RBI MPC meeting begins today: Policy announcement set for October 9

The Reserve Bank of India (RBI) is set to begin its three-day monetary policy meeting on Monday and will run from October 7 to October 9.

All eyes are on the outcome, as the central bank has kept the repo rate unchanged for the last nine consecutive meetings.

The repo rate, currently at 6.50 per cent, has remained steady since the RBI adopted a cautious stance to balance inflation control and economic growth.

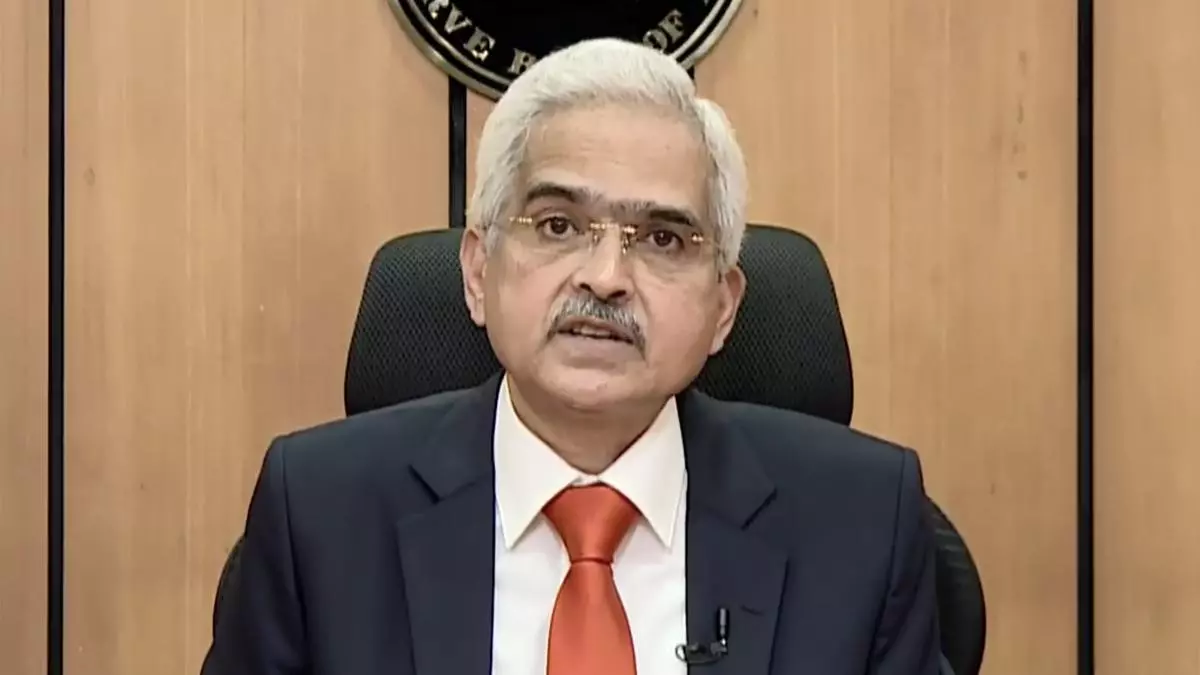

The Monetary Policy Committee (MPC), headed by RBI Governor Shaktikanta Das, is expected to weigh key factors like inflationary trends, global economic uncertainties, and domestic growth prospects. Inflation continues to be a challenge, particularly in food and fuel prices, which saw a surge earlier this year.

As per the data by Ministry of Statistics & Programme Implementation, though the, All India Consumer Price inflation in August was 3.65 per cent, which is under the RBI target band but the food inflation stands at 5.65 per cent and it remains above the RBI’s medium-term target of 4 per cent.

Despite these inflationary pressures, the RBI has opted for a status quo on the repo rate, primarily to support economic recovery post-pandemic.

However, there are rising concerns that external factors, like the rising global crude oil prices on tensions in West Asia which may compel the RBI to reconsider its current stance.

Earlier this month the central government appointed three new members to the monetary policy committee. The MPC comprises three members from the RBI and three external members appointed by the Central Government.

The newly reconstituted committee consists of the Governor of the Reserve Bank of India as the Chairperson, ex officio; the Deputy Governor of the Reserve Bank of India, in charge of monetary policy–Member, ex officio, and one officer of the Reserve Bank of India, nominated by the Central Board — Member, ex officio.

The new external members included in the MPC are Professor Ram Singh, Director, Delhi School of Economics, University of Delhi, Saugata Bhattacharya, economist; and Dr. Nagesh Kumar, Director and Chief Executive, Institute for Studies in Industrial Development.

Market participants and analysts are closely monitoring this meeting for any forward guidance on future rate actions. Many believe the central bank will continue its wait-and-watch approach, but a surprise rate hike cannot be entirely ruled out.

On September 18, the US Federal Reserve announced a steep 50 basis points interest cut in its review meeting. US Fed announced the rate cuts after holding interest rates steady for eight straight meetings.

The outcome of the MPC meeting will be announced on October 9, and will set the tone for future monetary policies amid the changing global economic landscape.