Higher interest rates, weak rupee drive NRI deposits to 10-year high

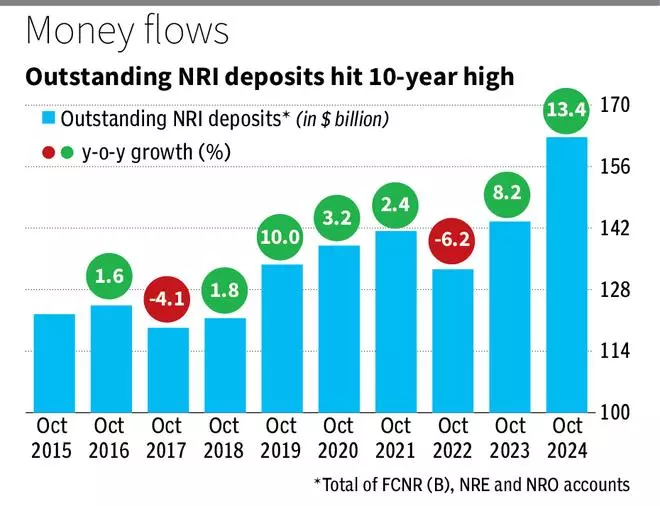

Interest rate differentials between India and global markets are helping India’s external account with non-resident deposits in scheduled commercial banks hitting a 10-year high in October 2024.

The Reserve Bank of India (RBI) data shows that NRI deposits outstanding as of October stood at $162.7 billion up 13.4 per cent y-o-y. This was the biggest annual growth rate in outstanding NRI deposit balances in the last nine years. The net NRI deposit inflows also saw a spike in FY25. Deposit inflows in the seven months -April to October 2024- are already at $11.9 billion, compared to $14.7 billion in the full fiscal 2024.

NRI deposits comprise foreign currency deposits called FCNR (B), non-resident external (NRE), and non-resident ordinary (NRO) accounts. While FCNR (B) deposits can be maintained in foreign currency and are not converted to the rupee, an NRE account allows NRIs to deposit or save foreign earnings in Indian currency and NRO enables them to manage and save their Indian earnings in Indian currency.

High growth

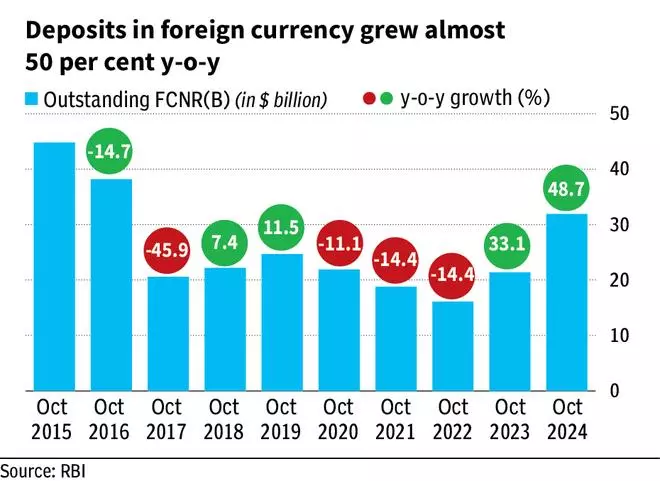

In the 12 months ended October 2024, the foreign currency-denominated FCNR(B) pool grew the highest at almost 50 per cent y-o-y. The share of FCNR (B) to total NRI deposits is also at an 8-year high of nearly 20 per cent. FCNR(B) insulates NRIs from exchange rate fluctuations while offering higher rates than global markets. Both principal and interest in such deposits are also tax-free in India and fully repatriable.

“A significant portion of the growth in NRI deposits have come from FCNR(B). This points to the fact that NRIs are taking advantage of better rates of interest in their home country India and also view the overall economy as stable,” Sachin Sachdeva, Vice President, Sector Head – Financial Sector Ratings at ICRA, said.

Future factors

Analysts also note that banks have stepped up efforts to tap the Non-resident segment for deposits.

Federal Bank, in its recent earnings call, said that it has seen a 14 per cent y-o-y growth in FCNR deposits, noting that besides their deposit mobilisation efforts among NRIs, the declining rupee has been a “tactical advantage.” “There may be other implications of [the declining rupee] but the NR customer tends to react positively to a weak rupee and increases his remittances to India,” the management said.

However, ICRA’s Sachdeva noted that if the outlook on the Indian rupee is negative going forward, then the NRE and NRO account balances may be impacted in the future.

As per a recent World Bank report, India continued to be the top recipient countries for foreign remittances in 2024, with an estimated inflow of $129 billion. Mexico ($68 billion), China ($48 billion), the Philippines ($40 billion), and Pakistan ($33 billion) are also in the top five.