Rural areas have the least presence of payments banks’ offices: Crisil

Rural areas have the fewest number of payment banks (PBs) operating desks, while urban areas have the highest number of operating desks, according to Crisil Market Intelligence and Analytics (MI&A).

At the end of December 2022, the maximum number of offices was in urban (44 percent) and peri-urban (40 percent), followed by urban (11 percent) and rural (5 percent). Six payments banks had 741 operating offices at the end of last year.

According to the credit rating agency, the operating offices of payment banks are likely to grow in rural areas due to the government’s increased focus on financial inclusion.

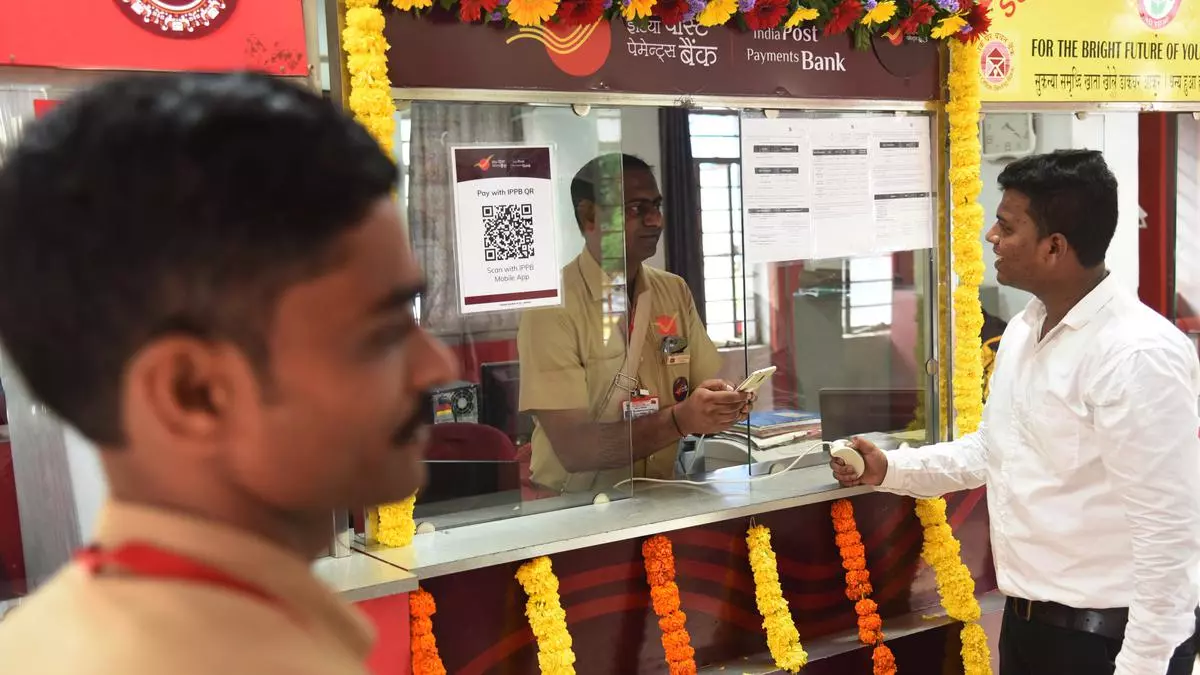

Airtel Payments Bank, India Post Payment Bank (IPPB), Fino Payments Bank, PayTM Payments Bank, NSDL Payments Bank and Jio Payments Bank are the six PBs currently in operation.

Job desks facilitate small savings and provide payments and remittance services to migrant workers, low-income families, small businesses, and other informal sector entities.

In a memorandum prepared on the basis of a DRHP for the IPO of National Securities Depository Ltd, the agency said that these operating offices make up a very small percentage of the total number of points of contact for PBs because they tap into the extensive network of dealers and doorstep service providers in order to provide banking services and services. Related in the last mile.

For example, NSDL Payments Bank had 23 lakh points of contact in December 2022, while Paytm Payments Bank had 2.1 lakh points of contact across India as of FY21. Venu Payments Bank had a merchant network of 14 lakh points of contact at the end of March 2023. .

With penetration of services such as credit, insurance, and mutual funds still at a very low level, Crisil stressed that cross-selling to unserved and/or unserved retail customers remains an attractive opportunity for payment banks.

The share of total credit outstanding is about 8 percent in rural areas, 13 percent in peri-urban areas and 79 percent in urban areas as of March 31, 2023, according to the note.

Although mutual fund penetration (mutual fund assets under management as a percentage of GDP) grew from 4.3 percent in 2001-02 to about 14.5 percent in 2022-23, penetration levels remain much lower than in other developed markets, This provides an opportunity for payment banks to sell investment products to clients in rural and peri-urban areas.

At the end of March 2022, PBs deposits reached ₹9,954 crores and their investment in government securities reached ₹9,924 crores, per RBI data.

PBs can hold a maximum balance of $2 lakh per individual customer at the end of the day. It can act as a commercial correspondent for another bank, distributing simple financial products such as mutual fund units and insurance products. However, they cannot carry out lending activities.