RBI reduces CRR to 4% to ease anticipated liquidity stress

The Reserve Bank of India (RBI) has decided to reduce the cash reserve ratio (CRR) of all banks by 50 basis points in two equal tranches of 25 bps each to 4.0 per cent of their deposits. This reduction will release primary liquidity of about ₹ 1.16 lakh crore to the banking system.

This is aimed at alleviating the expected liquidity tightness towards mid-December, when GST and advance tax outflows will happen.

The two-tranche CRR cut is with effect from the fortnight beginning December 14, 2024 and December 28, 2024, respectively.

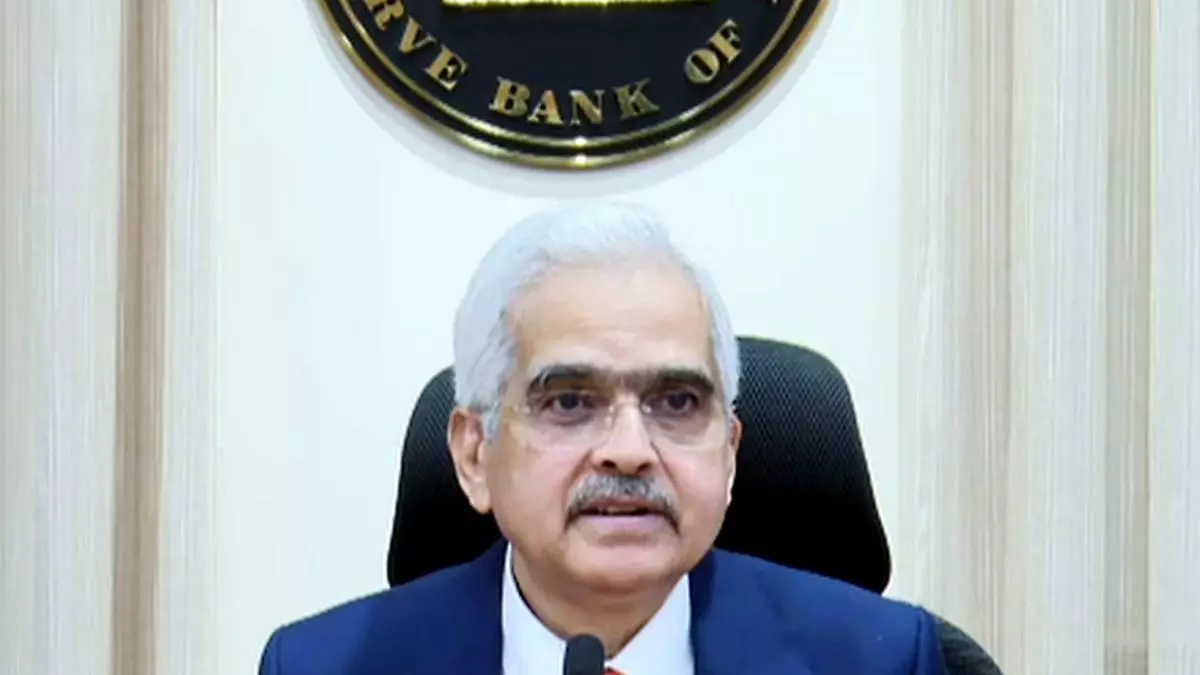

RBI Governor Shaktikanta Das said “Even as liquidity in the banking system remains adequate, systemic liquidity may tighten in the coming months due to tax outflows, increase in currency in circulation and volatility in capital flows. To ease the potential liquidity stress, it has now been decided to reduce the cash reserve ratio (CRR) of all banks…”

This will restore the CRR to 4 per cent of NDTL, which was prevailing before the commencement of the policy tightening cycle in April 2022, he added.

Banking expert V Viswanathan said the increase in the net interest margin on account of the CRR cut might be nullified by the increase in the interest rate ceiling on FCNR deposits that banks may offer now.

Sachin Sachdeva, Vice President & Sector Head – Financial Sector Ratings, ICRA Limited, said: “CRR cut positive for banks’ liquidity and profitability amid persisting challenges in deposit mobilisation. CRR cut by 50 basis points will free up liquidity by more than ₹1 lakh crore and aid credit expansion.”