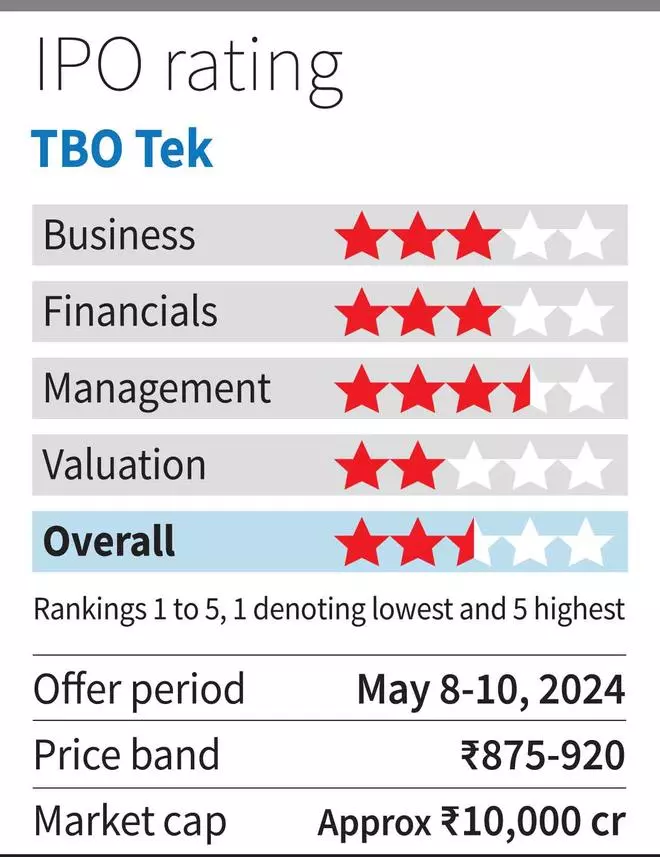

TBO Tek IPO: Should You Subscribe?

The IPO of TBO Tek, which operates a leading B2B global travel distribution platform connecting buyers and suppliers, hits the street next week. The ₹1,550-crore IPO consists of a fresh issue of ₹400 crore, the rest being offer for sale by promoters and other investors. Promoter stake, which is at 51 per cent now, will reduce to 44 per cent post issue.

The company operates in a unique space in the travel industry and has delivered strong growth in recent years and is levered to long-term growth prospects in the travel and tourism sector. Thus growth, good execution track record and business prospects are positives. At the same time, when it comes to valuation – priced at 7 times EV/revenue, 36 times EV/EBITDA and pre-issue PE of 46 times (all based on 9M FY23 numbers annualised) – while not excessive, is not attractive either.

While there may be listing gains, given the business prospects and current market sentiment, from a long-term investing perspective, considering the fact that travel/tourism is a cyclical industry, the current valuation does not leave much margin of safety. Hence, we recommend that investors wait it out for now, and can consider investing whenever there is an opportunity at more attractive valuations post listing.

Business

TBO Tek operates an online B2B travel distribution platform that provides a wide range of offerings for buyers and suppliers of travel products/services. By using its platform, suppliers such as hotels, airlines, car rentals, cruises, insurance and rail travel companies can connect with buyers such as travel agencies, independent travel advisors, tour operators, travel management companies, etc.

The tech stack built by TBO Tek allows and pushes for efficient product/services discovery in a single platform by connecting buyers and suppliers at an enterprise level. The buyers mentioned above, in turn, sell the products/services to end consumers in the business as well as retail category. One way to understand its business is with this example — if you book an international/domestic hotel stay or air ticket via an OTA or an offline travel agency, there may be a chance that these players had purchased it from TBO Tek’s platform.

For providing its services, TBO Tek earns its revenues in two ways — B2B rate model and Commission model. Under B2B rate model, the company receives inventory from suppliers upon which a certain mark-up is added and then sold to the buyers. Hotels and related offerings make up for bulk of revenue under this segment.

Under the commission model, the supplier fixes the price at which they want to sell on the platform, for which the company gets a commission, part of which is shared with the buyers to incentivise them. Major revenue in this segment comes from air ticket as well as hotel and ancillary offerings.

The take rate, ie mark-up or commission earned/gross transaction value (GTV) is higher for hotels and ancillary offerings at 7-8 per cent as compared to around 2.5 per cent for air tickets. Opportunity to scale up on profitability may depend more on how the share of hotels and ancillary sales to overall transaction value tracks. The hotels and ancillary GTV as a share of total GTV for TBO Tek has increased from 38.53 per cent in FY22 to 48.15 per cent in FY24 (9 months). This has been one of the major drivers in boosting EBITDA margins from 6 per cent in FY22 to 18.8 per cent now.

TBO Tek’s business is global in nature, connecting suppliers and buyers across geographies; 42 per cent of its GTV was sourced from outside India for 9M FY24. Hence, growth will depend on demand from domestic as well as global customers. There are multiple metrics to evaluate the long-term prospects of the company some of which are — one, take rate; two, global travel and tourism industry growth – as per data in RHP, expected to grow at CAGR of 8.2 per cent between 2023 and 2027; three – increase in suppliers and buyers on its platform and customer retention resulting in more bookings (12.2 million bookings in 9M FY23 – up 11 per cent). Broadly, these trends have fared well for the company in recent years and are reflected in financials.

The company intends to use the bulk of IPO proceeds for growth initiatives, with 75 per cent of the ₹400 crore earmarked for strengthening the tech platform for onboarding more buyers and suppliers, investing in international subsidiary to grow global business, inorganic acquisitions and marketing and sales initiatives.

Financials

For 9M FY24, company’s revenue grew 31 per cent to ₹1,023 crore, while EBITDA grew 32 per cent to ₹192.6 crore. EBITDA margin was at 18.82 per cent. Net profit grew 24 per cent to 157.8 crore. The company has a good balance sheet with net cash of around ₹400 crore.

Since FY21 and FY22 performance was impacted by Covid, they may not serve as a good comparable for assessing 2-3 year growth performance. The FY20-24 (9M annualised) revenue CAGR is at around 23 per cent, reflecting good growth from the pre-Covid base.

There is no listed domestic or international peer for the company to compare its performance or valuation with.

We would also like to bring the reader’s attention to one data point — in February 2024, PE firm General Atlantic purchased 7.5 per cent stake in TBO Tek from an earlier investor. The current IPO price band at ₹875-920 is at an approx 56 per cent premium. While not much can be inferred from this since the company or promoters were not involved in the transaction, it is worth taking note of.