Some NBFCs aggressively chasing growth without building sustainable business practices: RBI Governor Das

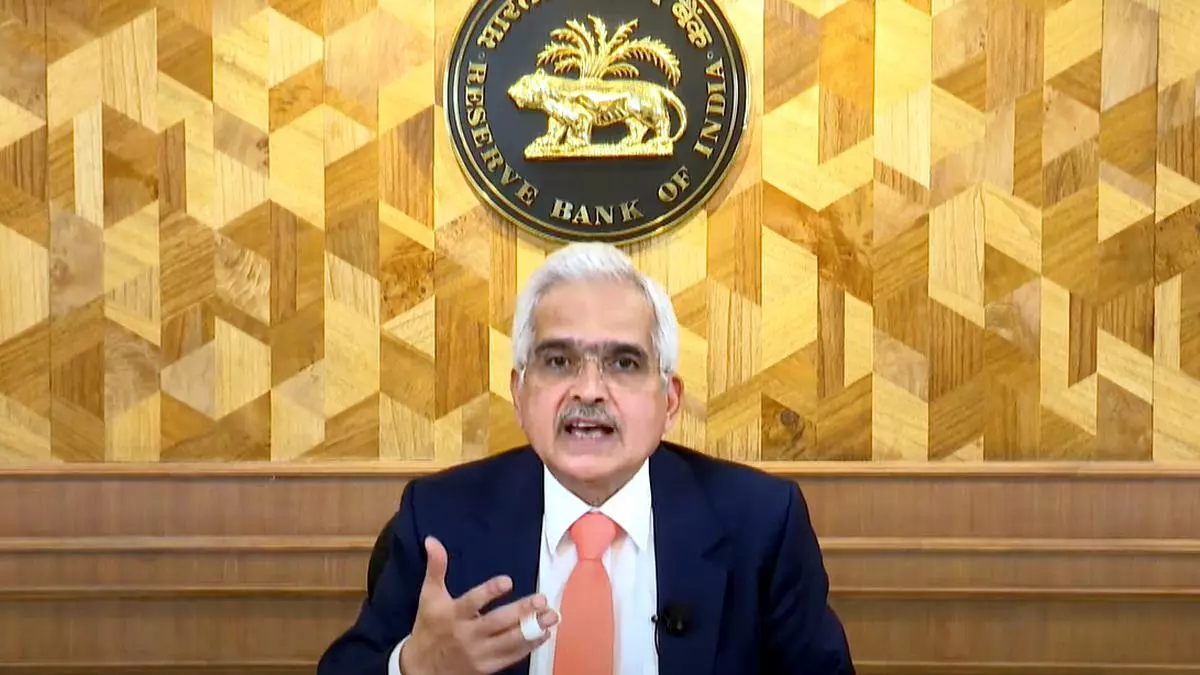

Even as the overall health of non-banking finance companies (NBFCs) remains strong, the Reserve Bank of India (RBI) has observed that some NBFCs are aggressively pursuing growth without building up sustainable business practices and risk management frameworks, RBI Governor Shaktikanta Das said in his Monetary Policy Committee (MPC) statement today.

“An imprudent ‘growth at any cost’ approach would be counter productive for their own health,” Das, said. He also flagged that driven by the significant accretion to their capital from both domestic and overseas sources, and sometimes under pressure from their investors, some NBFCs – including microfinance institutions (MFIs) and housing finance companies (HFCs) – are chasing excessive returns on their equity.

While such pursuits are in the domain of the boards and managements of NBFCs, concerns arise when the interest rates charged by them become usurious and get combined with unreasonably high processing fees and frivolous penalties.

“These practices are sometimes further accentuated by what appears to be a ‘push effect’, as business targets drive retail credit growth rather than its actual demand. The consequent high-cost and high indebtedness could pose financial stability risks, if not addressed by these NBFCs,” Das said.

According to Anil Gupta, co-group head of financial sector ratings at ICRA, given the wider purpose for credit inclusion served by MFIs and HFCs, the rating agency does not expect a general tightening of guidelines for the sector. However, given the cautionary statements by the regulator, there could be more regulatory scrutiny around the business models and risk practices of some specific NBFCs. If the regulatory concerns remain unaddressed, entity-specific action cannot be ruled out, he said.

A senior banker shared similar views. He said that while the regulator could consider hiking risk weight on bank loans to HFCs and MFIs, the regulator may bring in new norms on fair practice, loan pricing transparency, risk management policies, and enhance the duties of chief risk officer of the entity.

Governor Das today also said that NBFCs may review their prevailing compensation practices, variable pay and incentive structures as some of these practises appear to be purely target driven in certain NBFCs. Such practices could result in adverse work culture and poor customer service.

It is important that NBFCs, including MFIs and HFCs, follow sustainable business goals, ‘compliance first’ culture, a strong risk management framework, strict adherence to fair practices code and sincere approach to customer grievances.

“The Reserve Bank is closely monitoring these areas and will not hesitate to take appropriate action, if necessary. Self-correction by the NBFCs would, however, be the desired option,” he said.

Das also said that recent commentary on likelihood of stress building up in a few unsecured loan segments like loans for consumption purposes, micro finance loans and credit card outstanding is being monitored by the RBI. The regulator, Das says, will take measures, as may be considered necessary to counter the issues. Banks and NBFCs, on their part, need to carefully assess their individual exposures in these areas, both in terms of size and quality.

Continued attention also needs to be given to potential risks from inoperative deposit accounts, cybersecurity landscape, mule accounts, Das said.

Says Rajiv Sabharwal, MD and CEO, Tata Capital Ltd, “Banks and NBFCs have played a critical role in promoting financial inclusion and credit access to underserved communities. However, the shifting landscape demands institutions to sharpen their strategies, especially in unsecured lending space, where stringent and cautious underwriting will be key to mitigating potential risks to financial fabric.”