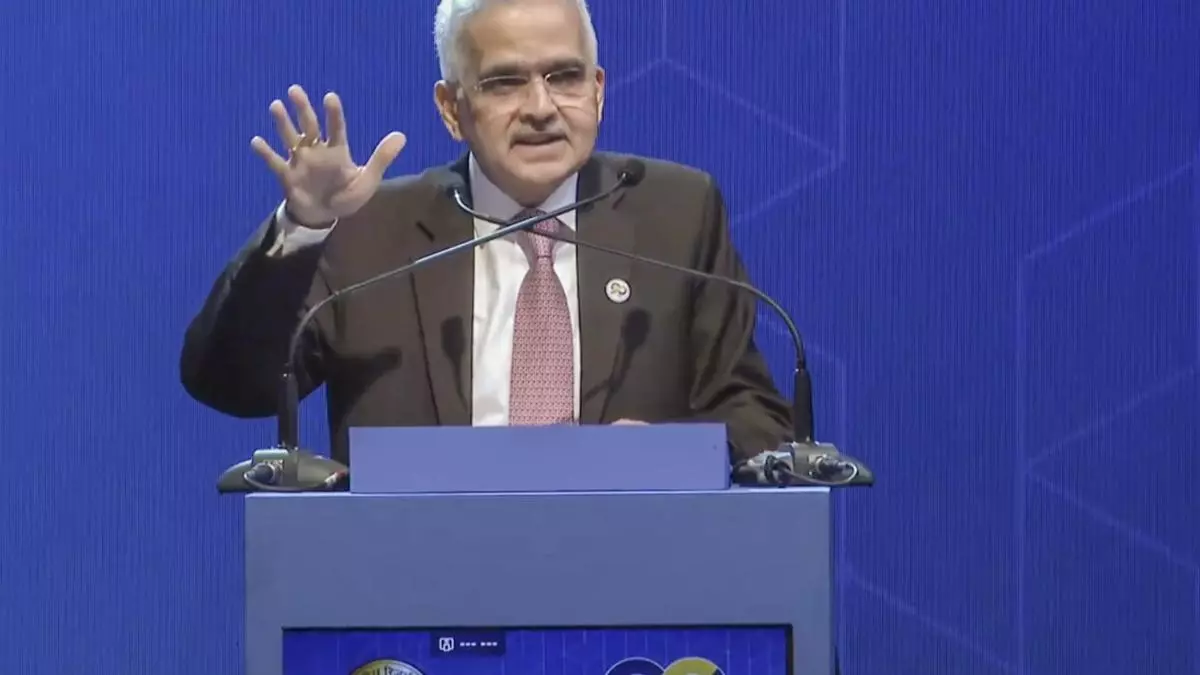

RBI Governor foresees UPI system as a game-changer in cross-border remittances

India’s real-time payment system — Unified Payments Interface (UPI) system — has the potential to evolve into a cheaper and quicker alternative to the available channels of cross-border remittances, according to RBI Governor Shaktikanta Das.

Video Credit: Businessline

A beginning can be made with small value personal remittances as it can be quickly implemented, he said at the RBI@90 Global Conference on “Digital Public Infrastructure and Emerging Technologies”.

UPI is a system that powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing and merchant payments into one hood. It also cater to the “peer-to-peer” collect requests which can be scheduled and paid as per requirement and convenience.

Peer-to-peer cross-border payments

Das noted that while much efficiency has been achieved in wholesale markets, the retail cross-border space is still fraught with multiple layers that add to the cost and delays in cross-border remittances.

“Needless to say modern technology offers solutions which can smoothen these frictions. With the emergence of Fast Payment Systems across countries and experimentation around Central Bank Digital Currency (CBDC), new possibilities are opening up to bring in greater efficiency to cross-border payments.

“Maximum efficiency gains in such initiatives would come from ensuring inter-operability as a key design element,” he said.

A CBDC is a legal tender issued by a central bank in digital form. It is a digital or virtual currency. It is the same as a fiat currency and is exchangeable one-to-one with it – only its form is different. In India, RBI launched CBDC pilots in both retail and wholesale segments in late 2022.

It may be pertinent to note that in order to further expand international reach of Indian payment systems, RBI has joined Project Nexus, a multilateral international initiative to enable instant cross-border retail payments by interlinking the domestic fast payments systems (FPSs) of four Association of Southeast Asian Nations (ASEAN) countries (Malaysia, Philippines, Singapore, and Thailand); and India.

The Governor said that ideally, while the legacy payment systems should be able to connect to each other and so should the CBDC systems, one country’s legacy system should also be interoperable with another country’s CBDC.

“Actual implementation of interoperability would pose challenges and may involve certain trade-offs. Technical barriers may be surmounted by using common (international) technical standards,” he said.

Further, the governance structure or management framework for long-term sustainability needs to be finalised.

Das observed that a key challenge in this journey of attaining harmonisation and interoperability among countries could be that countries may prefer to design their systems as per their domestic considerations.

“We can overcome this challenge by developing a plug-and-play system that allows replicability while maintaining the sovereignty of respective countries.

“India has made some progress in this direction and would be happy to develop a plug and play system for the benefit of the community of nations,” he said.