F&O Strategy: PFC: Calendar Bull-Call Spread

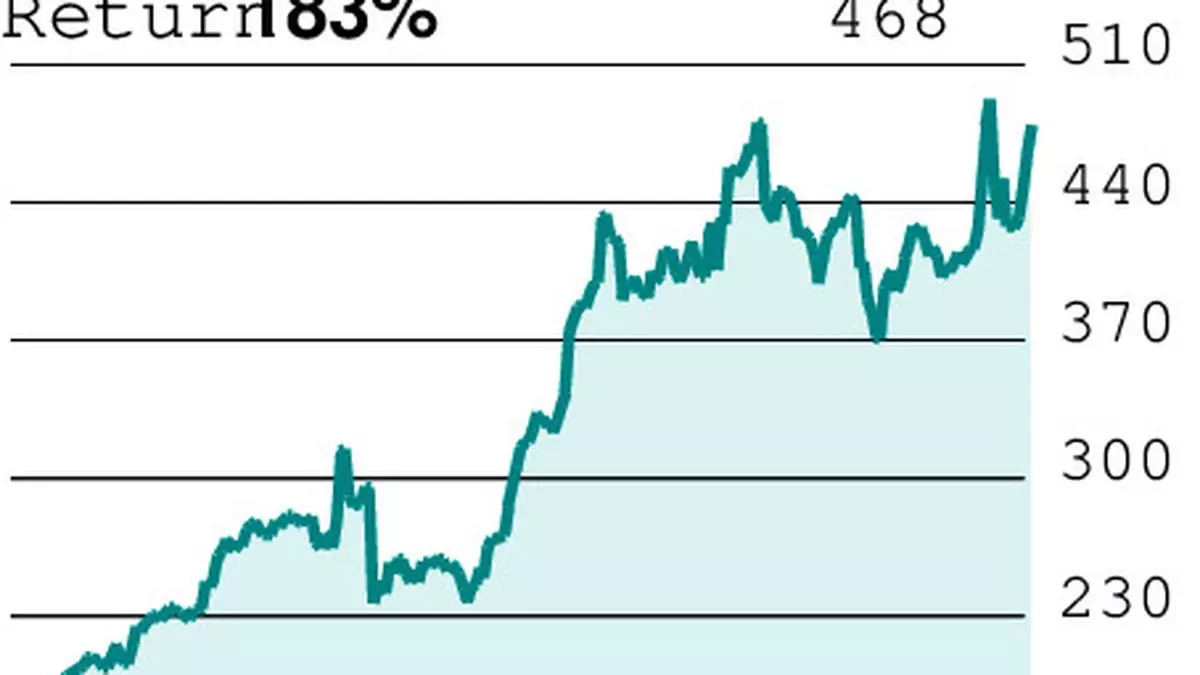

The outlook for the stock of Power Finance Corporation (PFC) (₹465.95) appears bright. If the current bullish trend sustains, it has the potential to create a new high. The nearest resistance is at ₹544. Immediate support is at ₹433 and ₹361. A close below the latter will change the positive outlook. We expect the stock to sustain the bullish trend.

F&O pointers: The PFC May futures closed at ₹466 and the June futures at ₹467.15 against the spot price of ₹465.95. The small premium over the spot indicates unwinding of long positions. Open interests for PFC May futures declined from a high of eight crore shares on April 26 to current 6.30 crore shares. Option trading indicates that PFC could move in a wide range of ₹400-500.

Strategy: Consider a diagonal calendar bull-call spread. Initiate by selling 450-strike call (May series) and simultaneously buying 480-strike call (June contract). As these options closed with a premium of ₹21.40 and ₹28.80 respectively, traders may have to incur an initial outflow of ₹11,431.25. This would be the maximum loss, which will occur if PFC turns weak and dips below ₹450.

On the other hand, profit potentials are high if PFC falls or stays flat during the series and rises sharply during June series. Traders should keep in mind that as the results of the General Election will be out on June 4, stocks, especially those that cater to power, will be more volatile. So, risk-averse traders could stay away from the strategy.

Traders could consider exiting the position at a profit of ₹12,500 or a loss of ₹3,800, whichever occurs first.

Follow-up: Hold Tata Power strategy for one more week.

Note: The recommendations are based on technical analysis and F&O positions. There is a risk of loss in trading