RBI increases the frequency of reporting of credit information by lenders to credit info companies

The RBI has decided to increase the frequency of reporting of credit information by lenders, including Banks and NBFCs, to Credit Information Companies (CICs) from monthly intervals to fortnightly basis or shorter intervals.

This is aimed at providing a more up-to-date picture of a borrower’s indebtedness.

At present credit institutions (CIs) or lenders are required to report the credit information of their borrowers to credit information companies (CICs) at monthly or such shorter intervals as mutually agreed between the CI and CIC.

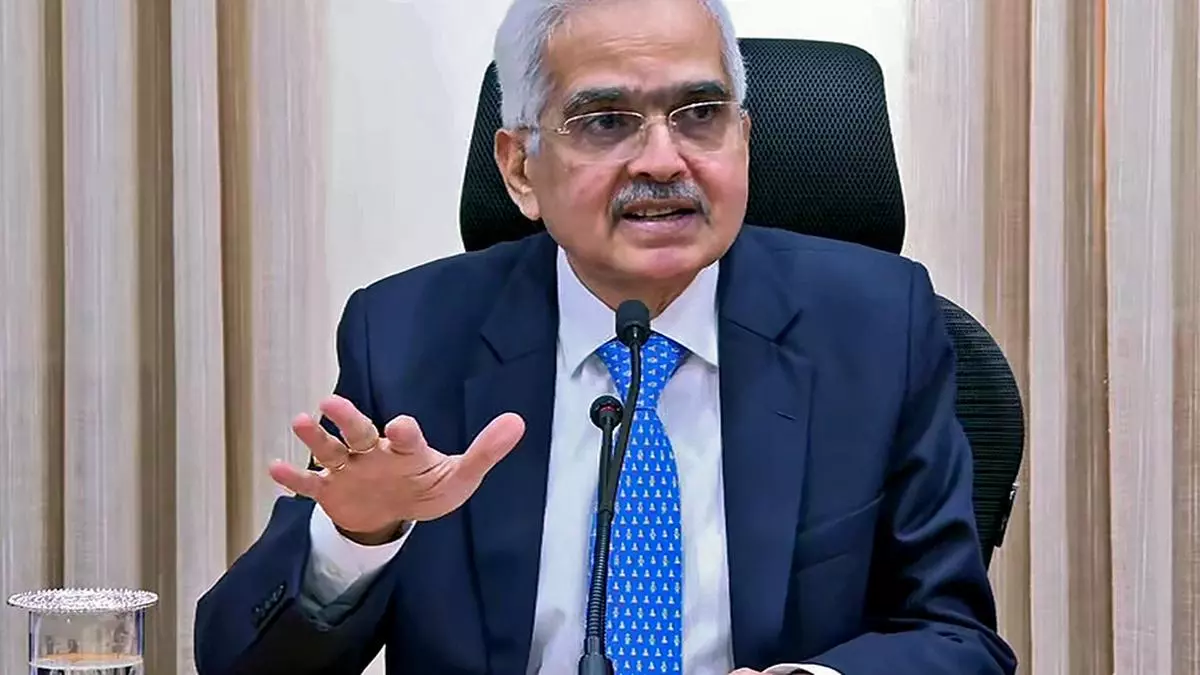

“The fortnightly reporting frequency would ensure that credit information reports provided by CICs reflect a more recent information. This will be beneficial to both borrowers and lenders (Cis),” RBI Governor Shaktikanta Das said.

Borrowers will have the benefit of faster updation of information, especially when they have repaid the loans. Lenders will be able to make better risk assessment of borrowers and also reduce the risk of over-leveraging by borrowers.

CICs will now be required to ingest credit information/ data received from the CIs, as per their data acceptance rules, within five calendar days (against seven calendar days earlier) of its receipt from the CIs.

The central bank said its instructions on “frequency of reporting of credit information by CIs to CICs” will be effective from January 1, 2025. However, the CIs and CICs are encouraged to give effect to these instructions as expeditiously as feasible but not later than January 1, 2025.

CICs have been asked to provide a list of CIs which are not adhering to the fortnightly data submission timelines to Department of Supervision, Reserve Bank of India, Central Office at half yearly intervals (as on March 31 and September 30 each year) for information and monitoring purposes.