RBI calls for enforceable Code of Conduct for CoCs under IBC

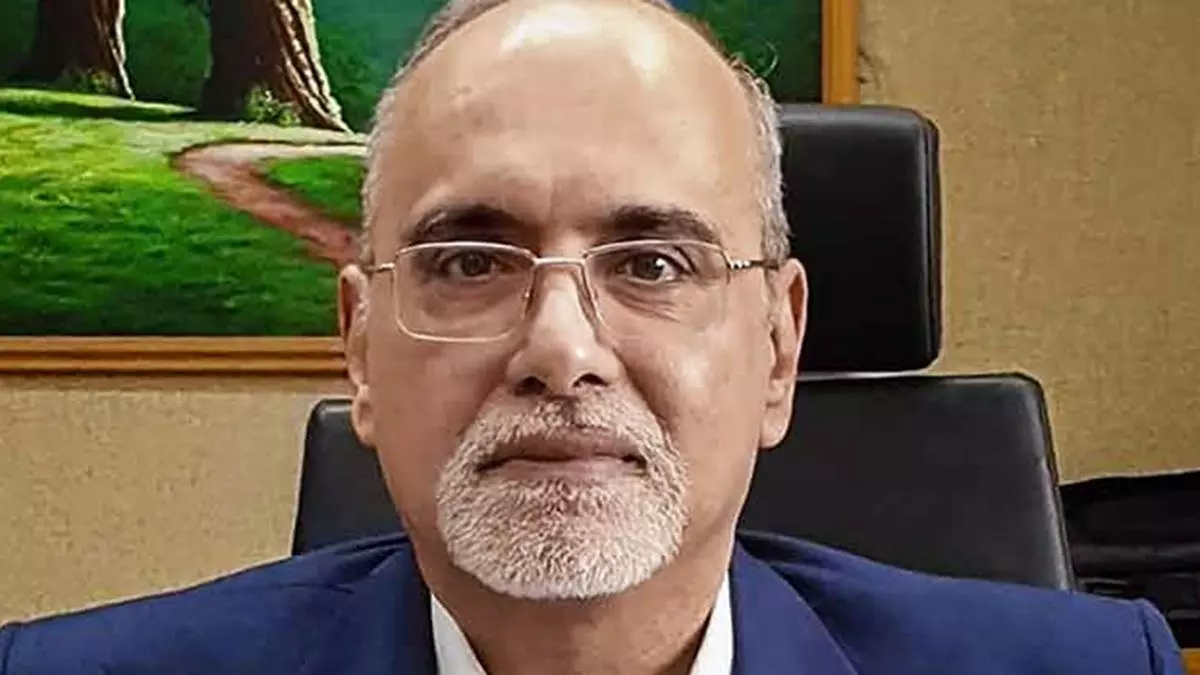

The Committee of Creditors (CoC), which is a key decision making body under the Insolvency and Bankruptcy Code (IBC), should be subjected to an “enforceable” Code of Conduct, Rajeshwar Rao, Deputy Governor, Reserve Bank of India (RBI) said on Saturday.

The insolvency regulator IBBI should ideally be vested with the powers to enforce norms for the conduct of all stakeholders under IBC process, Rao said at an international conclave, jointly organised by INSOL India and Insolvency and Bankruptcy Board of India (IBBI).

It would not be possible for sectoral regulators to enforce this given the diverse set of financial creditors involved in the process, he added.

Highlighting the pivotal role assigned to the CoC in the Corporate Insolvency Resolution Process (CIRP) under the IBC, Rao emphasised the need for significant improvements, citing instances where the CoC’s performance has fallen short in various aspects.

Noting that IBC has assigned a central role to CoC in the Corporate Insolvency Resolution Process (CIRP), Rao noted that this is an area where significant improvements are needed. There have been instances where CoC’s performance has been found lacking in several respects.

This includes disproportionate prioritisation of individual creditors’ interest over the collective interest of the group; disagreements among creditor members in approving the resolution plan due to concerns about undervaluation or perceived lack of viability; Disagreement on the distribution of proceeds even when a resolution plan is agreed upon; non participation in the CoC meetings and lack of effective engagement, coordination or information exchange amongst the members, he said.

Instances have also been noted regarding insufficient skill sets in areas like corporate finance, legislation, and industry knowledge. Lastly, the nomination of financial creditors to CoCs are entrusted with responsibilities that far exceed their authority, he added.

“It is in larger interest of creditors themselves that issues relating to creditors are addressed by members themselves without waiting for regulatory prescription or fiats.

However, when incentives are not perfectly aligned, deviations from best practices become the norm. Therefore, we need an enforceable code of conduct for the committee of creditors,” Rao said.

His remarks on the need for an enforceable Code of Conduct for CoC are significant as currently, there is no mandatory regulatory oversight on the member behaviour or actions of CoCs under IBC. Another matter of worry is that during the last financial year ended March 2024, the realisation by creditors under IBC was 27 per cent, exactly half of the 54 per cent recovery recorded in initial years.

In August this year, IBBI developed self-regulating “Guidelines for Committee of Creditors” to help conclude Resolutions under IBC in a time-bound manner and maximise the value of corporate debtors’ assets. However, experts noted that without statutory force, the Guidelines will remain merely advisory/self-regulating and may not achieve their intended purpose.