There are no plans to charge subscription for IPL: Viacom18’s Anil Jayaraj

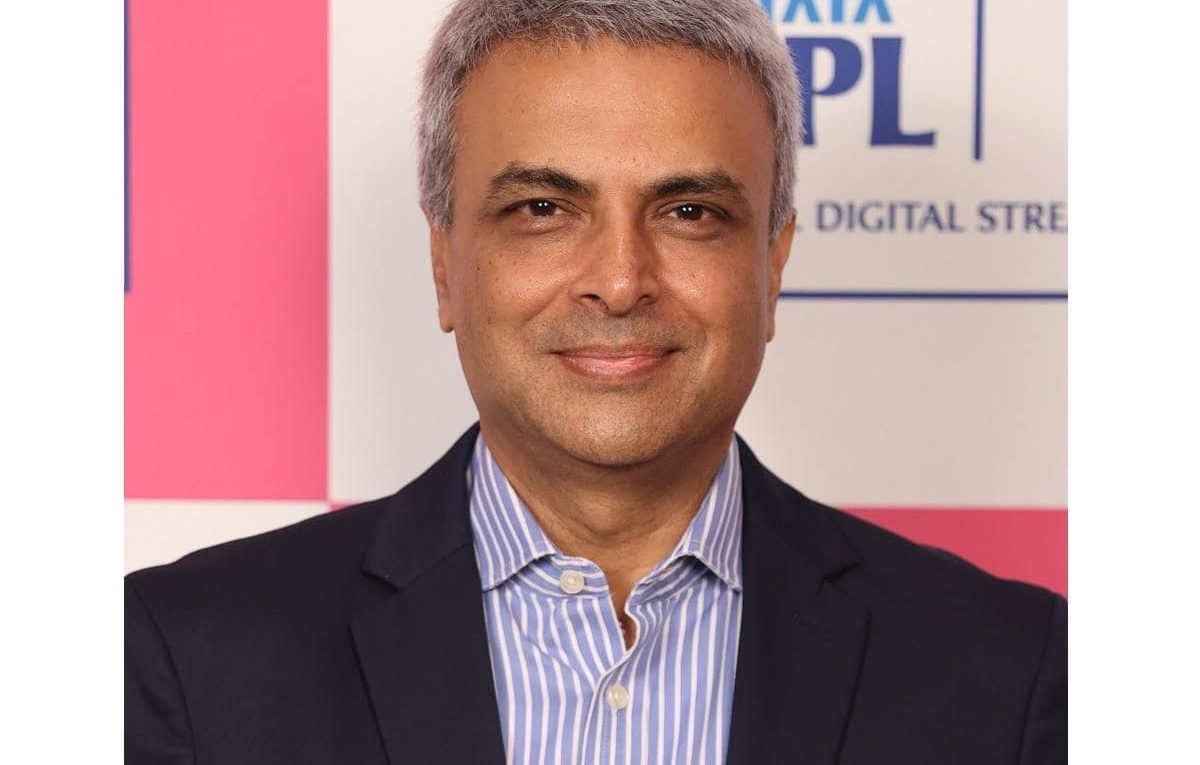

After streaming the FIFA World Cup for free, JioCinema has chosen to do the same with the Indian Premier League (IPL). JioCinema is part of the Rs 4,145 crore company Viacom18 Media (FY22) which in turn is a joint venture between Reliance Industries and Paramount Global. In 2021, Bodhi Tree Systems — a platform owned by James Murdoch and former Star Uday CEO Shankar — announced that it would acquire a significant portion of Viacom18 for $1.78 billion. Earlier this year, it reduced its commitment to $528 million. Viacom18 will pay close to Rs 24,000 crore for the digital rights to the IPL over five years. As the first season begins, Vanita Kohli Khandekar talk to Anil Jayaraj, head of its sports activity. Edited excerpts:

How has your IPL experience been so far? Any learning or challenges?

