Index Outlook: Nifty 50 and Sensex Extend Weekly Declines with Gradual Correction Within Uptrend

Nifty 50 and Sensex have declined for the fourth consecutive week. The indices were down 0.61 per cent and 0.57 per cent respectively last week. However, the pace of the recent fall seems to be slow. The price action on the chart indicates lack of strong sellers to drag the benchmark indices sharply lower. This strengthens the case that the fall that is happening now is just a correction within the overall uptrend. Strong supports are coming up for the Sensex and Nifty that can halt the current fall. As such we reiterate that the indices can resume their broader uptrend after a little more fall from the current levels.

Among the sectors, barring a few, most sectoral indices fell last week. The BSE Metals and BSE Oil & Gas indices were the worst performers. The indices were down 3.93 per cent and 1.28 per cent respectively.

FPI action

The foreign portfolio investors (FPIs) continue to buy the Indian equities. The equity segment saw an inflow of $617 million last week. The month of August has seen a net inflow of about $1 billion into the equities. The FPI action indicates that they are continuing to buy the dips. This leaves the chances high of seeing a reversal any time soon. This is also positive for the Sensex and Nifty from a long-term perspective.

Nifty 50 (19,310.15)

The expected break below 19,300 happened twice last week, but did not sustain. Nifty made a low of 19,253.60 on Friday, but managed to bounce back from there. It has closed the week at 19,310.15, down 0.61 per cent.

Short-term view: Nifty struggled to break above 19,500 last week. But at the same time, the pace of fall is also not strong. This leaves the outlook little mixed for the near term. Supports are at 19,250, 19,200 and then in the 19,100-19,000 region. Resistances are at 19,500 and then 19,590 – the 21-Day Moving Average.

So broadly 19,000-19,600 will be the possible trading range in the short term. Within this, the bias is positive. So, if a fall towards 19,200 or 19,100-19,000 is seen, then that should be considered as a good buying opportunity rather than becoming more bearish.

A decisive break above 19,600 will bring back the bullish momentum and take the Nifty up to 19,800 and higher levels again.

Chart Source: MetaStock

Medium-term view: The big picture is still positive. We reiterate that the recent fall is just a correction within the broader uptrend. Strong support is in the 19,000-18,900 region. Although the index has been falling over the last four weeks, the pace of fall has been slow. That leaves the chances high for the Nifty to sustain above the 19,000-18,900 support zone.

We can expect the Nifty to reverse higher anywhere from the broad 19,100-18,900 region. That will keep our bullish view intact to see 20,200 on the upside.

The bullish view will come under threat only if the Nifty declines below 18,900. In that case, a fall to 18,600 and lower can be seen. But a new and a strong negative trigger is needed to drag the Nifty below 18,900.

Sensex (64,948.66)

The break below 65,000 happened in line with our expectation last week. Sensex made a low of 64,754.72 before closing the week at 64,948.66, down 0.57 per cent.

Short-term view: The fall that has been in place over the last four weeks could halt anytime soon. Significant support is at 64,500 which can be tested this week. If Sensex manages to bounce back from 64,500, a rise to 66,000-66,300 can be seen in the near term. That will also increase the chances of a trend reversal.

On the other hand, if the Sensex declines below 64,500, an extended fall to 64,000 is possible. As such, the price action around 64,500 will need a close watch. Our preference is to see the Sensex bouncing back from around 64,500.

Chart Source: MetaStock

Medium-term view: The broader trend is still up. The recent fall is just a correction within that. Strong supports are at 64,500 and then in the 64,000-63,800 region. We expect the uptrend to remain intact. Sensex can see a fresh leg of rally either from 64,500 itself or after an extended fall to 64,000-63,800. That leg of upmove can take the Sensex up to 67,800-68,000 over the medium term.

The outlook will turn bearish only if Sensex declines below 63,800. Such a break, though less likely can take the index down to 62,200-62,000.

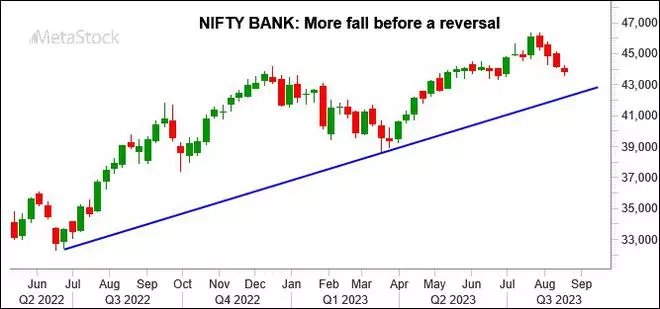

Nifty Bank (43,851.05)

Nifty Bank index extended the fall last week. The index made a low of 43,600.35 and then has bounced back from there. We had expected a fall up to 43,500. Nifty Bank index has closed the week at 43,851.05, down 0.79 per cent.

Short-term view: The 100-Day Moving Average, currently at 43,696, has limited the downside very well all-through last week. However, the short-term trend is still down. Any bounce from here could be short-lived. Resistance is there in the 44,300-44,600 region, which can cap the upside.

As such, the Nifty Bank index can continue to fall and test 43,000 either from here itself or after a short-lived bounce.

Chart Source: MetaStock

Medium-term view: The broad 43,000-42,500 region is a strong support. The current fall can halt anywhere in this region. A fresh leg of rally, thereafter, will mark the resumption of the broader uptrend. That rally will have the potential to take the index back to 46,000 again. It will also keep the long-term bullish view intact for the Nifty Bank index to target 48,650 on the upside.

Dow Jones (34,500.66)

The Dow Jones Industrial Average broke the 35,000-35,600 range on the downside and fell sharply last week. That break has taken the index down towards 34,500 as expected. The Dow made a low of 34,263.19 and has bounced from there to close the week at 34,500.66, down 2.21 per cent.

Chart Source: MetaStock

Outlook: The broader picture is positive. Strong support is in the 34,200-33,900 region. A fall below 33,900 looks unlikely at the moment. As such, we can expect the Dow Jones to reverse higher anywhere from the 34,200-33,900 region and resume the uptrend. That can take the index up to 35,000-35,300 initially. It will also keep the broader picture bullish to see 36,500 on the upside eventually over the medium term.