NBFCs across the spectrum post record disbursements in FY23

FY23 turned out to be a successful year not only for banks but also for Non-Banking Financial Companies (NBFCs). With consumption soaring two years into the pandemic, non-bank lenders across sectors saw record payments and asset growth over the previous fiscal year.

Cholamandalam Finance’s total payout jumped 87 per cent year-on-year to Rs. 66,532 crore (Rs. 35,490 crore) in FY23 driven by growth across vehicle financing, new business and home loan categories.

Granted, vehicle financing still makes up more than 60 percent of Chola’s loan book. The company entered into home and business loan categories to diversify its asset book.

Mahindra & Mahindra Financial Services, another major player in vehicle finance, recorded an 80 per cent growth in its payouts in FY23 to Rs.49,541 crore.

-

Also read: With temperatures rising, Chennai and Bengaluru are experiencing their hottest May in years

On the company’s fourth-quarter earnings call, Ramesh Iyer, vice chairman and managing director, attributed the payout hike to a recovery in the rural market driving demand for used vehicles, tractors and cars.

Sundaram Finance recorded its highest annual disbursement in FY23 at Rs.20,966 crore (58 percent growth), as against Rs.13,275 crore in FY22.

This performance came after three challenging years, starting with a slowdown in CV sales and followed by two years of Covid, said Rajeev C. Lochan, managing director.

growth engines

Non-bank financial firms that cater via consumer finance, small business loans, and loans against property (LAP), too, have seen payments grow.

Kaitav Shah, BFSI Research Analyst at Anand Rathi Institutional Equities, said technology adoption, new business lending, fintech partnerships, GST use and alternative underwriting data are some of the factors driving the growth of non-bank financial corporate loans compared to banks.

Even smaller non-bank financial firms like Five Star Business Finance saw their payments nearly double to Rs. 3,391 crore in FY23. The company mainly provides small loans for business, asset creation and other economic purposes to small entrepreneurs and self-employed individuals. Higher payments have also pushed up total assets under management (AUM) for many lenders.

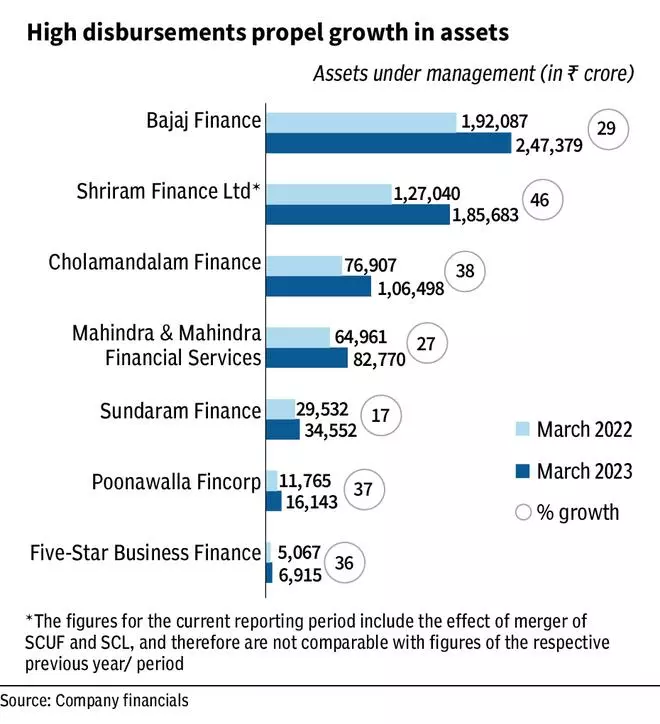

Bajaj Finance’s total loan book grew by 29 per cent over the previous year to reach INR 2.47 crore. We have disbursed 29.6 million loans. We’ve added 11.6 million new customers to the franchise, which is the highest ever customer addition we’ve actually made as a company,” said Rajeev Jain, MD, Bajaj Finance Ltd, on the fourth-quarter FY23 earnings call.

Shriram Finance saw its assets grow by 46 per cent to INR 1.86 crore. Cholamandalam Finance’s total assets crossed the ₹1-lakh crore mark in the previous financial year, and grew by 38 per cent year-on-year.