Index Outlook: Nifty 50 and Sensex Hit New Highs, Nifty Bank Surges

Nifty 50 and Sensex made new highs last week in line with our expectation. Nifty made a high of 20,222.45 while the Sensex touched 67,927.23.

The Nifty Bank index has risen and closed well above 46,000 as expected. Sensex and Nifty were up about 1.9 per cent each, while the Nifty Bank surged about 2.4 per cent last week.

Sensex and Nifty have been rising very well over the last three weeks. On the charts, this three-week rise indicates strong momentum. But crucial resistances are coming up for both the indices which will need a close watch. Whether this resistance is getting broken or not will be key in deciding the next move.

However, the Nifty Bank index is looking bullish and has more room to rise. So, the rise in Nifty Bank index might aid in keeping the Nifty and Sensex also higher, going forward.

Among the sectors, the BSE Bankex and BSE IT outperformed last week by surging 2.51 per cent and 2.36 per cent respectively. The BSE Power, BSE Capital Goods and BSE Oil & Gas indices were down about 1.2 per cent each.

FPI action

The foreign portfolio investors (FPIs) continued to sell the Indian equities for the second consecutive week. However, the quantum of selling was less. The equity segment saw a net outflow of $68 million last week. During September, the FPIs have taken out $573 million from the equity segment. If the FPI selling intensifies, then that might disrupt the ongoing rally in the Sensex and Nifty.

Nifty 50 (20,192.35)

The rise to 20,200 has happened last week in line with our expectation. Nifty made a new high of 20,222.45 on Friday before closing the week at 20,192.35, up 1.88 per cent.

Short-term view: The outlook is bullish. Immediate support is at 20,100-20,000. Below that 19,850-19,800 is the strong short-term support.

Crucial resistances are coming up at 20,300-20,400. Nifty can test this resistance this week. Whether it will breach 20,400 or not is not very clear now.

Failure to breach 20,400 can drag the index down to 20,200 and even 20,000, thereafter. But a strong break above 20,400 will boost the momentum. Such a break will take the Nifty up to 20,500 and even higher.

For now, we prefer to allow for a test of 20,300 and 20,400 from here. Then watch the price action thereafter to get clarity on the next move.

Graph Source: MetaStock

Medium-term view: The region between 20,300 and 20,400 is a very crucial resistance. As mentioned last week, failure to break 20,400 and then a subsequent fall below 20,000 can drag the Nifty down to 19,200-19,000 again. In that case, Nifty can remain in a sideways range of 19,000-20,400 for some more time.

On the other hand, a sustained break above 20,400 will be very bullish. It will see the Nifty targeting 21,000 and even 21,500, going forward.

Looking at the weekly chart, the rise over the last three weeks is very strong. So, the chances are high for the Nifty to breach 20,400 and target 20,700-20,800 and even 21,000-21,500. For this view to go wrong, Nifty has to fall below 19,800.

Sensex (67,838.63)

Sensex rose well above the expected level of 67,500 last week. The index made a new high of 67,927.23. It has closed the week at 67,838.63, up 1.86 per cent.

Short-term view: The outlook is bullish. Immediate resistance is at 68,000. A break above it can take the Sensex up to 68,800-69,000.

Support is at 67,200. Failure to break 68,000 and a fall below 67,200 can turn the short-term outlook negative. In that case, a fall to 66,000 is possible.

Graph Source: MetaStock

Medium-term view: The level of 68,000 is a very crucial resistance. A sustained break above it will boost the bullish momentum. It will open the doors for the Sensex to target 70,000 and even higher levels.

But failure to breach 68,000 can drag the index lower and keep it in a range of 64,500-68,000.

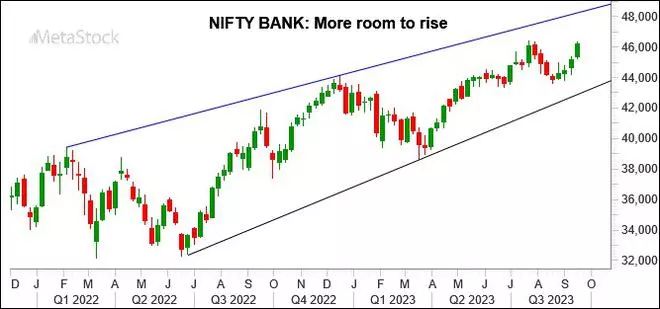

Nifty Bank (46,231.50)

As expected, the Nifty Bank index has risen towards 46,200 last week. It made a high of 46,310.40 on Friday before closing the week at 46,231.50, up 2.38 per cent. The price action and the strong close last week indicates that the upmove in the Nifty Bank index is gaining momentum.

Short-term view: The outlook is bullish. Immediate support will be in the 46,000-45,900 region. Below that, 45,750 is the next strong support that can limit the downside in the short term. Nifty Bank index can test 47,400 over the next couple of weeks. A break above 47,400 will open the doors for an extended rise to 48,000-48,300.

The short-term view will turn negative only if the index declines below 45,750. In that case, a fall to 44,850 can be seen.

Graph Source: MetaStock

Medium-term view: The big picture is bullish. We retain the view of the Nifty Bank index targeting 48,650-48,700 if the rise happens immediately. If the upmove spills over to next quarter, then 49,640 can be the target.

The medium-term outlook will turn bearish only if the index declines below 43,000 – a strong trend support. But that looks unlikely in the absence of any new strong negative trigger.

Dow Jones (34,618.24)

The Dow Jones Industrial Average failed to rise past 35,000 last week. The index rose to a high of 34,977.97 on Thursday and then fell sharply on Friday giving back most of the gains. It has closed the week at 34,618.24, up 0.12 per cent.

Graph Source: MetaStock

Outlook: Immediate support is at 34,575 – the 21-Day Moving Average (MA). A break below it can take the Dow Jones down to 34,400 or 34,200. A fall beyond 34,200 looks less likely as of now.

Broadly, 34,200 to 35,100 can be the trading range for now. A breakout on either side of this range will determine the next move.

Considering the strong supports at 34,400 and 34,200, the probability looks high for the Dow Jones to break above 35,100 and rise to 35,500 and 36,000 in the coming weeks.