Lok Sabha clears Banking Bill, to strengthen governance

After five days of pandemonium, the Lok Sabha on Tuesday resumed business to pass the Banking Laws (Amendment Bill, 2024).

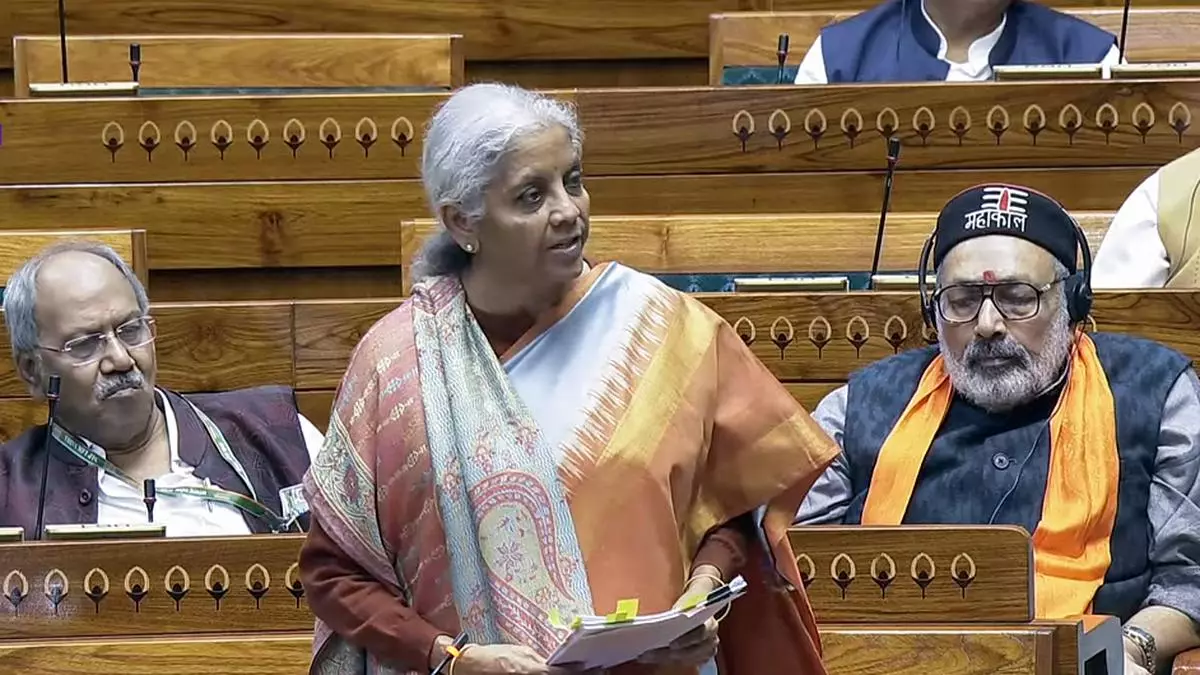

Among the important provisions of the statute are inclusion of four nominees in a bank deposits/accounts/lockers and enhancement in the threshold for shareholding of a beneficial interest by an individual to ₹2 crore from ₹5 lakh. Moving the Bill, Finance Minister Nirmala Sitharaman said that it aims to strengthen governance in the banking sector and enhance customer convenience.

Although the legislative business was resumed in earnest, the House continued to witness heated exchanges between the treasury benches and the opposition especially on the prevailing economic situation, banking industry and bribery allegations against business tycoon Gautam Adani. There was an uproar from the opposition when a ruling party MP said a former Prime Minister was involved in phone banking. Later, the Speaker expunged the name of the former PM from the proceedings of the House.

Moving the Bill for consideration and passage, Finance Minister said: “The proposed amendments will strengthen governance in the banking sector and enhance customer convenience with respect to nomination and protection of investors.”

Once the Bill becomes the law, deposit holders or locker holders can name up to four persons as nominees. Currently, only one nominee is permitted for these cases with some conditions.

Unclaimed deposits

The higher number of nominees for depositors’ money aims to reduce unclaimed deposits in banks. Unclaimed deposits with banks have witnessed a 26 per cent jump year on year to ₹78,213 crore at the end of March 2024, as per the RBI Annual Report.

Replying to the debate, the Finance Minister highlighted the strength of the banking sector, emphasising that public sector banks are efficiently managed and do not rely on government funding. She noted that all public sector banks are profitable, with a total profit of ₹85,520 crore in the first half of the current fiscal year.

“Banks are being professionally run today. The metrics are healthy so they can go to the market and raise bonds, raise loans and run their business accordingly,” the FM said.

She added: “Look around and the world has lost their banks where regulatory systems are sound, the banks have failed. We can’t have our banks struggling. We must credit RBI and FinMin for it. Since 2014, we are cautious that banks remain stable.”

Pointers

Changes in Banking Laws, RBI Act

– Allow for the nomination of up to four persons, including provisions for simultaneous and successive nominations regarding deposits, articles in safe custody, and safety lockers

– Increasing the threshold for shareholding of a beneficial interest by an individual, etc., to Rs 2 crore from Rs 5 lakhs

– To revise the reporting dates for the submission of statutory reports by banks to the Reserve Bank of India, so as to align them to the last day of the fortnight or month or quarter

– Increasing the tenure of directors (excluding the chairman and whole-time director) in co-operative banks to 10 years from 8 years

– Allow a director of a central co-operative bank to serve on the board of a state co-operative bank