Index Outlook: Sensex, Nifty 50: Vulnerable to Fall More

The Indian benchmark indices witnessed a sharp fall last week. Sensex and Nifty 50 fell over a per cent each. Nifty Bank index, on the other hand, tumbled over 3 per cent last week. The bounce seen in the second half of the week seems to lack strength. There are strong resistances to cap the upside and keep the indices under pressure. So, broadly the picture is looking weak and more fall can be seen in the short term.

Among the sectors, the BSE PSU and BSE Oil & Gas indices outperformed last week by surging 4.94 per cent and 4.33 per cent respectively. The BSE Realty and BSE Bankex underperformed last week. The indices were down 2.24 per cent and 2.91 per cent respectively.

Watch the FPIs

The Indian equity segment witnessed a huge foreign money outflow last week. The foreign portfolio investors (FPIs) pulled out over $2 billion from the equity segment last week. This is very important to watch. If the FPIs continue to pull out money, then the Nifty and Sensex will come under more pressure. That leaves the chances high for the benchmark indices to fall more from here.

Nifty 50 (21,571.80)

Nifty began the week on a weak note and tumbled to a low of 21,285.55 on Thursday. The bounce thereafter failed to get a strong follow-through rise above 21,700. The index has closed the week at 21,571.80, down 1.47 per cent.

Short-term view: The outlook is weak. Strong resistance is in the 21,650-21,750 region. Support is at 21,400. As long as the Nifty remains below 21,750, the outlook will be bearish. As such, the chances are high for the index to break 21,400 this week. Such a break can drag the Nifty down to 21,000 and 20,900.

This 21,000-20,900 is a significant support. So, the price action thereafter will need a close watch to see if a bounce is happening or not.

To avoid the above-mentioned fall to 21,000, Nifty has to break above 21,750 first. Thereafter, a subsequent rise above 21,850 is needed to turn the outlook bullish. Only in that case, a rise to 22,000 and 22,200 will come back into the picture.

Graph Source: MetaStock

Medium-term view: The outlook is bullish. 21,000-20,500 is a strong support zone. A break below 20,500 might not be easy. We expect this support zone to hold and limit the downside. A bounce from the 21,000-20,500 region will have the potential to take the Nifty up to 22,500 or even 23,200 in the coming months.

As mentioned in this column a couple of weeks ago, 23,200 is a very strong long-term resistance that is likely to cap the upside. We can expect the Nifty to see a strong 10-15 per cent correction from there. So, the rise to 22,500-23,200 mentioned above will be the last leg of the current uptrend.

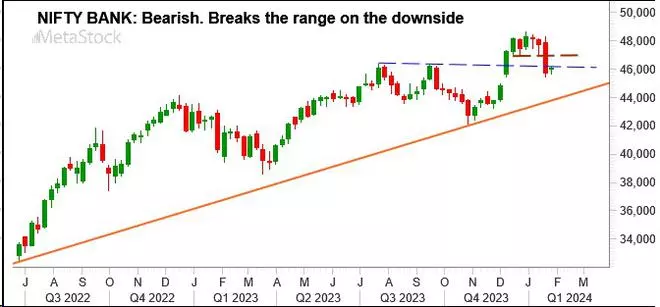

Nifty Bank (46,058.20)

Nifty Bank index tumbled to a low of 45,430.70 last week. Although it has bounced back from that low, it has to gain momentum to sustain and extend the rise, going forward. The index has closed the week at 46,058.20, down 3.46 per cent.

Short-term view: The trend is down. The bounce towards the end of last week could just be a correction within the downtrend. Immediate resistance is at 46,300. Above that, 47,000-47,100 is the higher and strong resistance zone. If the Nifty Bank index manages to breach 46,300, a rise to 47,000-47,100 is possible. However, a rise beyond 47,100 is unlikely.

We expect the Nifty Bank index to resume the fall either from 46,300 itself or after an extended rise to 47,000-47,100. That leg of fall can drag it down to 45,000 first. An eventual break below 45,000 can take it further down to 44,200 or 44,000.

Graph Source: MetaStock

Medium-term view: The broader trend is still up. The region around 44,000 is a very strong support. As such, the above-mentioned fall to 45,000 and 44,000 will be a very good buying opportunity on the Nifty Bank index. A fresh rise from around 44,000 will have the potential to take the Nifty Bank index up to 50,000 and 52,000 in the coming months.

Sensex (71,423.65)

Sensex fell sharply in the first half of the week and made a low of 70,665.50. The bounce-back move from this low failed to breach 72,000 decisively. The index has come down sharply from around 72,026 on Saturday to close the week at 71,423.65, down 1.58 per cent.

Short-term view: Failure to rise past 72,000 last week is a negative. As long as the index stays below 72,000, it can remain under pressure. A fall to test the support at 70,680 is possible this week. A break below 70,680 can intensify the selling pressure. Such a break can drag the Sensex down to 70,300-70,000 first and even lower, going forward.

A strong rise past 72,000 is needed to turn the sentiment positive. If that happens, Sensex can rise to 73,000-74,000.

Graph Source: MetaStock

Medium-term view: Intermediate support is at 69,500. If that holds, we can see one more leg of rise to 73,500-74,000. Thereafter, a strong correction is possible which can take the Sensex below 69,500 towards 68,000 or 67,000.

The region between 68,000 and 67,000 is a very strong support zone for the Sensex. A fall beyond 67,000 is unlikely. As long as the Sensex stays above this support zone, the long-term trend will continue to remain up. As such, a fresh rise from this support zone will have the potential to target 73,500 again and then higher levels eventually over the long term.

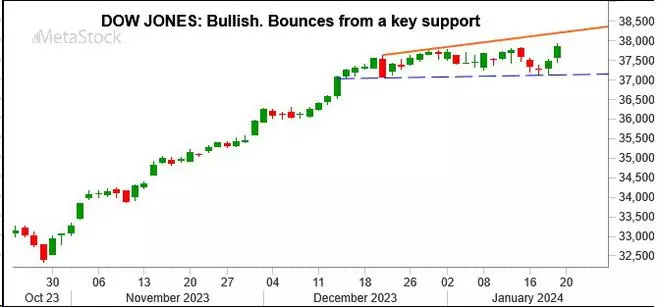

Dow Jones (37,863.80)

The Dow Jones Industrial Average began the week on a weak note. The index fell to a low of 37,122.95 on Thursday. However, it had risen back sharply from there, recovering all the loss. The index has closed the week slightly higher at 37,863.80, up 0.72 per cent.

Graph Source: MetaStock

Outlook: The price action on the charts indicate the presence of strong buyers around 37,100. This leaves the bias positive. Immediate support is around 37,500. The Dow Jones can rise to 38,250-38,350 this week.

The price action, thereafter, will need a close watch. A sustained break above 38,350 can boost the bullish momentum. Such a break can take the Dow Jones up to 39,250-39,350 over the medium term.

On the other hand, failure to rise past 38,350 and a pull-back thereafter can drag the Dow Jones down to 37,900-37,850 again.

Our preference will be to see a break above 38,350 if not immediately, but eventually, and see a rise to 39,250-39,350.