TReDS scheme will grow to become a game-changer, says Kotak Mahindra Bank

The Budget 2024-25 has a lot for MSMEs – a new credit guarantee scheme, bringing more companies under the TReDS platform, more SIDBI branches in MSME clusters, etc.

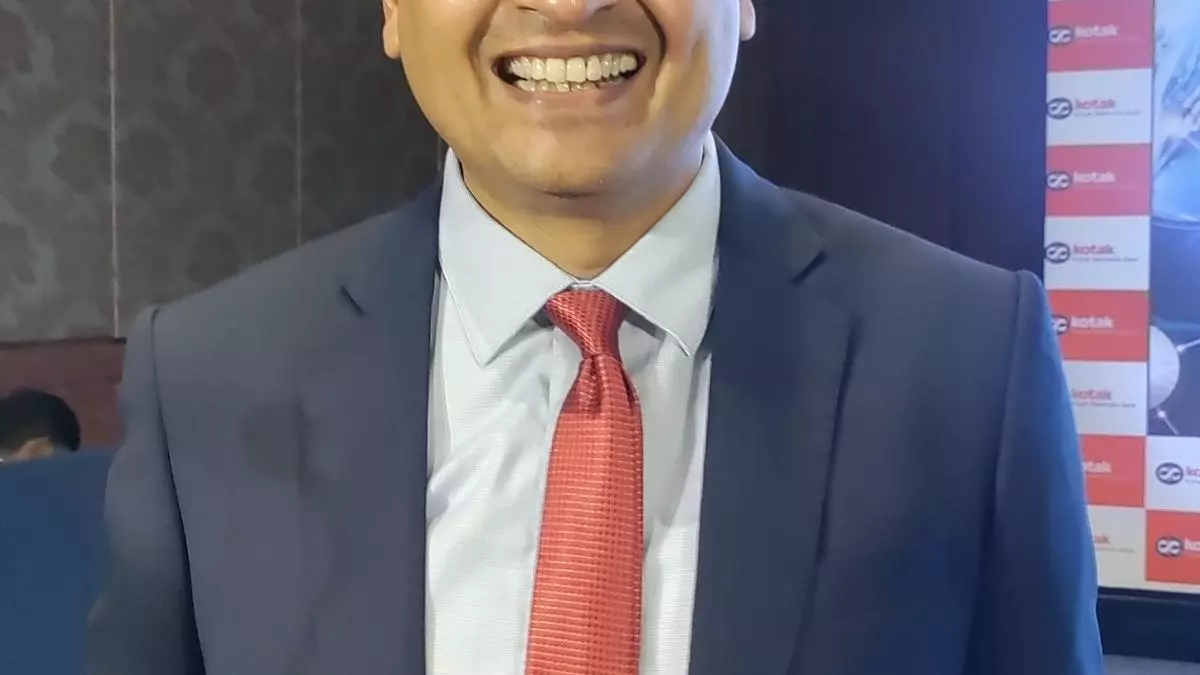

To discuss these in detail, businessline caught up with Shekhar Bhandari, President, Small and Medium Enterprises, Kotak Mahindra Bank. The bank has an MSME loan book of $ 11 billion; Bhandari says the NPAs are negligible, and the bank expects to double the book in three years. Excerpts from the conversation:

There is already a credit guarantee scheme for MSMEs. Why do you think the government has brought in a new scheme when there is already one?

I think they experimented with the ECLGS (Emergency Credit Line Guarantee Schem) during covid, where 20 per cent of the total loan outstanding by the bank was guaranteed by the government specially for the various sections and the emergency security.

The scheme was a significant success credit disbursement happened in record time. The assistance helped MSMEs to manage and fight the covid stresses. Each one of them repaid the entire loan which was taken during those times.

The government is thinking right in bringing in a similar scheme. What are the significant learnings from ECLGS? It was simple, it was quick, it had the least amount of underwriting work. I guess the new initiative is to make it bigger and deeper.

To answer your question as to why a new scheme and why the existing scheme itself could not be used, I think it purely has to do with the processes. It is easier to build a new house than to remodel an existing one.

What is your take on the existing credit guarantee scheme?

I’m not the best person to comment on it because we use the scheme only if a customer requests it. Apparently, customers are not excited, so they are not requesting it. However, a couple of interactions have shown that the process needs to be much simpler and quicker. I guess the government is trying to do that in the new scheme.

What is your impression of credit guarantee schemes in general? Experts say they have not been successful in India.

There are credit guarantee schemes and there is something called credit guarantee insurance. If both are coupled and given as a complete solution, it would be a better product in the marketplace. Chinese and European economies, when they were building their MSME sector, adopted this dual approach of having a credit guarantee scheme and give a credit insurance.

Could the high fee be a hinderance?

I don’t think so. There is a fee for every insurance. There is a fee for bank guarantee. If people see value, they don’t mind paying a fee. The real issue is, the scheme should be simple and fast. It should motivate people to take it rather than feel, “I’ll go for it if there is no option.”

What is your view of the TReDS (Trade Receivables electronic Discounting System) scheme, which also does not seem to have taken off well?

I think TReDS is one of the best schemes for MSMEs and corporates which want market-linked funding. There are three TReDS platforms (RXIL, which is a JV of SIDBI and NSE, M1Exchange and Invoicemart – on these platforms, MSMEs (only) can participate as sellers and get their bills discounted).

I think they have a good product, but adoption and onboarding take time. Initially, I too thought that TReDS would be lapped up, but it has taken longer than expected. That said, the compounded growth rates of volumes are looking healthy.

In the recent budget, the government has reduced the turnover threshold of buyers for mandatory onboarding on the TReDS platform from ₹500 crore to ₹250 crore. The finance minister said that this would bring 22 more PSUss and 7,000 more companies onto the platform. TReDS will grow.

So, you think it is just a matter of time before TReDS catches on?

Yes. True, the volume numbers should have been much higher than they are now. But will it grow, the answer is definitely ‘yes’. I also see a couple of new platforms coming in. I foresee them coming in and revolutionizing.

I think they them coming and revolutionizing, in terms of giving better user interface and user experience, bringing in more data analytics and artificial intelligence into the system. The government is also pushing all PSUs into TReDS. I’m sure TReDS will be a game changer.

Published on July 27, 2024