Weekend Bites: More trouble in IT paradise, RBI’s plans, and taxing expats

The information technology (IT) sector has been our pride and joy for years. It put India on the global business map, it shines in our services exports, and it hires tens of thousands every year. But the recent months have not been kind. And now the results are showing.

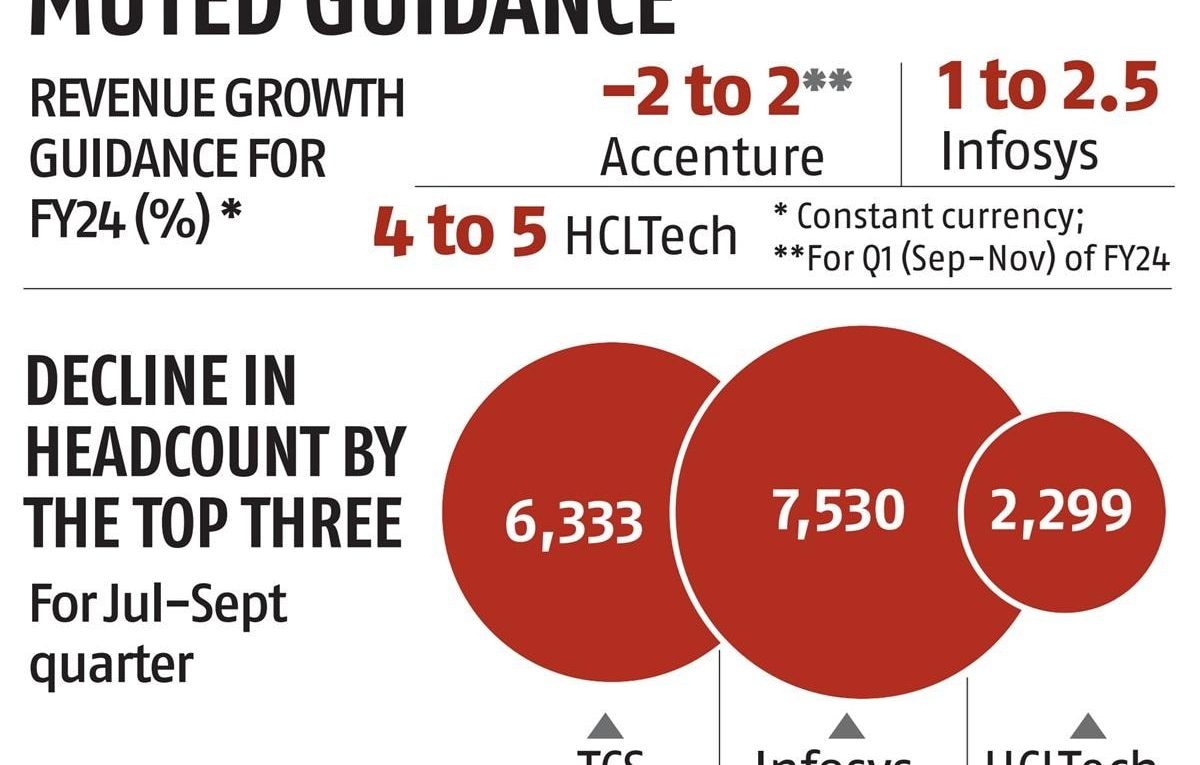

Last week, Infosys issued a none-too-inspiring guidance. This week, things got worse.

Wipro reported an almost flat net profit and a marginal decline in revenue for the second quarter of FY24 amid an uncertain global economic outlook and weak client demand. It forecast a sequential drop in third-quarter revenue and attributed it to a “significant” slowdown in discretionary spending by clients.

Thierry Delaporte, Wipro’s CEO, told us the deal volume remained strong but discretionary spending was down.

Meanwhile, salary hikes at IT companies have taken a back seat. Some have deferred payments, others have stalled them. HR experts said salary hikes would be restrained this year.

Though mega deals are still closing at a good rate, most of them are driven by cost-optimisation initiatives of clients and cannot fully compensate for aggregate cutbacks in discretionary spending across industry segments. Margin expansions do indicate, however, that IT services firms still have the headroom to cut costs further, said our Editorial.

The IT sector is the largest employer in the corporate sector, accounting for nearly a third of the salary and wage expenses of listed companies in FY23. A reduction in headcount and subpar salary increments in the sector could dampen consumer demand.

