Global wheat market seen under more pressure on money managers’ bearish outlook

The global wheat market is likely to come under further pressure on resurgence in money managers’ bearish outlook, though price movements are vulnerable to critical updates such as Russian wheat harvest, say analysts.

Research agency BMI, a unit of Fitch Solutions, has forecast second-month wheat futures on the Chicago Board of Trade to average at $6.05 a bushel ($222.29 a tonne).

September wheat futures on CBOT are ruling at $5.84 a bushel ($214.57/tonne). The year-to-date average wheat price stands at $6.06 a bushel, it said.

The World Bank, in its Commodity Outlook, said wheat prices are forecast to decline by 15 per cent in 2024, reflecting elevated production.

Up & down

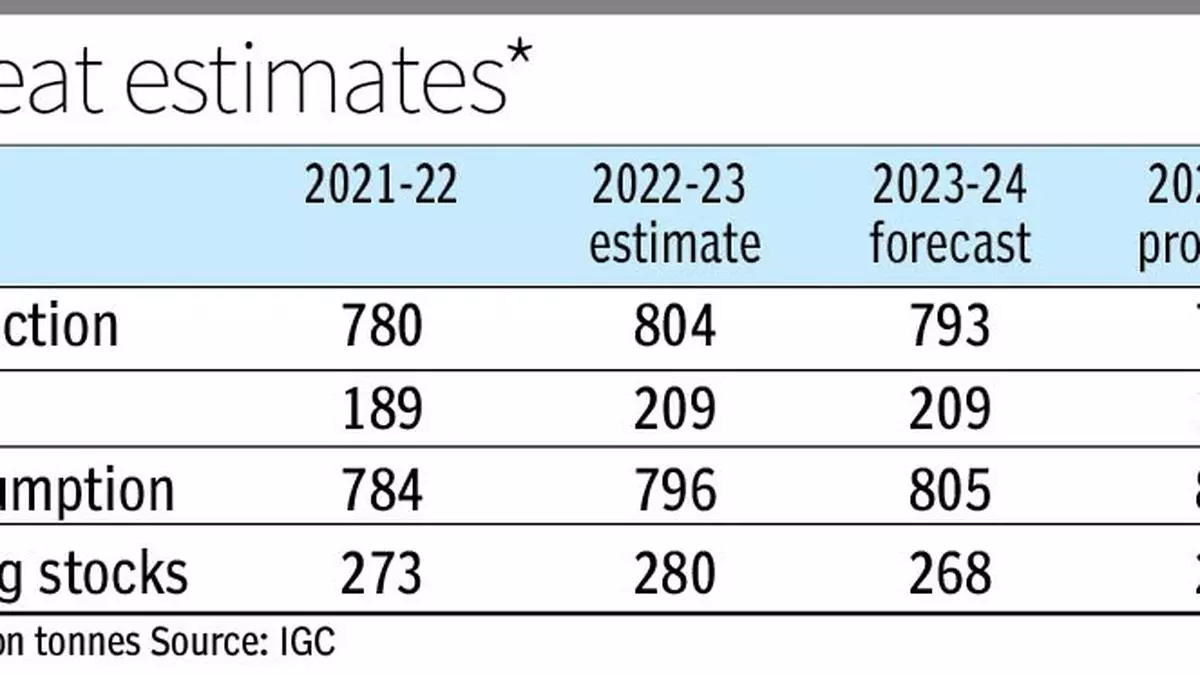

Wheat prices surged to $7.14/bushel on May 27, a gain of 30 per cent since the beginning of 2024. However, since then it has dropped 20 per cent. Wheat is down nearly 12 per cent year-on-year. “Building on our projection of a 0.2 per cent decrease in global wheat production for the 2023-24 season, we anticipate a 0.4 per cent increase in the 2024-25 season, with output reaching 790.2 million tonnes,” said the research agency.

It forecast year-on-year production growth in key regions with Australia set to see a 22 per cent production increase, China 2.5 per cent increase and the US a 4 per cent increase.

ING Think, the economic and financial analysis wing of Dutch financial services firm ING, said the US Department of Agriculture (USDA) has rated 51 per cent of the US winter wheat crop as good to excellent. It is higher than the 40 per cent seen at the same time a year ago.

Rising shorts

The USDA Economic Research Service (ERS) said global wheat production in 2024-25 is forecast 7.4 million tonnes (mt) lower than initial estimates but remains at a record 790.8 mt.

BMI said the wheat market’s sensitivity to abrupt price escalations is due to short-covering activities, particularly as traders increased their bearish bets.

The research agency said on April 16, the net short position for soft red winter wheat stood at a significant 96,403 contracts. It reflected a general expectation of ample supplies, with a strong emphasis on Russia and the US. “Yet, the market’s sentiment shifted as worries over the Russian wheat crop emerged, leading to a downward revision in yield forecasts and a reduction in net short positions to 25,431 contracts by May 21,” said BMI.

Recent data from the Commodity Futures Trading Commission showed net shorts at 45,116 contracts. “This resurgence in net short positioning suggests a correction in the market after its initial overreaction to the Russian crop concerns and the influence of positive early-season crop data from the US, which reinforced bearish views,” the research agency said.

Offtake to narrow deficit

These movements are indicators that the wheat market is “vulnerable to rapid, short-lived price movements in response to critical updates, such as those related to the Russian wheat harvest outlook”, it said.

The research agency said with money managers resuming the build-up of net short positions, downward pressure on prices persists. “The market remains sensitive to any significant news that could potentially disrupt supply expectations,” it said.

BMI said it anticipates global wheat consumption at 791.3 mt in the 2024-25 season. This will substantially narrow the global production deficit, decreasing it from -10.4 million tonnes in the 2023-24 season to just -1.1 million tonnes in the 2024-25 season.

The USDA ERS said global wheat exports for the July−June 2024-25 trade year were forecast 2.4 mt lower at 213 mt. It said wheat consumption has been lowered to 792 mt with smaller feed and residual use more than offsetting a small increase in food, seed and industrial use.

Global wheat ending stocks are forecast lower by 1.3 mt at 252.3 mt — the lowest since 2015/16, but opening stocks will be 261 mt.