Resume trading in suspended agri-derivatives

It’s been a while since commodity derivatives market regulator SEBI has suspended more than half a dozen agricultural commodities.

In October 2022, the Commodity Derivatives Advisory Committee (CDAC) proposed relaunching futures trading for those outstanding commodities whose prices are below the minimum support price (MSP). However, the suspension is extended until December 2023.

Therefore, some questions about immediate policy actions arise. (1) Is extension of suspension practical? (ii) Can technical and fundamental analyzes justify the re-launch of derivative contracts? (3) Is intermittent cancellation necessary to restore utility in the commodity derivatives market?

Analysis of spot price action in pending derivatives and comparison with MSPs followed by fundamental analysis will answer these questions.

Technical Analysis

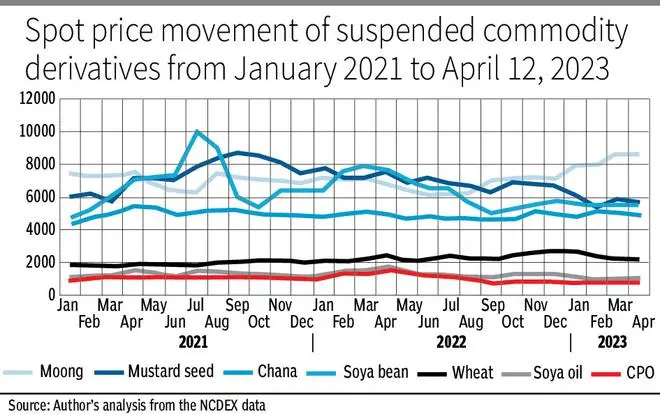

Table 1 presents the domestic price movement of the pending commodities from the date of the hold until April 12, 2023.

Chana, which was suspended in August 2021, saw a negative 2 percent change in prices, while crude palm oil, mustard seed, soybean and soybean oil saw lower spot price action, and mung and wheat saw a change of 26 percent and 7 percent. respectively.

Also, the spot prices surveyed showed joint movement with the MSP of mustard seed, soybean and wheat.

The difference between the spot prices polled by the exchange and the MSP was the maximum for soybeans, followed by mung, mustard seed, and wheat. Shana’s MSP exceeded the spot prices surveyed in April 2023.

Table 1

Fundamental analysis

Consider the fundamental analysis of outstanding agricultural derivatives. Prices have been holding steady for some time for commodities except for mustard seed after the suspension. Prices of soybeans, soybean oil and crude palm oil increased through April 2022 (see Figure 1).

First, higher prices are attributed to several factors affecting macroeconomic uncertainty and resilience, specifically the opening up of major market economies, and improvement in consumer demand.

Secondly, the global soybean production networks have suffered a shake-up due to bad weather in Brazil and Argentina, the decline in sunflower production in Ukraine due to geopolitical tensions, the scarcity of labor in Malaysia affecting palm oil production, etc. Also, the restriction of palm oil export Crude from Indonesia leads to higher prices globally.

Graph (Fig. 1)

Wheat prices described an upward trend from February 2022 as the Russo-Ukraine war drove up prices due to fear of supply disruption.

Meanwhile, increased exports from India, depleted stockpiles and lower production estimates supported the upward trend in prices.

Mustard showing a downward trend in prices after the suspension was attributed to oversupply over production for two consecutive years. Mustard futures contracts during the arrival season depicted a price drop as they traded back to spot prices.

-

Also read: Can agricultural value chains solve the agricultural crisis and build a just rural future?

Thirdly, looking at the period from April 1, 2022 to April 11, 2023, the spot prices of most of the pending commodities showed a price correction, which was attributed to the abundant production of major commodities such as channa, mustard seeds, soybeans, etc.

The increased supply of mustard for two consecutive years led to a price correction. For edible oils, domestic prices have been corrected in line with international prices.

There is a decline in the international prices of soybean oil, crude palm oil and soybeans. Indonesia’s lifting of export restrictions on palm oil led to a stockpile build-up that lowered domestic prices.

policy suggestions

Without agricultural derivatives, hardly any information was shared between the derivative and the spot market for the outstanding futures contract. This could affect the quality of the market and the motivation for arbitrage in the commodity sectors.

Therefore, the regulator and the CDAC should facilitate the resumption of derivatives trading for those commodities whose spot prices show co-movement with the MSP, or reach a certain threshold for the maximum commodity price in the pre-suspend period.

Marginalization, market-wide position reduction, and implicit practices must be strong enough to corner unscrupulous market participants and maintain the orderly functioning of the commodity derivatives market.

In conclusion, a wise decision can avoid the existential crisis of agricultural commodity exchange and commodity market ecosystem in general.

(Day teaches at IIM, Lucknow. Data provided by NCDEX recognized. Views are subjective.)