Index Outlook: Sensex, Nifty 50: Near-term outlook is positive

Nifty 50, Sensex and the Nifty Bank indices are managing to sustain higher. The benchmark indices moved up last week, but gradually. The indices were up in the range of 0.4-0.75 per cent.

The short-term outlook is positive. As such, we can expect the indices to rise further from current levels. However, the price action last week indicates lack of strength in the upmove. So, there needs to be some caution as the indices move up from here.

Among the sectors, the BSE IT and BSE FMCG indices closed in red last week. They were down 1.12 and 0.81 per cent respectively. The BSE Capital Goods indices surged the most last week. The index was up 6.4 per cent.

FPI action

The Foreign Portfolio Investors (FPIs) were net buyers of Indian equities last week. They bought $1.4 billion in the equity segment. It is important to see if the FPIs increase their buying quantum going forward. If that happens, then it would support the Sensex and Nifty to scale more new highs.

Nifty 50 (23,465.60)

After struggling to breach 23,400 initially, Nifty broke this hurdle towards the end of the week and closed higher. The index touched a new high of 23,490.40 and has closed at 23,465.60 — up 0.75 per cent for the week.

Short-term view: The outlook remains positive. Immediate support is at 23,300. As long as the Nifty stays above this support, the short-term view will remain bullish. A rise to 23,800 and 24,000 is possible in the short-term.

Immediate resistance is at 23,500. A break above it can trigger the above-mentioned rally.

The price action around 24,000 will need a close watch. We see high chances for a corrective fall to 23,500 thereafter. As such, some caution is needed as the Nifty approaches 23,800 and 24,000.

Graph Source: MetaStock

Medium-term view: The outlook is bullish. There is room for a rise to 24,300-24,500 from here. A decisive break above 23,700 can trigger this rise. After this rise, there are good chances to see a corrective fall which can take the Nifty down to 23,000-22,500. If there is an extended correction, then 21,000 can be seen on the downside.

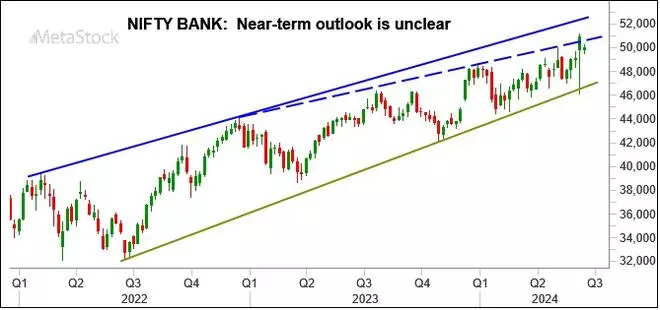

Nifty Bank (50,002)

Nifty Bank index was stable, and range-bound last week. The index oscillated between 49,500 and 50,520 all through last week. It has closed at 50,002 — up 0.4 per cent for the week.

Short-term view: The immediate outlook is slightly unclear for the Nifty Bank index. Support is at 49,400. Resistance is at 50,600. A breakout on either side of these two levels will determine the next leg of move in the short-term.

A break above 50,600 can take the Nifty Bank index up to 51,500 and 52,000. On the other hand, a break below 49,400can take the index down to 48,500.

Graph Source: MetaStock

Medium-term view: The big picture continues to remain positive with strong support in the 46,000-45,000 zone. Nifty Bank index has potential for a rise to 53,000-53,500. After this rise, there are good chances to see corrective fall to 50,000-49,000. So, as the Nifty Bank index moves up to 53,000, we have to turn cautious rather than being overly bullish.

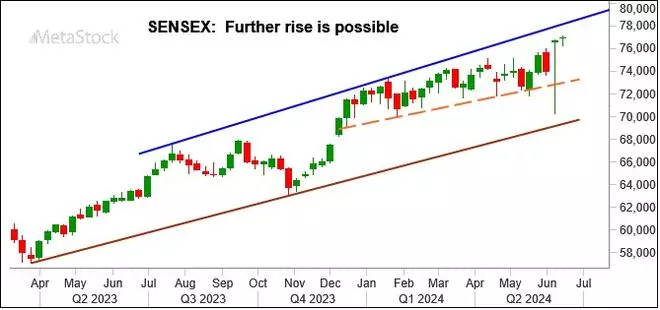

Sensex (76,992.77)

Sensex is managing to sustain above 76,000. However, it seems to lack strength to breach 77,000 decisively. The index made a high of 77,145.46 before closing at 76,992.77 — up 0.39 per cent for the week.

Short-term view: Immediate support is at 76,550. Below that 76,000 is the next important support. As long as the Sensex stays above 76,000 the outlook is bullish. Sensex can rise to 78,400 and 78,600 in the short-term. A break above 77,000 can trigger this rise.

After this rise to 78,400-78,600 there are good chances to see a corrective dip to 76,500-76,000 is a possibility.

Graph Source: MetaStock

Medium-term view: The broad region between 75,000 and 74,000 can be a strong support for the Sensex now. The medium-term outlook will remain bullish as long as the index stays above this support zone. Sensex has potential to target 80,000 and even 82,000 in the coming months.

To negate this rise, Sensex has to fall below 74,000. If that happens, 71,000 can be seen on the downside.

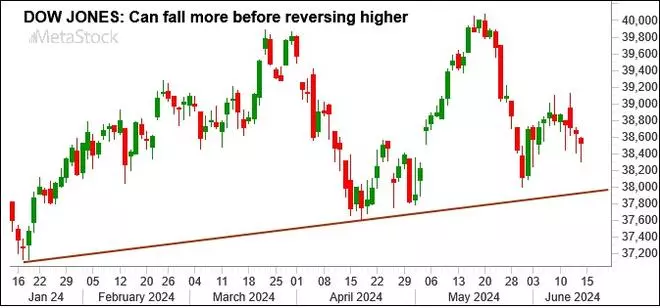

Dow Jones (38,589.16)

Dow Jones failed to sustain the break above 39,000. It made a high of 39,120.26 and fell from there giving back all the gains. The index fell to a low of 38,305.85 before closing the week at 38,589.16, down 0.54 per cent.

Graph Source: MetaStock

Outlook: The near-term outlook is negative. The Dow Jones can fall to 38,000-37,900 this week. The price action thereafter will need a close watch.

A bounce from around 38,000 can take the index up to 39,000 again. On the other hand, a break below 37,900 will increase the downside pressure. Such a break can drag the Dow Jones down to 37,500.

The region between 39,000 and 39,200 will be an important resistance. Dow Jones has to rise past 39,200 to turn the sentiment positive. Only then the doors will open for a rally to 40,000 levels again.