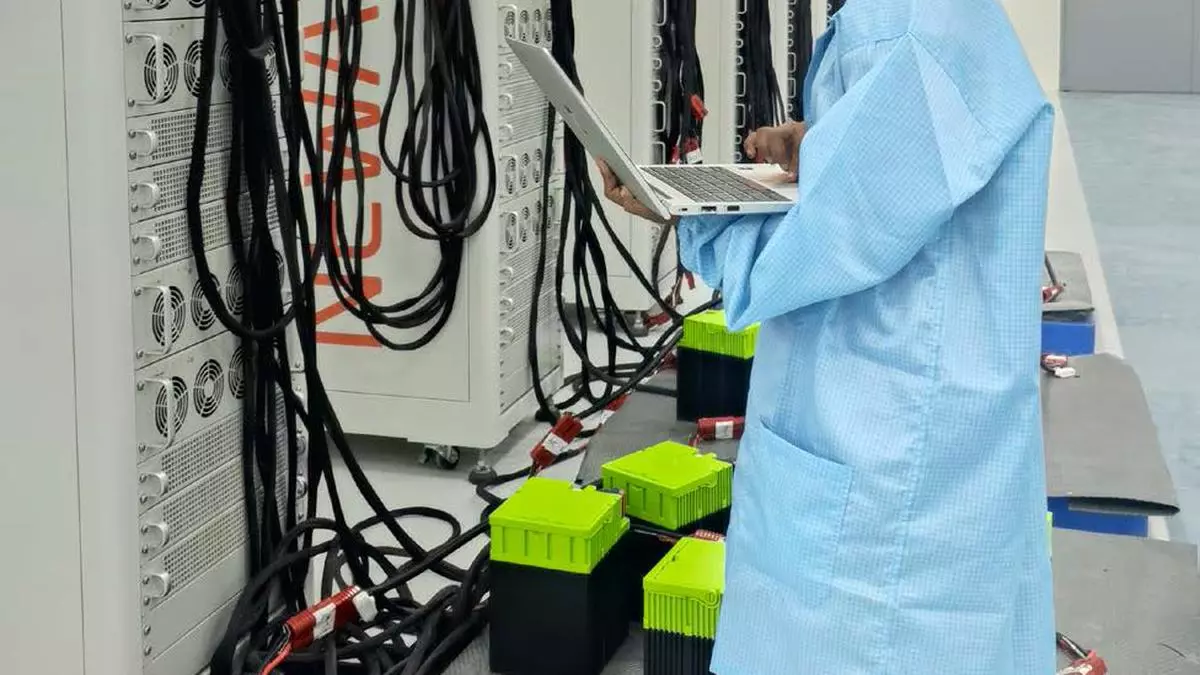

What holds promise over the long-term is its new energy business which involves Lithium-ion battery cell and pack manufacturing, EV charging products and energy storage solutions. This business is housed in 100 per cent subsidiaries – Amara Raja Advanced Cell Technologies and Amara Raja Power Systems. Lithium battery packs are currently being supplied to 3-wheeler OEMs. The company is building a new pack assembly plant in Telangana to cater to two-wheeler, three-wheeler and industry applications. Production is expected to commence in FY25. It has also commenced construction of the Cell Giga Factory where an initial capacity of 2GW in Phase I will be scaled up to 16GW by 2030. The company is working on both NMC (Nickel Manganese Cobalt) and LFP (Lithium Ferro Phosphate) technologies for cells.

For cell technology, in-house R&D as well as investments made in a few tech companies and technology tie-ups are expected to provide support. The company requires heavy investments in the new energy business. The management expects capex in the immediate term at ₹2,000 crore for in house R&D centre as well as the NMC line (2 GW) for cells. Another ₹2,000-2,500 crore capex is expected for the LFP line (4-5 GW) in the near term. Commercial production for cells is expected towards the end of FY26 or FY27.

Piaggio, Mahindra and Mahindra, BSNL and Indus Towers are existing clients in the new energy space. Amara Raja has recently signed up with Ather for supply of cells for two-wheelers, as and when the company commences production.

Segmental margins for this business stood at 5 per cent in Q1FY25.

Financials

In Q1FY25, consolidated net sales moved up 16.7 per cent to ₹3,263 crore and net profits, by 25.6 per cent, to ₹249 crore. Operating margin came at 13.4 per cent vs. 13.1 per cent a year ago. Although prices of lead, the key raw material, has been trending down in recent months, the company took price hikes during the quarter to pass on rise in copper, plastics and other operational costs.

It is looking at a capex requirement of ₹1,000-1,500 crore this fiscal and is planning on raising short-term debt towards this, to an extent. Long-term debt raising plans are also on cards, given the spending requirements in the new energy business. However, the fact that the company is not heavy on debt currently, lends support.