Indian banks write off ₹10.6 lakh crore in 5 years, 50% linked to large corporates

The government on Monday informed the Lok Sabha that all Scheduled Commercial Banks have written off nearly Rs 10.6 lakh crore in the last 5 years, out of which nearly 50 per cent belong to large industrial houses. It also said that nearly 2300 borrowers, each having a loan amount of Rs 5 crore or more, wilfully defaulted around Rs 2 lakh crore.

As per the Reserve Bank of India (RBI) guidelines and policy approved by bank boards, NPAs, including those in respect of which full provisioning has been made on completion of four years, are removed from the balance-sheet of the bank concerned by way of write-off.

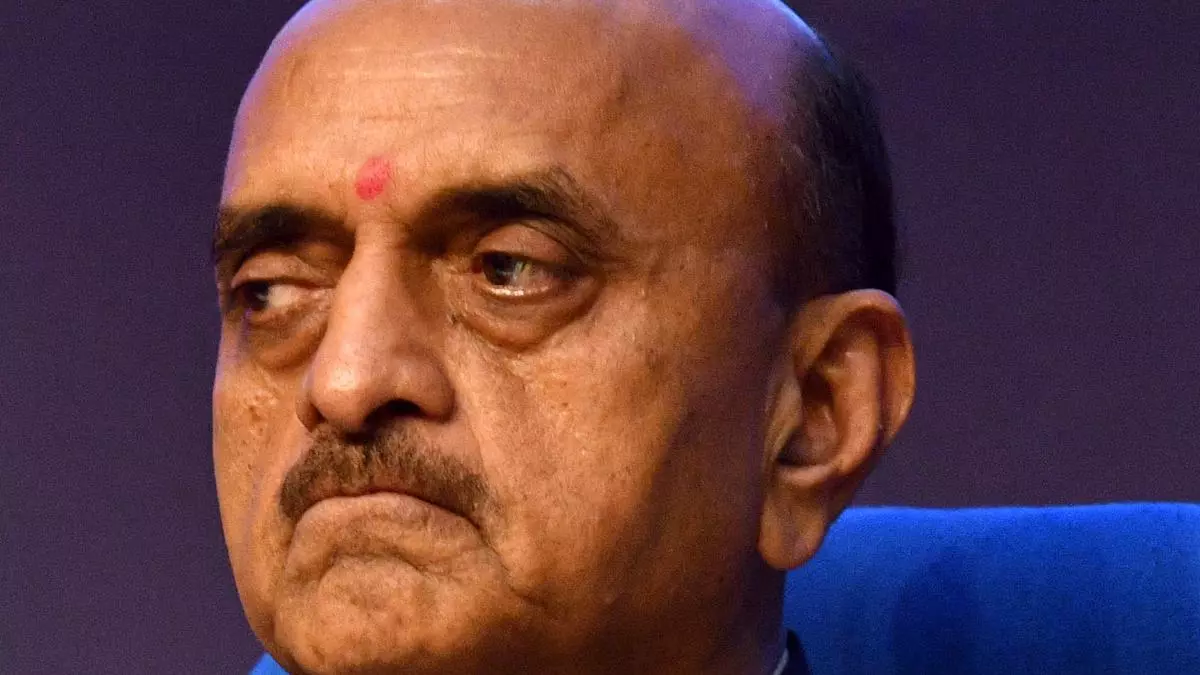

“Such write-offs do not result in waiver of liabilities of borrowers to repay,” Minister of State in the Finance Ministry Bhagwat Karad said in written response. The process of recovery of dues from the borrower in written-off loan accounts continues, write-off does not benefit the borrower, Karad added.

Further, Banks continue to pursue recovery actions initiated in written-off accounts through various recovery mechanisms. These mechanisms include filing of civil suits or in Debts Recovery Tribunals, action under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002, filing of cases in the National Company Law Tribunal under the Insolvency and Bankruptcy Code, 2016, through negotiated settlement/compromise, and sale of non-performing assets. “Government does not spend any amount on write-offs of corporate loans,” he said.

The Minister did not name individual borrowers whose accounts have been written off citing the RBI Act. Quoting RBI, he said that all Scheduled Commercial Banks (SCBs) have collected an aggregate amount of Rs. 5,309.80 crore as penal charges, including penalty charges against delay in payment of loans, during the financial year 2022- 23.

Wilful Defaulter

In response to another question, Karad said that Scheduled Commercial Banks (SCBs) and All India Financial Institutions report certain credit information of all borrowers having aggregate exposure of Rs. 5 crore and above to the Central Repository of Information on Large Credits (CRILC). “As reported in CRILC database, as on 31.3.2023, total 2,623 unique borrowers were classified as wilful defaulters, with aggregate outstanding of over Rs 1.96 lakh crore by SCBs,” he said.

Further, he said that banks initiate/continue with action against wilful defaulters under the various recovery mechanisms available, such as filing a suit in civil courts. Banks can also negotiate settlements or, compromise or even sell nonperforming assets. Further, as per the RBI’s Framework for Compromise Settlements and Technical Write-offs on June 8 2023, compromise settlements are undertaken by lenders in respect of wilful defaulters without prejudice to the criminal proceedings underway against such debtors, he said.

The Minister also clarified that the primary regulatory objective behind allowing wilful defaulters to enter into compromise settlement is to enable multiple avenues for lenders to recover the money in default without much delay. Apart from the time value loss, inordinate delays result in asset value deterioration, hampers ultimate recoveries, he said.