Three stocks that outperformed market in the week ended April 28, 2023

With markets closed on Monday due to Maharashtra Day, Indian markets will open on Tuesday after a gap of three days.

Here is a summary of the main trends of the Indian stock markets last week.

Both the Sensex and Nifty 50 benchmarks have risen about 2.5 percent each week in the past week. Except for the BSE Consumer Durables Index (flat all week), all other major sectoral indices rose during the week. BSE Realty (5%), BSE Capital Goods (4.5%) and BSE Power (3.4%) were the main gainers.

Among the BSE 500 stocks, the top 5 gainers were Rail Vikas Nigam Limited (38.84 per cent), Gujarat Fertilizers and Chemicals (28.8 per cent), India Bulls Real Estate (27.97 per cent), Mangalore Refinery and Petrochemicals Limited (20.58 per cent). cent) and IRCON International (17.66 per cent).

Here are the three stocks that outperformed the overall market last week.

Rail Vikas Nigam Ltd (RVNL)

RVNL Provides railway construction services through the design and construction of bridges, roads and related infrastructure.

Two major events sent the stock up nearly 40 percent in one week.

First, RVNL has announced that it has won a Rs 121 crore project from North Central Railway to provide E1-based automatic signaling with continuous track circuits and other associated works. Secondly, the Ministry of Finance approved the granting of the project support unit Navratna Status, an upgrade from the previous Miniratna case. This means that the company will have more autonomy regarding some financial decisions.

RVNL stock is currently trading at a P/E multiple of approximately 15.53x.

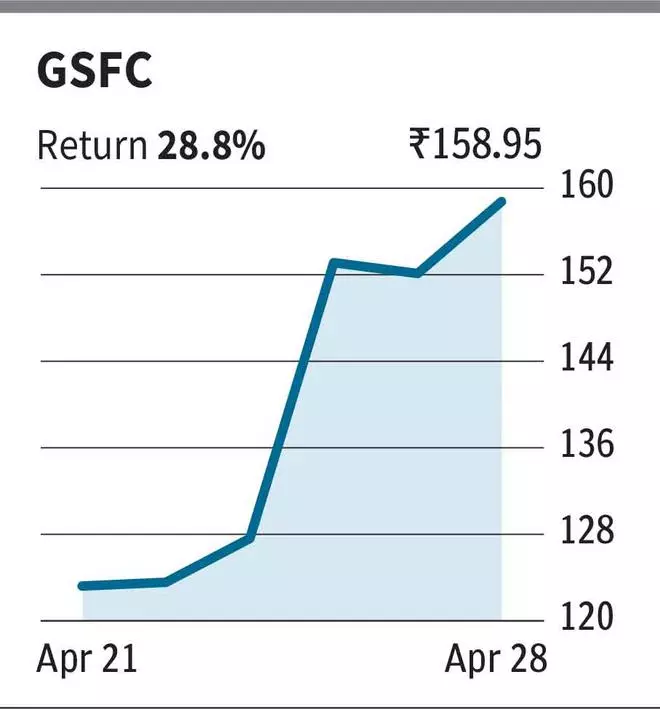

Gujarat Fertilizers and Chemicals (GSFC)

GSFC share price by 29 percent last week.

the New Policy Announcement by Gujarat Government Dividends, bonuses, stock splits and buybacks seem to have triggered a surge in PSUs in Gujarat, including GSFC. Under the new policy, PSUs are supposed to pay shareholders a minimum dividend of at least 30 percent of their after-tax earnings or five percent of their net worth, whichever is higher.

On account of the stated policy, Street believes that better capital allocation and financial discipline can be expected and investors will be given more clarity about what they can expect in terms of dividends and bonus shares.

GSFC stock is trading at an excess earnings multiple of approximately 4.76x.

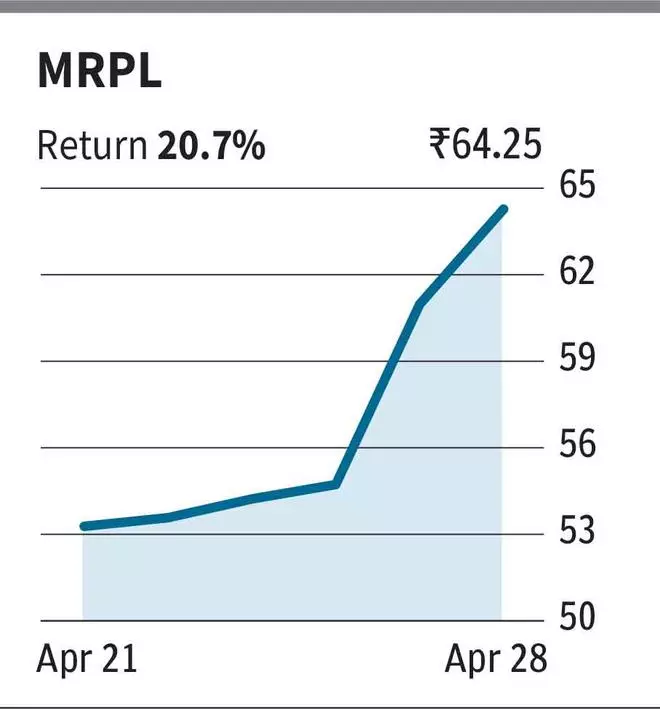

Mangalore Refinery and Petrochemicals Limited (MRPL)

stock MRPL It gained nearly 20 percent on account of strong quarterly results. A subsidiary of ONGC, MRPL manufactures and sells refined petroleum products in India.

The company witnessed a sequential jump in EBITDA from about Rs.287.4 crore in the third quarter to Rs.3490.2 crore in the fourth quarter of FY23. Compared to a loss of about Rs.195 crore during the third quarter, the company reported a net profit of about Rs.1913.4 crore in the fourth quarter.

However, it’s worth noting that the company’s revenue and PAT are down about 36 percent year-over-year, and inventory is also down about 20 percent last year.

MRPL stock is trading at a trailing earnings multiple of about 3 times.