F&O Strategy: Long Straddle on Fin Nifty

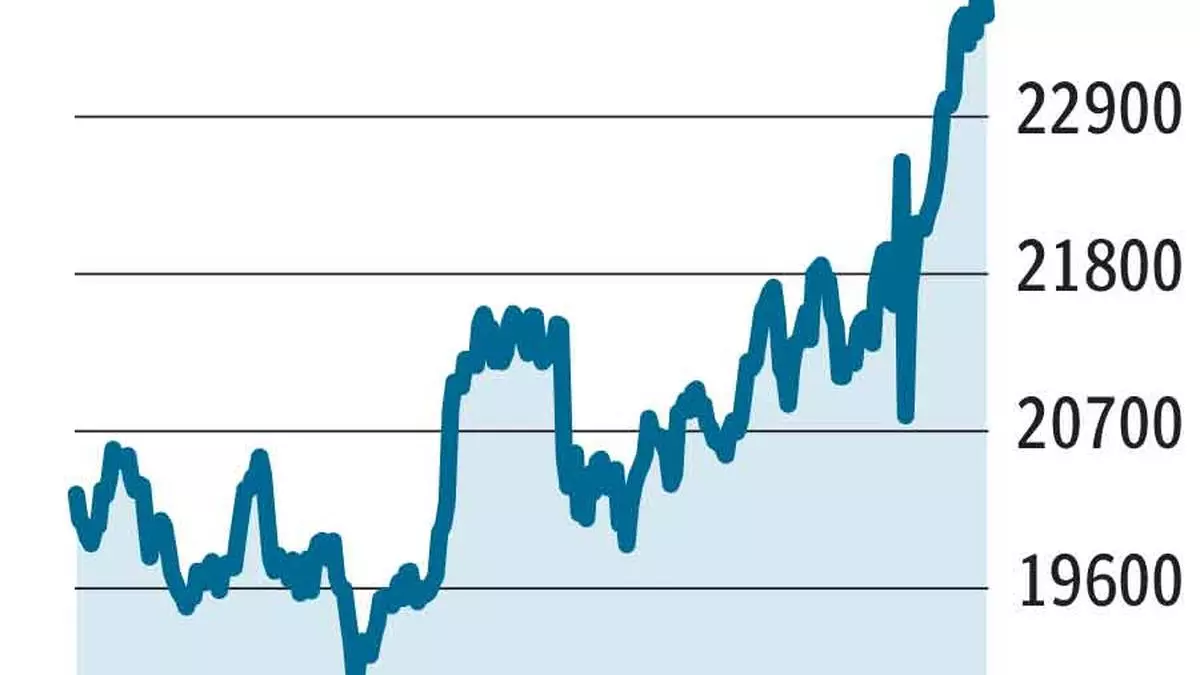

The long-term outlook for Nifty Financial Services (Fin Nifty) (23,641.75) will be positive as long as it stays above 18,890. If the index manages to hold on to current rally, it can register a new peak around 28,500.

Fin Nifty finds an immediate support at 22,837 and the major one at 20,867. However, a close below 18,890 could weaken the index to 15,050. We expect the index to witness higher volatility in the short term.

Key event: The Union Budget will be presented on July 23. The pronouncements will have a big impact on Fin Nifty.

F&O pointers: Nifty Financial Services July futures is ruling at 23,700.15 against the spot price of 23,641.75. Though the premium indicates existence of long positions, Fin Nifty July futures shed open positions in the last few days due to some profit booking. Option trading indicates that the index could move in the 22,500-25,000 range.

Strategy: Consider a long straddle on Nifty Financial Services by buying the July expiry 23,500-strike call and put simultaneously. As these options closed with a premium of ₹425.75 and ₹297.95, this strategy would cost traders ₹28,948 (market lot 40).

The maximum loss would be the premium paid — ₹28,948. This will occur if Fin Nifty moves at around current levels until expiry. On the other hand, if the index dips below 22,776.30 or rises above 24,223.70, the position will start yielding positive turns.

Hold the position till the Budget is presented and the strategy can be reviewed the next day.

Follow-up: Strategy on M&M would have given a profit.

Note: The recommendations are based on technical analysis and F&O positions. There is a risk of loss in trading