F&O Strategy: Buy Titan Call Option

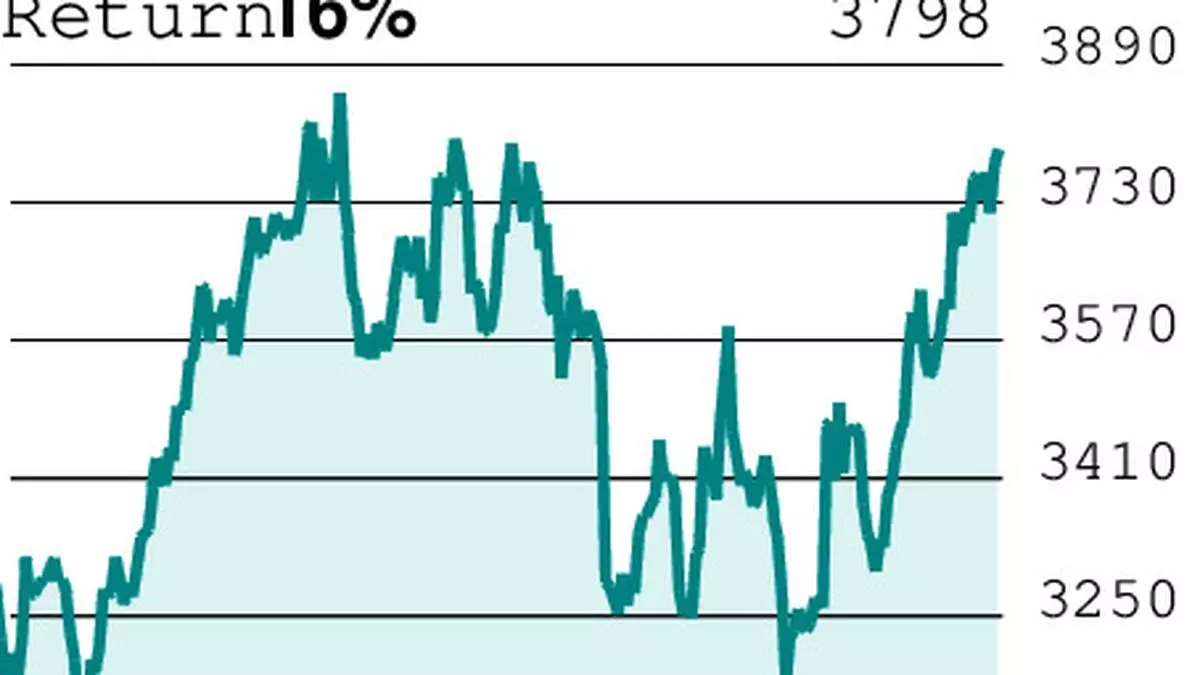

After moving in a narrow range for quite some time, the stock of Titan Company (₹3,797.20) has entered a crucial level. Immediate resistance is at ₹3,810. A conclusive close above this will trigger a fresh rally. In that event, the stock could hit a new peak above ₹4,265.

Support levels are at ₹3,630 and ₹3,280. Overall, we expect the stock to sustain the current bullish trend.

F&O pointers: Titan September futures is currently ruling at ₹3,800.70 against the spot price of ₹3,797.20. The October futures on Titan is trading at ₹3,826. Higher premium signals significant rollover of long positions. Option trading indicates that the stock could move in the ₹3,500-4,000 range.

Strategy: Buy a plain-vanilla call option — 3,900-call of October month. This option contract closed with a premium of ₹74.60 on Friday. As the market lot is 175 shares per lot, this strategy would cost traders ₹13,055, which would be the maximum loss. This will happen if the stock fails to move past ₹3,900. The break-even point is ₹3,974.60.

Traders can aim for an initial target of ₹125 (premium). Aggressive traders could even aim for ₹140 with strict stop losses. However, initial stop loss can be placed at ₹20 which can be shifted to ₹55, if the stock opens on a flat note.

Shift the stop-loss to ₹70, if the underlying stock of Titan moves past ₹3,825. However, if the stock opens on a strong note, we advise traders to stay away.

Note: The recommendations are based on technical analysis and F&O positions. There is a risk of loss in trading