We started broadcasting it after the FIFA World Cup and the Women’s Premier League (WPL). This helped us identify some of the things we were trying to fix after the FIFA World Cup. Also, IPL is the first exclusive property on digital. While we can’t share viewing figures now, I can tell you that the IPL had 22 million viewers at the same time on April 12 and 24 million on April 17. And both happened on a weekday. (According to a press release, TATA IPL 2023 on JioCinema had 1.5 billion video views in its opening weekend. The total numbers won’t be clear until after the IPL ends in May) What’s surprising is the depth and breadth of digital consumption.

Can you share examples please?

For example, we have a promotion called Jeeto Dhan Dhana Dhan. You predict what will happen next (wickets, boundaries) and win a car daily. Among the 10-12 games so far, what is surprising is the towns that people won with cars from – Lakisarai, Hajipur, Mahwah. These are really small cities that you would think digital penetration would take some time to deepen. This has been really encouraging.

Secondly, this year we have commentary in 12 Indian languages, and for the first time in Bhojpuri, Punjabi, Gujarati and Odia. What it has done to stimulate consumption, especially if one looks at Bhojpuri and Punjabi, is incredible. For example, if a viewer is consuming in Bhojpuri and you compare his consumption in English or Hindi, the Bhojpuri numbers are 3-4 times that of the Hindi/English of the same consumer.

Thirdly, as part of the service, we provide multi-camera (multi-camera) and 360-degree field images. It gives viewers a sense of being in the dugout. If you want to watch the match only from the stem camera or from a bird’s eye view, you can choose to do so. The intuition with which people use these features is amazing.

I was previously with Star Sports who held the TV rights and the digital rights to the latest IPL. What is the difference operationally when you have both rights?

context in terms of time. In 2017, when Star acquired the rights, it was critical to get both because the digital ecosystem was still expanding — not growing yet. Broadband speeds were low, so TV was still critical. In the first couple of years, it was very clear that once the affordability barrier and the controversy over payment of contributions were removed, the volume of consumption in India was enormous. In the first two years, it was a huge hit for advertisers and viewers. Once it moved to a subscription-based model — after 5 minutes, consumers hit the paywall — the business underwent a big change because we couldn’t get many people and there was limited inventory. Also, internet penetration changed from 2017 to 2022. There are 750 million people online now. If you are betting this time, it makes sense to make it digital.

What are the monetization windows on IPL given that you are streaming it for free? Will JioCinema start charging for subscriptions after it reaches a certain audience?

I will answer this only in the context of sports. There are no subscription plans. The ad model has worked very well with sports. Like anything else, we’ll continue to evaluate this. Whatever our goals for the first year, it looks like we’ll achieve them.

Do you see Viacom18 making money on the IPL after five years?

We have a five-year plan. In the first year, we are ahead of the plan. If we continue down the same path, then yes, we will do well on this property.

For example, what kind of advertising rates does an IPL viewer get on digital versus television?

Unlike television ad sales, digital ad sales are different. I can reach 5 million people who want to buy a pen. If you only get to 4 million, you only pay for those. Advertising that has not been shown (not seen) on digital media will not be paid for. It’s the opposite on TV. On TV, you might walk away to the kitchen or wherever while the ad is playing. Unlike digital, sports on TV are not sold on a CPM (cost per thousand or thousand) basis. There is an annual contract for example 10-12 lakh rupees per ten seconds. It was only near the end of the tournament that CPM tacitly started.

Why are viewing numbers not shared?

Any ad on my number has a tracker. The advertiser knows which audience he is getting. So it is a transparent way of advertising. So advertisers don’t worry. The biggest number in viewership is about vanity. We’ll play that game later.

IPL technology and cricket dominate the sports economy in India. How are other sports doing on JioCinema?

For us, FIFA was a milestone. It did well in revenue and viewership. We have a large number of rights outside of cricket. Then we have the LaLiga Cup, the NBA, the Olympics, and hockey. They are standing. They are not as big as cricket but they are important viewership drivers. WPL was huge. In both viewership and revenue, we’ve made double what we set out to achieve. Participation was high – 50 minutes per game per user. IPL gets just over 60 minutes per game per user.