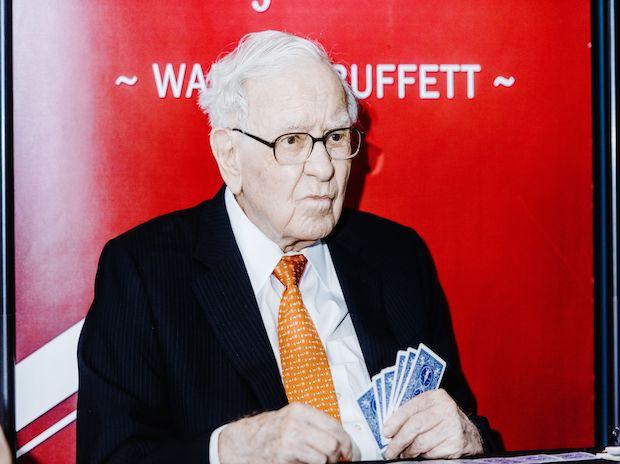

Q1 profits jump to $35.5 bn at Buffett’s Berkshire ahead of annual meeting

Warren Buffett’s company said its first-quarter earnings rose along with the paper value of its portfolio, giving the thousands of shareholders who will fill the arena on Saturday to hear the billionaire and several other top conglomerate executives answer questions for hours with some good news to start the day.

It’s a once-in-a-lifetime opportunity, said Chloe Lane, who flew in from Singapore to meet for the first time and learn from Buffett and his longtime investment partner Charlie Munger.

The Berkshire shareholder meeting always draws a crowd of people who admire investors and want to hear whatever wisdom they have to offer about recent events and life lessons. And with both men in their 90s this year, some of the crowd is feeling the urgency to attend now while both men are still here.

Charlie Munger is 99 years old. I just wanted to see it in person. It’s on my bucket list, Wu said. I must attend as long as I can.

Berkshire Hathaway said Saturday morning that it earned $35.5 billion, or $24,377 per Class A share, in the first quarter. That’s more than 6 times last year’s $5.58 billion, or $3,784 per share.

But Buffett has long warned that those final figures can be misleading for Berkshire because large fluctuations in the value of its rarely-sold investments distort earnings. This quarter, Berkshire sold just $1.7 billion in stock while posting a paper investment gain of $27.4 billion. Part of this year’s investment gain included a $2.4 billion increase related to Berkshire’s planned acquisition of a majority stake in Pilot Travel Centers in January.

Buffett says Berkshire’s operating profit, which excludes investments, is a better measure of a company’s performance. By this metric, Berkshire’s operating profit grew nearly 13% to $8.065 billion, compared to $7.16 billion a year ago.

The three analysts surveyed by FactSet expect Berkshire to report operating profit of $5,370.91 per Class A share.

The first quarter of this year was relatively quiet compared to last year when Buffett revealed that he spent $51 billion at the beginning of last year, acquiring stocks such as Occidental Petroleum, Chevron and HP. Buffett’s buying has slowed over the rest of last year except for a number of additional purchases from Occidental.

At the end of the first quarter of this year, Berkshire held $130.616 billion in cash, up from $128.585 billion at the end of last year. But Berkshire spent $4.4 billion during the quarter buying back its shares.

The quarterly report did not disclose any significant new equity investments this year. But most of Berkshire’s selective mix of companies has fared well despite fears of a looming recession.

Berkshire’s insurance unit, which includes Geico and a number of major reinsurers, reported $911 million in operating profit, compared to $167 million a year ago, driven by a rebound in Geico’s results. Geico benefited by charging higher premiums and reducing ad spend and claims.

But Berkshire BNSF Rail and its large utility unit reported lower earnings. BNSF earned $1.25 billion, down from $1.37 billion, as the number of shipments it handled fell 10% after it lost a large customer and imports slowed at West Coast ports. The Utilities division added $416 million, down from $775 million last year.

Besides those big companies, Berkshire has an eclectic lineup of dozens of other companies, including a number of retail and manufacturing companies like See’s Candy and Precision Castparts.

(Only the title and image for this report may have been reworked by the Business Standard staff; the rest of the content is generated automatically from a shared feed.)