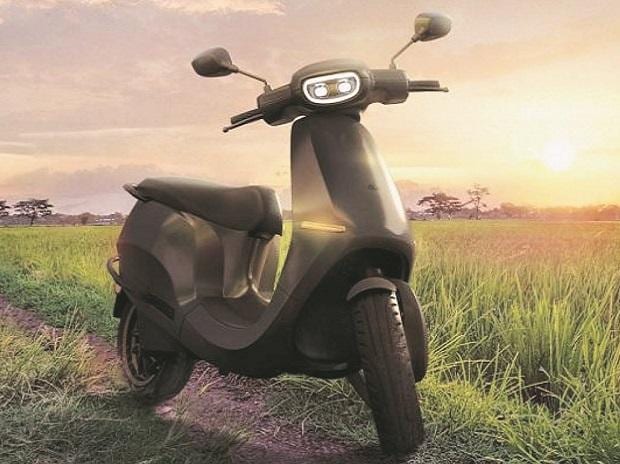

Tesla on two wheels? India’s Ola Electric feels the strains of success

Bhavish Aggarwal, India’s answer to Elon Musk, is racing to roll out millions of electric scooters and speed his nation to a cleaner future. Some of his mechanics can’t keep up, though.

Aggarwal’s Ola Electric, which he likens to Tesla in the West, is zipping towards a stock-market listing after going from zero to 338,000 e-scooter sales in about two years. The tech entrepreneur vows to banish the internal combustion engine (ICE) from India, where two-wheel vehicles rule the roads.

We will “end the ICE age”, the 38-year-old told Reuters ahead of the launch of new Ola e-scooters starting at about $1,000 on Aug. 15, Indian Independence day. He said the company, already valued at $5.4 billion, would quadruple its annual production capacity to 2 million e-scooters by early new year.

Yet Ola’s rapid ride faces a few potholes.

Parts of the company’s nationwide network of over 400 service hubs which maintain and repair its EVs are showing signs of strain after the surge in sales, according to Reuters visits to 35 centres in 10 states between July and October, plus interviews with 36 Ola service staff and 40 customers.

Staff at more than half of those centres, mainly sites in the big metropolitan areas of Mumbai, Chennai and Bengaluru, said they had significant backlogs, with demand outstripping their workforce or their supply of spare parts, and repair waiting times ranging from three days to two weeks.

At an Ola workshop in Thane, among the biggest of the 14 centres in the Mumbai region, more than 100 e-scooters awaiting repairs were visible outside in a clearing, many parked in a muddy clearing gathering dust and littered with bird droppings.

Devendra Ghuge, a Thane service manager, told Reuters in late October that the number of cases the centre dealt with had risen from 200-300 to roughly 1,000 a month over the previous four months, with waiting times stretching up to two weeks.

In January, Ola founder and CEO Aggarwal had pledged that customers would be able to bring their vehicles into a hub and receive same-day service in most cases.

In the August interview, he said customers were “voting with their wallets every month” by snapping up Ola EVs. But he acknowledged service capacity issues and said Ola was “aggressively” bolstering its service network by adding 100 new centres and hiring more technicians.

“We have the highest number of products on the market … and we do have a scale-up required in our service network,” he said.

An Ola spokesperson said the Reuters reporting didn’t accurately capture the scale and quality of the company’s robust and growing service operations.

Ravi Bhatia of auto consulting firm JATO Dynamics said a good service network was critical in India, the world’s biggest two-wheeler market. Indians are new to tech-packed EVs that can be more sensitive to bumps and bashes than many conventional scooters and motorbikes, he added.

India can indeed pose tough driving conditions, and two-wheelers are used by hundreds of millions of people to navigate roads that are often congested and riddled with potholes.

Ola needs “to build the infrastructure for service accordingly, otherwise word-of-mouth will bite them,” Bhatia said.

‘Tesla for West, Ola for rest’

Aggarwal often declares, “Tesla is for the West, Ola for the rest”, and he’s a man in a hurry.

He says all new scooters and motorbikes sold in India could be electric by the end of 2025, a goal way ahead of the government’s target of 70 per cent of new two-wheeler sales being EVs by 2030.

Two years since Ola’s first e-scooter rolled off the line, the startup has established itself as the leader in India’s two-wheeler EV market, with about a third of sales by volume. It has attracted marquee investors including Japan’s SoftBank and Singapore’s Temasek and is gearing up for a $700 million Indian IPO.

Industry data shows sales of e-scooters nearly tripled to over 700,000 in the year to March versus the previous year, thanks to Ola and also rivals like Hero Electric and TVS Motor.

Yet those sales were still a fraction of the 5.2 million new scooters and 10.2 million motorbikes sold in India, where EV adoption significantly lags countries like the U.S. and China, and charging infrastructure is in its infancy.

Ghuge, the manager at Ola’s Thane workshop, said reported service issues included battery drainages, software glitches and damaged wires. He put much of the service surge down to the fact Indians were inexperienced in driving e-scooters on the country’s often poorly maintained roads, adding that many vehicles had been damaged after slipping on roads during monsoon season.

“Electric vehicles are new to people so they aren’t aware of how to ride the vehicle to maximise optimal output,” he said.

Customer Khubeb Koradia, 25, said the Thane centre took three weeks to fix software-related issues after his EV broke down in September. The workshop “looked like a scooter graveyard” he said, referring to the scores of vehicles parked outside.

At the Ola centre in the city of Kochi, service manager Ronald Radhakrishnan told Reuters in August that its 17 staff were “unable to handle demand for repairs”. Dozens of vehicles were parked outside the workshop, with some also in an area being used to park scooters across the road.

Some customers have found it tough to book a repair slot.

Koradia shared a video with Reuters showing his attempt to book a slot on Oct. 31 for an e-scooter overheating problem. Seven of the nearest eight service centres to him in Mumbai rejected his request for repairs with the same message: “All slots for this location are full for the next few days.”

Hundreds of other Ola customers have also complained online about repair times or difficulties in finding servicing slots, according to a review of social media posts.

Aggarwal is bullish about his business, though, saying last month his sales had “gone through the roof” in India’s festive season, with an e-scooter being sold every 10 seconds.

During his Reuters interview, he dismissed much of the online outcry on service issues as “mudslinging” by rivals, without elaborating. “A lot of what you hear and see need not actually be the truth,” he said.

(Only the headline and picture of this report may have been reworked by the Business Standard staff; the rest of the content is auto-generated from a syndicated feed.)