F&O Strategy: Manappuram Finance: Calendar Bull-Call Spread

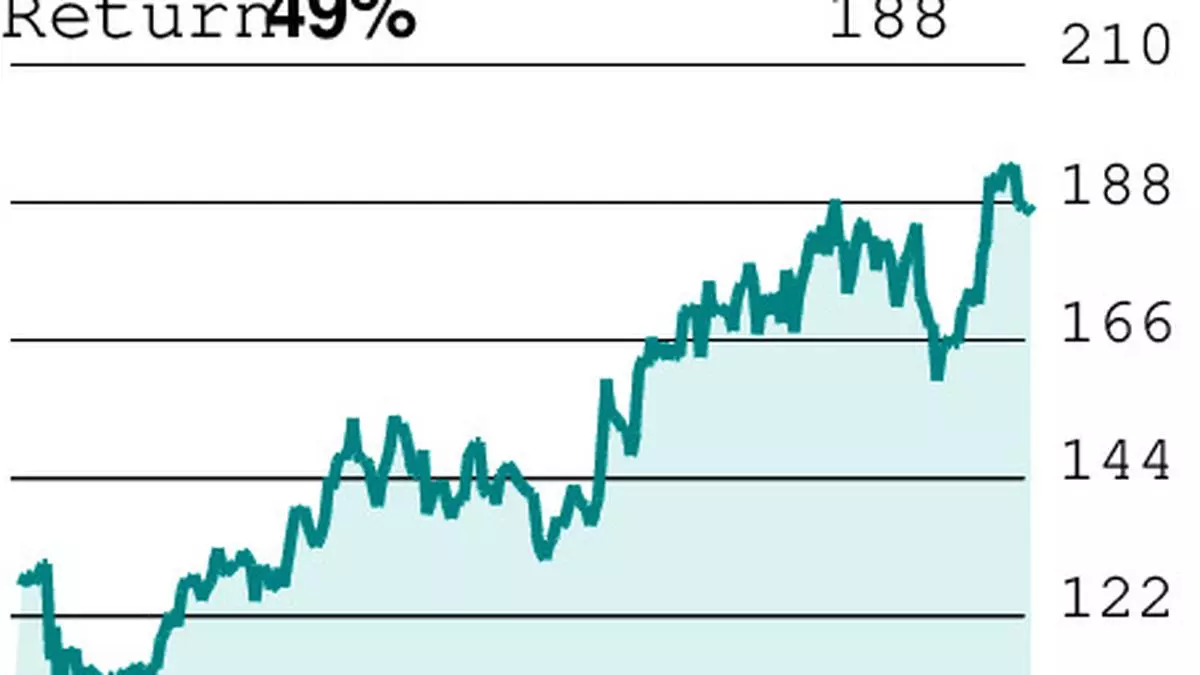

The long-term outlook remains positive for the stock of Manappuram Finance (₹188.15). A conclusive close above ₹207 will reconfirm the bullish trend. In that case, the stock can record new highs.

In the short term, the stock will move in a narrow range with an upward bias. The stock finds an immediate support at ₹172 and the major one at ₹148. A close below the latter will negate the long-term bullish outlook.

F&O pointers: Manappuram Finance April futures closed at ₹188.2 and May futures at ₹189.10 against spot close of ₹188.15. The counter witnessed a rollover of about 10 per cent to May series. This signals some traders prefer to wait for rollover. Option trading indicates that the stock could move in ₹180-220 range.

Traders should keep in mind that the market lot of the counter will be reduced from the current 6,000 to 3,000 from April 26.

Strategy: Consider a diagonal calendar bull-call spread on Manappuram Finance. This can be constructed by selling 190-strike of current month and simultaneously buying 200-strike call of next month.

As these options closed with a premium of ₹3.10 and ₹10.05 respectively, this strategy would cost ₹6.95. As the market lot is 6,000 shares, this would cost ₹19,200. (The change in lot size will reflect in the price from April 26).

Traders can exit the trade if the profit touches ₹10,000. On the other hand, exit if the loss mounts to ₹5,000.

Follow-up: The put option gave strong profit. Trader could consider exiting from TCS 4000-put option.

Note: The recommendations are based on technical analysis and F&O positions. There is a risk of loss in trading