In other news…

The Reserve Bank of India would conduct open-market sales of bonds once government spending picked up and there was an improvement in the durable liquidity surplus, two sources aware of the development told Reuters on Friday.

The RBI in August became a net seller of the US dollar for the first time in the current financial year.

Monetary policy has to remain extra alert to be ready to act as and when warranted to preserve the hard-earned macroeconomic stability, RBI Governor Shaktikanta Das has said.

Food should not become an instrument in war and disruption, amid increasing fragmentation caused by war and re-globalisation that has impacted supply chains and food security, Finance Minister Nirmala Sitharaman said on Friday.

Indian arms of 1,000 MNCs have received tax demands from GST authorities, seeking an 18 per cent levy on salaries and allowances paid to foreign expatriates by their overseas parent companies.

India and the UK are unlikely to ink their much-anticipated trade deal by the end of October as differences are yet to be ironed out. Although negotiations are on in full swing, a timeline for a deal cannot be ascertained at this point.

Tech that: Word from the world of technology and startups

X (formerly Twitter) will soon get two new premium subscription plans. “One is lower-cost with all features, but no reduction in ads, and the other is more expensive, but has no ads,” posted Elon Musk. He did not reveal the pricing.

Watch it: From The Morning Show

Byju’s and Akash’s promoters have had a chequered recent history. But now it seems Akash is the all-important cog in Byju’s wheel. Can Akash save Byju’s?

This is Suveen signing off. Please send tips, comments, news, or views about anything from IT woes to RBI bonds to [email protected].

(Suveen Sinha is Chief Content Editor at Business Standard)

Last week, Infosys issued a none-too-inspiring guidance. This week, things got worse.

Wipro reported an almost flat net profit and a marginal decline in revenue for the second quarter of FY24 amid an uncertain global economic outlook and weak client demand. It forecast a sequential drop in third-quarter revenue and attributed it to a “significant” slowdown in discretionary spending by clients.

Thierry Delaporte, Wipro’s CEO, told us the deal volume remained strong but discretionary spending was down.

Meanwhile, salary hikes at IT companies have taken a back seat. Some have deferred payments, others have stalled them. HR experts said salary hikes would be restrained this year.

Though mega deals are still closing at a good rate, most of them are driven by cost-optimisation initiatives of clients and cannot fully compensate for aggregate cutbacks in discretionary spending across industry segments. Margin expansions do indicate, however, that IT services firms still have the headroom to cut costs further, said our Editorial.

The IT sector is the largest employer in the corporate sector, accounting for nearly a third of the salary and wage expenses of listed companies in FY23. A reduction in headcount and subpar salary increments in the sector could dampen consumer demand.

In other news…

The Reserve Bank of India would conduct open-market sales of bonds once government spending picked up and there was an improvement in the durable liquidity surplus, two sources aware of the development told Reuters on Friday.

The RBI in August became a net seller of the US dollar for the first time in the current financial year.

Monetary policy has to remain extra alert to be ready to act as and when warranted to preserve the hard-earned macroeconomic stability, RBI Governor Shaktikanta Das has said.

Food should not become an instrument in war and disruption, amid increasing fragmentation caused by war and re-globalisation that has impacted supply chains and food security, Finance Minister Nirmala Sitharaman said on Friday.

Indian arms of 1,000 MNCs have received tax demands from GST authorities, seeking an 18 per cent levy on salaries and allowances paid to foreign expatriates by their overseas parent companies.

India and the UK are unlikely to ink their much-anticipated trade deal by the end of October as differences are yet to be ironed out. Although negotiations are on in full swing, a timeline for a deal cannot be ascertained at this point.

Tech that: Word from the world of technology and startups

X (formerly Twitter) will soon get two new premium subscription plans. “One is lower-cost with all features, but no reduction in ads, and the other is more expensive, but has no ads,” posted Elon Musk. He did not reveal the pricing.

Watch it: From The Morning Show

Byju’s and Akash’s promoters have had a chequered recent history. But now it seems Akash is the all-important cog in Byju’s wheel. Can Akash save Byju’s?

This is Suveen signing off. Please send tips, comments, news, or views about anything from IT woes to RBI bonds to [email protected].

(Suveen Sinha is Chief Content Editor at Business Standard)