Index Outlook: Sensex, Nifty 50: Can rise, but be cautious

The Indian benchmark indices managed to hold above their supports last week. Sensex, Nifty 50 and the Nifty Bank index have moved up for the second consecutive week. The Sensex and Nifty 50 were up over a per cent each and the Nifty Bank index closed higher by 0.56 per cent. However, this upmove is happening well within the broad range that we had mentioned in this column last week. There is room for more rise within this range. However, we continue to remain cautious rather than being overly bullish for now. So, we continue to insist traders to remain very careful and have strict risk management strategies in the form of stop-loss and adhere to it.

Among the sectors, the BSE IT was the only index that ended in red last week. The index was down 0.5 per cent. The BSE Capital Goods index outperformed by rising 3.77 per cent. The BSE Realty, BSE Power and the BSE Consumer Durables indices were up 2.93 per cent, 2.54 per cent and 2.5 per cent respectively.

FPI Flows

The foreign portfolio investors (FPIs) sold the Indian equities for the second consecutive week. They pulled out $359 million from the equity segment last week. However, the month of March witnessed a strong inflow of about $4.24 billion. It will be difficult for the Sensex and Nifty to gain momentum unless the FPIs begin to buy the equities very aggressively. So, as mentioned above, any further rise in the benchmark indices from current levels will have to be approached carefully.

Nifty 50 (22,326.90)

Nifty sustained well above the support at 21,900 last week. The index rose to a high of 22,516 before closing the week at 22,326, up 1.04 per cent.

Short-term view: The break and close above the 21-day moving average, currently at 22,165, is a positive. However, the price action on the chart indicates key resistance around 22,530. If the Nifty manages to sustain above 22,165, the outlook for the week will be positive. It will keep the chances high for it to break above 22,530. Such a break can take the Nifty up to 22,850 and 22,900 initially this week. An eventual break above 22,900 will see an extended rise to 23,200 in the coming weeks.

The level of 21,950 is the next important support below 22,165. A break below 21,950 can drag the Nifty down to 21,700 initially. A further break below 21,700 can take it down to 21,500. Such a fall will turn the short-term outlook bearish.

We prefer the Nifty to sustain above the 21-day moving average and rise to 22,900 or 23,200 in the short term.

Chart Source: MetaStock

Medium-term view: The chances of a rise to 23,200 and even 23,600-23,650 is still alive. However, we reiterate that more caution is needed as the Nifty moves above 23,000. We expect the upside to be capped at 23,600-23,650. A reversal either from 23,200 itself or from around 23,600 can trigger a strong corrective fall in the coming months.

The level of 21,500 is going to be a crucial support to watch. A break below it can drag the Nifty down to 20,800-20,500 initially. As mentioned last week, if the sell-off intensifies, the downside can extend even to 20,000-19,500.

However, from a long-term perspective, such a fall to 20,000-19,500 will be a very good buying opportunity. So as the Nifty falls towards 20,000, we have to start approaching the market from the buy side.

Nifty Bank (47,124.60)

Nifty Bank index rose to test the resistance at 47,400, but did not make a decisive break above it. The index touched a high of 47,440.45 and had come down slightly from there. It has closed the week at 47,124.60, up 0.56 per cent.

Short-term view: Immediate support is at 46,400. Below that, 46,000 is the next important support. If the index manages to sustain above 46,400, the chances are high for it to break 47,400. Such a break can take the Nifty Bank index up to 48,000.

Broadly, 46,000 to 48,000 can be the trading range for now. A breakout on either side of this range will determine the next move. A break above 48,000 can take the Nifty Bank index up to 49,000. A break below 46,000 can drag it down to 45,000.

Chart Source: MetaStock

Medium-term view: The 44,400-48,650 range is still intact. So, the long-term bullish view will still remain intact as long as the Nifty Bank index stays above 44,000. A decisive rise past 49,000 will open the doors for a rise to 51,000-52,000 and even 53,000. Thereafter, a corrective fall to 50,000 is possible.

However, before the above-mentioned rise happens, the chances of seeing some volatile swings between 44,000 and 49,000 cannot be ruled out.

The outlook will turn bearish only if the Nifty Bank index declines below 44,000. In that case, a fall to 43,000 and lower levels can be seen.

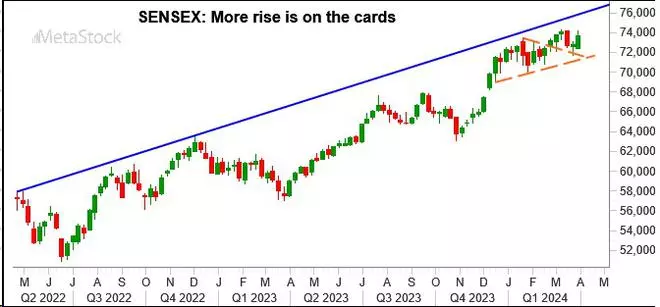

Sensex (73,651.35)

Sensex sustained above 72,000 and has risen well last week. It rose to a high of 74,190.31 before closing the week at 73,651.35, up 1.13 per cent.

Short-term view: The outlook is positive. Supports are at 73,000 and 72,000. Intermediate resistance is at 74,650. This can be tested if the Sensex manages to sustain above 73,000. A break above 74,650 can take the Sensex up to 75,600-75,750 in the short term.

The view will turn negative only if a break below 72,000 is seen. In that case, a fall to 71,000 and 70,000 will come into the picture.

Chart Source: MetaStock

Medium-term view: Strong support is in the 70,000-69,000 region. As long as the Sensex stays above this support zone, the outlook will remain bullish to target 78,000 on the upside. A sustained break above 74,650 will open the doors for this rally.

The outlook will turn bearish only if a decisive break below 69,000 happens. That will drag the Sensex down to 67,000-66,000.

Dow Jones (39,807.37)

The fall towards 39,200 and then a strong reversal happened in line with our expectation last week. The Dow Jones Industrial Average fell to a low of 39,277.19 in the first half of the week. But thereafter, it reversed sharply higher recovering all the loss. The index has closed the week at 39.807.37, up 0.84 per cent for the week.

Chart Source: MetaStock

Outlook: The view remains bullish. Supports are at 39,500 and 39,200. The Dow Jones can rise to test 40,200 – the next important resistance this week. The price action thereafter will need a close watch.

A decisive break above 40,200 will be bullish, and could see 40,600-40,800 on the upside. But a reversal from around 40,200 can drag the Dow Jones down to 39,500.

We prefer the Dow Jones to breach 40,200 and rise further, going forward.