Software firm Ebix files bankruptcy after short-seller attacks, debt woes

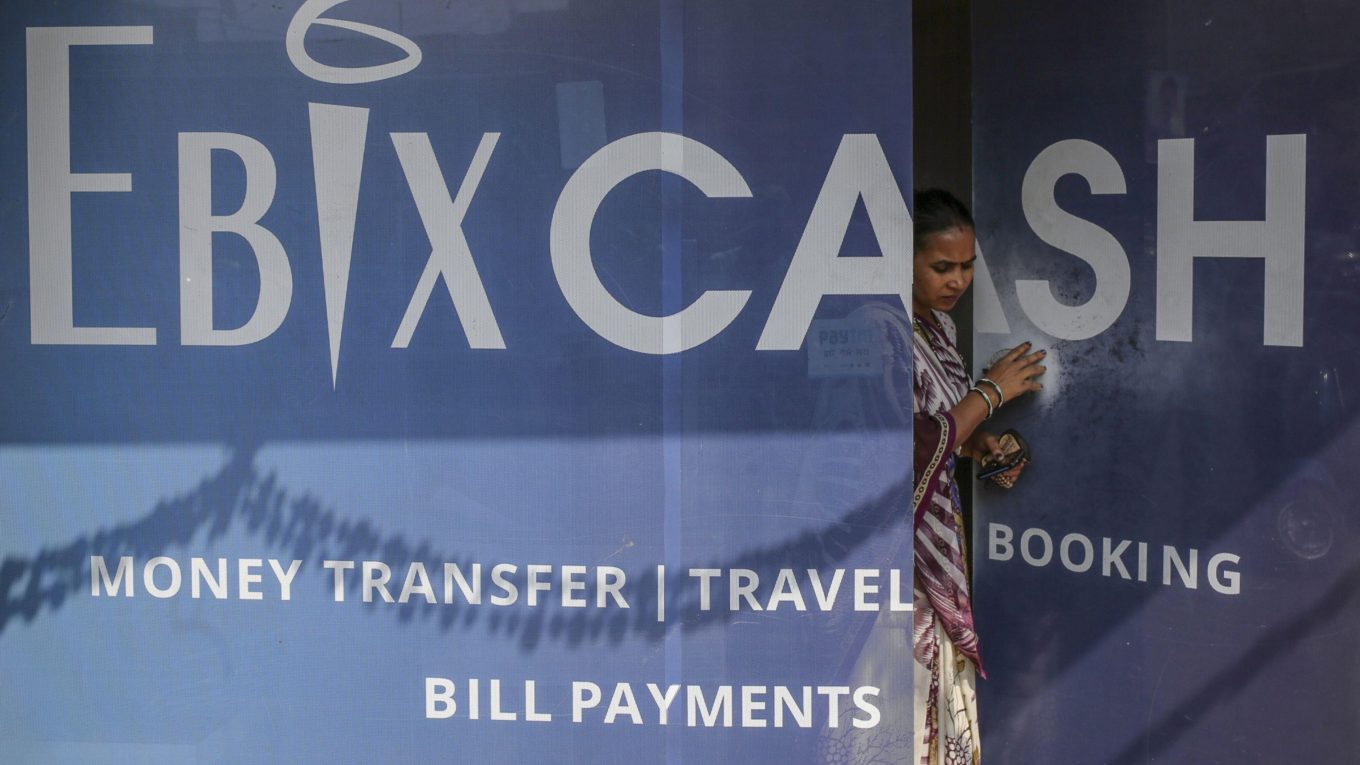

Insurance software firm and short seller target Ebix Inc. filed for bankruptcy after struggling to bounce back from high interest rates and looming debt payments. The Johns Creek, Georgia-based firm listed assets and liabilities of at least $500 million each in a Chapter 11 petition filed in Texas. The filing protects the company from creditors while it seeks court approval of a plan to repay them. (Photo: Bloomberg)

By Advait Palepu, Amelia Pollard and Jonathan Randles

Insurance software firm and short seller target Ebix Inc. filed for bankruptcy after struggling to bounce back from high interest rates and looming debt payments.

The Johns Creek, Georgia-based firm listed assets and liabilities of at least $500 million each in a Chapter 11 petition filed in Texas. The filing protects the company from creditors while it seeks court approval of a plan to repay them.

Publicly traded Ebix is the parent of Indian fintech company EbixCash, which facilitates payments, foreign exchange and prepaid gift cards. The company’s nearly 200 affiliates outside the US are not included in the bankruptcy filing, according to a statement.

In bankruptcy, the company plans to sell its North American life insurance and annuity assets to help pay off its debt. Insurance firm Zinnia, backed by Todd Boehly’s Eldridge Industries, will kick off the auction with a $400 million opening bid. The firm and its advisers will “conduct a fulsome marketing and sale process” for the assets of the company, according to the the statement.

The bankruptcy filing is not Ebix’s first encounter with trouble. A decade ago, a deal for Goldman Sachs Group Inc. to buy the company fell apart after a US criminal probe came to light. Neither the Department of Justice nor the Securities and Exchange Commission, which conducted its own probe, ended up taking action against Ebix.

Auditor Woes

Ebix blamed its bankruptcy on rising interest rates and the looming maturity of roughly $617 million of loans. Ebix said it faced additional challenges following the resignation of its former auditor RSM US LLP as well as “aggressive inquiries from short sellers of the Company’s stock.”

RSM resigned in early 2021 over disagreements with Ebix management over treatment of certain accounting classifications related to the company’s gift card business, Ebix Chief Financial Officer Amit Garg said in a sworn statement. Short seller Hindenburg Research previously accused Ebix of fabricating some of its revenue, including a substantial portion of revenue in its gift card business — an accusation the company denied.

Ebix hired outside lawyers and accountants to investigate issues identified by RSM, but the company’s board of directors “was satisfied that no steps were necessary with respect to the Company’s gift card business.” Still, the market reacted negatively to RSM’s resignation and subsequent Hindenburg report, which resulted in a 40% drop in the company’s market value, Garg said.

The case is Ebix Inc., 23-80004, US Bankruptcy Court for the Northern District of Texas (Dallas).

First Published: Dec 19 2023 | 12:03 AM IST